BOURSE SECURITIES LIMITED

November, 13th 2017

AHL, OCM results lower

This week we at Bourse review the nine-month financial results of two stocks within the Manufacturing 1 sector, Angostura Holdings Limited (AHL) and One Caribbean Media Limited (OCM). Both AHL and OCM continue to confront economic challenges which have negatively impacted revenue and profitability. We highlight some key areas of the performances and provide an outlook.

Angostura Holdings Limited (AHL)

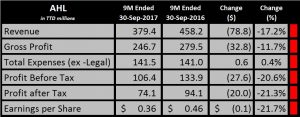

AHL reported Earnings per Share (EPS) of $0.36 for the nine-month (9M) period ended September 2017, a 21.7% decline when compared to the EPS of $0.46 reported a year ago.

For the period under review, Revenue fell 17.2% to $ 379.4M from $458.2M in the comparable period 2016. Despite a 25.8% decline in Cost of Sales, Gross Profit came in 11.7% lower, moving from $279.5M in 9M 2016 to $246.7M in 9M 2017. The Gross Profit Margin stood at 65.0% in 9M 2017, an improvement from 61.0% in the comparable period 2016. Total Expenses (excluding legal) remained relatively flat at $141.5M for the period. Group Profit before Tax stood at $106.4M, 20.6% lower than last year’s $133.9M for the same period. Profit before Tax Margin fell to 28.0% in nine-month 2017, from 29.2% in nine-month 2016. Overall, Profit for the period declined 21.3% moving to $74.1M from $94.1M in the comparable period.

Outlook

AHL continues to face economic challenges both locally and internationally. The Alcohol segment, which contributed 71.8% to the Group’s revenue in 9M 2017, saw a 23.3% decline over comparable periods. Revenue from the Non-alcohol segment grew 3.68% for the period under review. Overall, Revenue has been trending downward over a five-year period, with the exception of 9M 2016 which saw a brief 4.4% increase. While the Alcohol segment has been declining, the Non-alcohol segment has increased 20.0% over a five year period. The increased revenue in the Non-alcohol segment for nine-month 2017 was attributed to the positive sales performance of one of the company’s main products, Angostura Bitters.

AHL has managed to maintain relatively stable margins over the past four years., however with declining revenue it is critical to reduce cost to improve margins. The last quarter, typically the strongest for the firm, of 2017 may see some improvement in the due to seasonal demand. Cost containment will be of key importance in improving efficiency. On a positive note, AHL’s USD earnings from its international markets should provide a partial hedge against any potential TTD devaluation.

The Honourable Minister of Finance once again referred to AHL as a potential divestment of the State, in its attempt to recoup some of the funds owed by the CL Financial Group. Notwithstanding its weaker financial performance, AHL possesses a very valuable asset: the Angostura brand. The resilience of AHL’s stock price may be a reflection of investors’ confidence in the potential value of the Angostura brand.

The Bourse View

At a current price of $15.05, AHL trades at a trailing P/E of 30.71 times, above the Manufacturing 1 sector average of 22.72 times (excluding Guardian Media Limited). The stock offers a trailing dividend yield of 1.8%, below the sector average of 3.7% (excluding GML). On the basis of a strong international brand with stable USD earnings, but tempered by lower earnings, Bourse maintains a NEUTRAL rating on AHL.

One Caribbean Media Limited (OCM)

For the nine-month (9M) ended 30th September, 2017, OCM recorded Earnings per Share (EPS) of $0.50, down 28.6% from the corresponding period’s $0.70.

The Group’s Revenue declined 3.0% ($10.3M) from $337.8M to $327.5M over comparable periods. While Gross Profit for the period stood at $125.1M, representing a 2.1% declined from $127.8M in 9M 2016, the Gross Profit margin was maintained at 38.0%. Higher administrative costs contributed to the 6.5% decline in Operating Income, which stood at $56.6M at the end of the nine-month period 2017. The Operating Margin decline from 18.0% in 9M 2016 to 17.0% in 9M 2017. Share of Profit of associates and joint ventures fell sharply by 73.1% to $0.85M for 9M 2017 from $3.2M in the comparable 2016 period. Overall, Profit for the period was $38.9M, a 20.3% decline from $48.9M in the comparable period 2016.

Outlook

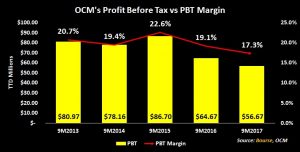

OCM’S revenue generation remains cyclical, driven by media events including elections and sporting events such as the World Cup and the Olympics. The cyclicality acts as a double edged sword for the company’s profitability, being a boon with increased event activity (as seen in 2015 during elections) and missed in the absence of the same. Profit before Tax has declined 30.0% over five years. OCM, like most companies within the Manufacturing 1 sector, will likely continue to face revenue pressures due to recessionary conditions. In addition, competition is more astringent, with the growing popularity of social media presenting a cheaper and more convenient medium for advertising.

According to the Chairman’s Report, the 3.0 % decline in revenue was attributable to contractions in advertising, compounded by new taxes in the Barbados market. In keeping with the Group’s strategic growth initiatives, OCM announced the acquisition of a 51% interest in Green Dot Limited, which specialises in Broadband and Cable Television. In 2016 OCM generated EPS of $0.82 and was able to pay dividend totalling $0.76. With lower earnings anticipated in 2017, the Group may encounter difficulties in sustaining comparable dividend payments from current earnings.

The Bourse View

At a current price of $14.00, OCM’s share price has retreated 30.0% year-to-date. OCM’s trailing P/E of 22.6 times is in line with the Manufacturing 1 sector P/E of 22.72 times. The stock currently offers a trailing dividend yield of 5.43%. OCM has held trailing dividend payments constant at $0.76 year-on-year although EPS has decreased 28.6%. As a result, the dividend pay-out ratio moved from78.4% in September 2016 to 122.6% in September 2017. A persistent depression of earnings could result in current dividend payment levels becoming unsustainable.

On the basis of OCM’s continued challenges with market contractions coupled with declining earnings and a high dividend pay-out ratio, Bourse maintains a SELL rating on OCM.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”