HIGHLIGHTS

Expenditure 2021/2022

- Expenditure:

-

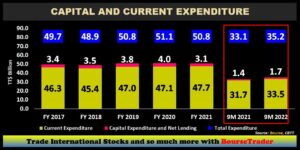

- Total Expenditure ↑ 6.4% YoY, from $33.1B in 9M 2021 to $35.2B in 9M 2022

- Current Expenditure ↑5.7% YoY

- Capital Expenditure ↑ 21.4% YoY

- Outlook:

-

- Shifts in Expenditure Allocations Expected

- Revision to Transfers and Subsidies underway

- Higher Capital Expenditure Likely

As the Honourable Minister of Finance prepares to deliver the T&T FY2022/2023 budget speech later today, this week we at Bourse focus on the expenditure side of the budget equation. Notwithstanding some reductions from peak levels in recent years, Total Expenditure by the state has remained notably ‘sticky’. With Revenue (i) fairly volatile and (ii) still not matching Expenditure levels, can expenditure be adjusted to help balance the country’s fiscal position? We discuss below.

Expenditure Increases

Initial projections in the FY2022 budget indicated a 3.1% year-on-year (YoY) increase in total expenditure to $52.4B. This figure was revised upwards to $55.5B during the mid-year review following the supplementary appropriation of $3.1B, to assist with increased operational costs across ministries. During the Spotlight on the Economy, data provided highlighted Total Expenditure of $53.5B for the soon-to-be concluded FY2022, suggesting that government spending may be marginally higher than initially anticipated.

Total Expenditure is comprised of two broad components. Current Expenditure includes spending by the Central Government on items non-capital in nature, meaning they provide a productive use to society but may not necessarily provide a concrete asset in return. Capital Expenditure, on the other hand, is usually focused on investments that facilitate production and revenue generation. It contributes to the overall stock of physical assets of the economy and is important for economic growth.

Between the fiscal years of 2017 to 2021, Current Expenditure accounted for roughly 93% of Total Expenditure, with Capital Expenditure accounting for the remaining 7%. During the first 9 months of FY2022 (9M 2022), these allocations remained relatively unchanged. Current Expenditure amounted to $33.5B, higher than $31.7B in 9M 2021 and Capital Expenditure amounting to $1.7B compared to $1.4B in the prior comparable period.

Transfers & Subsidies Dominate

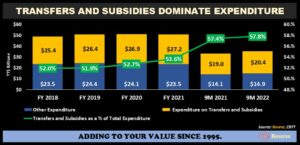

Transfers & Subsidies amounted to $20.4B in 9M 2022, 7.1% higher than $19.0B in 9M 2021. The second highest component, Wages and Salaries (20.4% of Total Expenditure), marginally increased 1.7% from $6.7B in 9M 2021 to $6.8B in 9M 2022. Expenditure on Goods and Services increased 11.4% YoY, to $3.5B in 9M 2022. Interest Payments decreased 2.0% from $2.83B to $2.77B in 9M 2022. Total Expenditure increased 6.4% from $33.1B in 9M 2021 to $35.2B in 9M 2022.

Transfers and Subsidies have hovered between $25B-$27B (or 52% – 53%) of Total Expenditure over the FY 2018 – FY 2021 period. Transfers and Subsidies accounted for 57.8% of Total Expenditure totaling to $20.4B for the fiscal 9-month period (October 2021-June 2022), 7.1% higher than the $19.0B in 9M 2021. Based on the data provided at the MoF’s Spotlight on the Economy, spending on Transfers and Subsidies was revised upwards from $28.1B to $29.8B for FY 2021/2022. With Transfers and Subsidies representing the largest single allocation of the national budget, it remains a prime area for moderation of spending, should it become necessary.

Breakdown of Transfers and Subsidies

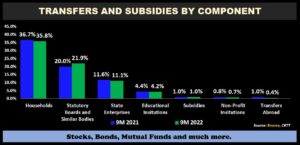

Transfers to households, the largest component of Transfers and Subsidies marginally fell 0.8% from 36.7% to 35.8% in 9M 2022 while Transfers to Statutory Boards and Similar Bodies climbed 1.9%, increasing its contribution towards transfers and subsidies from 20.0% to 21.9% in 9M 2022. Transfers to State Enterprises fell 0.5% to 11.1% over the 9-month period. Transfers to Educational Institutions declined 0.2%, while Subsidies remained constant at 1.0% of Transfers and Subsidies. Transfers to Non-Profit Institutions and Transfers Abroad experienced a drop in its 9M 2022 contribution of Transfers and Subsidies to 0.7% and 0.4% respectively.

