HIGHLIGHTS

Revenue 2021/2022

- Revenue:

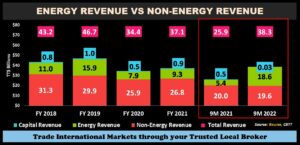

- Total Revenue ↑ 47.5% YoY, from $25.9B in 9M 2021 to $38.3B in 9M 2022

- Current Revenue ↑ 50.1% YoY

- Capital Revenue ↓ 92.6% YoY

- Tax Revenue ↑ 52.7% YoY

- Performance Drivers:

- Robust Energy Prices

- Rebound in Economic Activity

- Outlook:

- Spillover effects of increased Government revenue

- Increased Natural Gas Production?

As the investor and wider national community eagerly anticipates the upcoming FY2022/2023 National Budget carded for 26th September, 2022, this week we at Bourse review the ever-important Revenue side of the budget equation. Early indications suggest that the soon-to-be-concluded FY2022 would have enjoyed above-forecast Revenue from a significant improvement in energy prices, as well as improved tax collections from the resumption of economic activity. Is the likely improved Revenue performance sustainable going into the new Fiscal Year? What could be the implications for the T&T economy in the months ahead? Will investor sentiment and/or opportunities be affected? We discuss below.

GDP Projected to Recover

Following several years of weak/negative economic growth, Real Gross Domestic Product (GDP) growth was recorded at -7.4% in 2020 with the onset of the COVID-19 pandemic. While T&T’s economy has since been slow to recover, the Ministry of Finance (MoF) forecasts that real GDP growth in FY 2022 should be a welcome 3.0%.

According to the MoF’s published ‘Spotlight on the Economy’, the Energy sector is anticipated to be the major driver for GDP growth in FY 2022 with 5.0% estimated real GDP growth, while the Non-energy sector is expected to deliver 2.5% real GDP growth. All economic sectors should stand to benefit from resumption of business activity and the release of pent up consumer demand, despite inflationary pressures. A positive spinoff from recovering GDP is the prospect of improving financial metrics for the country, most notably T&T’s Debt-to-GDP ratio expected to hover around 72.2% in FY 2022 relative to the initially projected figure of 88.7%.

Energy Sector Drives Revenue Recovery

Total Revenue for the first nine months of fiscal 2021/2022 – based on data from the Central Bank of Trinidad and Tobago (CBTT)- climbed 47.5% from $25.9B in 9M FY 2020/2021 to $38.3B.

Total Revenue for FY 2022 was initially forecast to be $43.3B, which was then amended to $47.8B in the Mid-Year Review on May 16th, 2022. At the latest Ministry of Finance feature event, ‘Spotlight on the Economy’, held on September 2nd 2022, Total Revenue was further revised upward to $51.5B for FY 2021/2022 (+7.7%), with Energy Revenue accounting for 35.9% or roughly $18.5B.

9M fiscal 2021/2022 data places Energy Revenue at $18.6B, up 241.8% from $5.4B reported in the prior comparable period. This is likely attributable to windfall profits resulting from robust energy prices, with the remaining period of FY2021/2022 likely to benefit from continued strength across energy commodity markets. Favourable energy prices have extended into the downstream/petrochemical industries, including ammonia, urea and methanol.

Non-Energy Revenue was marginally lower across comparable periods, falling 2.1% from $20.0B to $19.6B in 9M 2021/2022, which may be a result of inflationary pressures and more cautious consumption patterns. Capital Revenue was 92.6% lower over comparable periods.

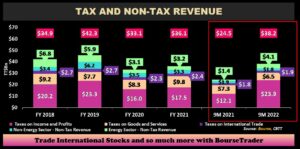

Revenue: Tax vs. Non-Tax

CBTT data indicates that Total Tax Revenue increased 56% for the 9M 2022 period compared to 9M 2021. The largest increase is attributable to Taxes on Income and Profits, advancing 97.5% from TT$12.1B in 9M 2021 to TT$23.9B in 9M 2022. Taxes on goods and services declined 9.8% to TT$6.5B in 9M 2022. Taxes on international trade showed a marginal increase from TT$1.8B to TT$1.9B in 9M 2022. The overall increase in tax revenue could be attributable to increased income from energy companies during the period.

MoF’s projections for taxes on income and profits presented at the spotlight on the economy is in the order of $28.1B in FY 2022, 40.0% higher than the initial forecast of $20.1B. Taxes on goods and services are expected to be $7.1B, 18.6% lower due to the accelerated payouts of VAT refunds that occurred during the year. Taxes on international trade was revised upwards to $2.7B.