Another Fiscal Deficit?

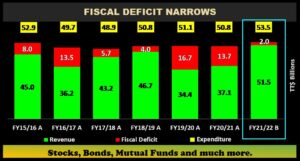

Based on the most recent projections, the fiscal deficit (the difference between Total Revenue and Total Expenditure) is expected to narrow following in FY2022 on account of an energy price-driven Revenue recovery. Revenue is projected to be TT$51.5B for FY 2022, revised upward from the initial projection of TT$43.3B. This marks a 38.8% increase from FY 2021 (TT$37.1B). Despite the improved Revenue, the fiscal deficit persists as Expenditure expanded to TT$53.5B, 5.3% higher than 2021 (TT$50.8B). The fiscal deficit is now estimated to be TT$2B in FY 2021/22, an upward revision from the Mid Year’s projection of TT$7.7B.

Expenditure Cuts on the Horizon?

Stemming from the Spotlight on the Economy, the MoF’s goal of achieving a primary budget surplus by 2023 and an overall budget surplus by 2024 would inevitably require increased revenue generation and/or more efficient revenue collection, as well as moderation of expenditure to sustainable levels. Indications during the Spotlight on the Economy suggest that one area which is being focused on for expenditure rationalization would be Transfers and Subsidies.

Fuel prices have already been adjusted in April 2022, with the price of premium and super gasoline increasing by one dollar to $6.75 and $5.97 per gallon respectively, while the price of diesel increased by $0.50 to $3.91 per gallon. Recent budget statements have alluded to a move to fully floating fuel prices, as well as the privatization of fuel stations. Coming on the heels of this recent increase, the Honorable Minister of Finance highlighted during the Spotlight on the Economy that the FY21/22 fuel subsidy is now expected to be an estimated $2.7B. A possible cap on the fuel subsidy of $1.0B going forward was also suggested.

Reviews of utility tariffs, including electricity and water rates, have been an ongoing conversation in recent years. Various reports indicate that rate reviews for both the Water and Sewage Authority (WASA) and the Trinidad and Tobago Electricity Company (T&TEC) are at various stages of progress. The Minister of Public Utilities during a webinar in April 2022 noted that WASA is scheduled to deliver proposal documents to the RIC, which includes a justification for an increase in the water rate. If approved, this will be the first rate increase for both state-owned companies since 1993.

Impact on Consumers

Adjustments to/removal of subsidies would inevitably impact consumers. Higher fuel costs recorded at the pumps as well as increased water and electricity rates would be borne by households and businesses alike. The proposed revisions to fuel prices and utility rates in T&T could reduce disposable income/discretionary spending and further intensify inflationary pressures, resulting in a weaker consumer. Ultimately, the GORTT’s target to reduce subsidies and total expenditure could place upward pressure on the cost of living, with subsequent impact on consumer and broader economic activity.

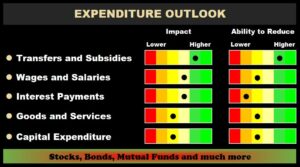

Expenditure Outlook

The scope for and impact of expenditure cuts across different segments of the budget would vary widely as T&T heads into FY22/23. Transfers & Subsidies, being the largest component of spending could have the highest impact on expenditure reduction at the state level. This would, however, require more financial responsibility to be placed on citizens. Spending on Good & Services and Capital Expenditure would have less scope to be reduced, with an overall less meaningful impact on the overall budget equation.

Adjustments to Wages & Salaries remains a highly sensitive topic, with ongoing public sector wage negotiations already simmering. Interest payments, meanwhile, remain a function of both the volume and price of outstanding debts. FY21/22 has, thus far, been characterized by stable debt levels. Domestically, interest rates have also remained relatively stable, suggesting there may be no material increase of interest payments in the near-term.

The Expenditure Enigma – reducing state expenditure while ensuring that private consumption and investment activity does not stall – remains a delicate balancing act. The equation becomes more complex when adding objectives of (i) achieving debt sustainability, (ii) balancing future budgets and (iii) ensuring citizens retain a comfortable standard of living in a rising cost environment.

We at Bourse take this opportunity to wish the Honourable Minister of Finance a successful delivery of the FY2022/2023 fiscal budget.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”