Non-Tax revenue also increased from 9M 2021 to 9M 2022. For the Fiscal 9M 2022, Non-Tax Revenue accounted for TT$5.9B of the TT$38.2B Total Revenue collected, 78% higher than $3.3B (9M 2021).

Energy Prices Stay Strong

Budgeted Revenue for FY2022 was initially predicated on an oil price of US$65/barrel. However, supply shocks and ongoing geopolitical turmoil has markedly increased energy commodity prices during the fiscal year, leading to a revised budget price of $95/barrel for FY2021/2022, above the 8M average market price of US$91.02/barrel.

Current WTI crude oil price forecasts for 2022 according to the Energy Information Administration (EIA) are US$98/barrel and US$91/barrel for 2023 respectively, which – if realized- could support higher revenues for FY2022/2023.

The FY2022 budget was based on an initial Natural Gas price of US$3.75/MMBtu which was revised upward to US$5/MMBtu, below the October ‘21-May ‘22 average Henry Hub market price of US$5.39/MMBtu.

While the EIA expects the price of Henry Hub Natural Gas to average US$9/MMBtu in Q4 2022 and US$6/MMBtu in 2023, the extent of benefit to the T&T economy would depend on improving domestic natural gas production. During a keynote speech at the 2022 Trinidad & Tobago Energy Conference, T&T’s Minister of Energy and Energy Industries noted that several pending developments including De Novo Energy Ltd.’s Zandolie project, EOG Resources Inc.’s Osprey East and West project, and BP Trinidad and Tobago LLC’s (bpTT) Cassia Compression project (among others) are expected to increase domestic natural gas production levels in the medium-term.

Revenue Outlook Brighter?

The MoF’s spotlight on the economy painted a more positive outlook of T&T’s economy in the near-term, premised on favourable international energy commodity prices bolstering the government’s fiscal operations.

The U.S. Energy Information Administration (EIA) expects higher-than-average natural gas prices, with global markets still wrought with uncertainty arising from geopolitical events. The EIA expects that oil prices will remain near current levels for the remainder of 2022, although with continued price volatility. Higher energy commodity prices and increased demand for energy-related products is anticipated to continue supporting T&T’s revenue generation in the upcoming fiscal year. Higher demand, however, could be thwarted by the increasing likelihood of recessionary conditions across major economies.

A domestic energy production recovery could be on the cards, with natural gas production poised to benefit from the start-up of several upstream projects from bpTT, Shell Trinidad and Tobago, EOG Resources Trinidad and Touchstone Exploration.

Revenue from the Non-energy sector, based on available data, has remained relatively subdued. With a recovery in Energy Sector Revenue, there is the increased likelihood of positive economic spin-off effects on the Non-Energy Sector. The overall economy, while feeling the impact of increased inflationary pressures, should also be boosted from the removal of COVID-19 restrictions.

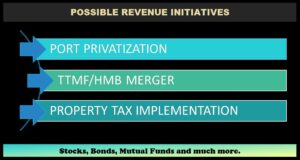

‘New’ Revenue Initiatives Ahead?

Looking ahead, several revenue initiatives mentioned during the FY 2021/2022 budget reading could be implemented in subsequent fiscal periods.

The Privatization of the Port of Port of Spain remains an initiative for revenue generation. In April 2022, the Works and Transport Minister signalled completion of the preliminary phase while in July 2022, the Minister mentioned formalising the Request for Proposals in seeking an investor for the Port Authority of Trinidad and Tobago.

An initial public offering (IPO) of ‘Trinidad & Tobago Mortgage Bank’, the merged entity that will be formed between T&T Mortgage Finance Co. Ltd (TTMF) and the Home Mortgage Bank (HMB), remains a possible divestment for capital revenue generation. The merger was reported to have been approved by the Board of Directors of both entities on August 6th 2021, with the goal of creating customer and stakeholder value, as well as improving organisational efficiency. The Finance Minister reiterated in the 2022 budget reading intentions of an IPO of the government’s shares to encourage participation in and development of the capital market. As at December 2021, the combined entities’ asset base totalled approximately $8.0 billion, with total equity of approximately $2.4 billion.

The implementation of property tax remains a revenue initiative on the fiscal agenda. During the spotlight on the economy, the MoF indicated that property tax could be implemented firstly on commercial properties, to be followed by residential properties. The MoF elaborated that this was consistent with the Government’s policy to fund the regional corporations.

With a much more dynamic environment and resurgence in the economy’s major revenue driver (Energy), investors will be tuned into to the MoF’s September 26th budget presentation to get greater clarity the revenue outlook and investment implications.

Next week, we review the expenditure side of the budget equation as we prepare for the upcoming FY 2022/23 National Budget Reading.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”