BOURSE SECURITIES LIMITED

6th March, 2017

TCL stumbles, GKC Grows

This week, we review the 2016 performance of Trinidad Cement Limited (TCL) and GraceKennedy Limited (GKC). TCL was hit with one-off costs and lower revenues which negatively impacted earnings, while GKC reaped the benefits of growth in all of its segments. We look at their performance for the year and provide a brief outlook.

Trinidad Cement Limited (TCL)

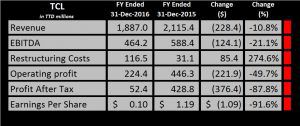

TCL reported Earnings per share (EPS) of $0.10 for the year ended December 2016 (FY2016), a 91.6% ($1.09) shortfall when compared to the $1.19 reported in 2015. While at a glance this would appear to be a steep decline year-on-year, several adjustments are needed to more meaningfully compare FY2015 and FY2016. In terms of one-off items affecting profitability, TCL incurred manpower restructuring costs of $44.4M and stockholding costs of $72M in FY2016. Accordingly, adjusted EPS would be in the order of $0.37, 34% lower than the adjusted EPS of $0.56 in 2015 (assuming a 25% tax rate). Earnings were further dented by poor results in the local subsidiary of TCL, Readymix Limited (RML). RML experienced a 35.4% shortfall in revenue and a loss of $8.9M.

With respect to recurrent line items, TCL’s revenue fell 10.8% ($228.4M), from $2,115.4M to $1,887M. Faced with declining revenues, TCL curtailed some of its expenses, as evident by a 10.6% reduction in personnel benefits and a decline of 12% in operating expenses. Expense management initiatives could not offset the fall in revenue, leading to a reduction in earnings before interest, tax, depreciation and amortisation (EBITDA) of $124.2 M (21.1%). TCL’s EBITDA margin also retreated from 27.8% in FY2015 to 24.6% in FY2016. Profit before tax decreased by 81.6% ($397.8M), on account of non-operating expenses mentioned earlier. With a higher effective tax rate of 41% in 2016, (compared to 12% in 2015), profits after tax fell from $428.8M to $52.4M, a decline of 87.8% ($376.4M).

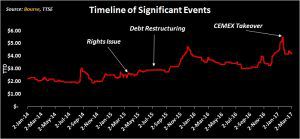

Notice was given in TCL’s audited financial report that on 24th January 2017, CEMEX, through its indirect subsidiary Sierra Trading, acquired 113 million ordinary shares of TCL, thereby increasing their shareholding from 39.5% to a majority stake of 69.8%.

Outlook

Recent efficiency measures implemented by TCL, among other initiatives, will prove key to future performance with the Group likely to face a cooling T&T market.

Challenges:

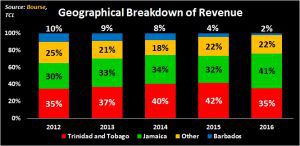

- Demand in TCL’s main market of Trinidad and Tobago has remained sluggish in 2016, as evident by the decline in local cement sales of 20%, following a marginal decline of 1% in 2015. Jamaica has now taken the title of TCL’s main market by revenue, based on FY2016 results.

- For the second time in the last decade, TCL is being challenged by a solid competitor in the regional market, Rock Hard Cement Limited. This company currently supplies cement at lower prices than TCL. Should the ongoing price and image duel continue, TCL could feel the impact of lower market share.

- Like all other companies listed on the stock exchange, TCL will be faced with a higher effective tax rate of 30% in 2017 on profits over TT$1M (compared to 25% in 2015). This in turn will weigh on after-tax profits.

Opportunities

- Historically, Trinidad and Tobago has accounted for the majority of TCL’s revenue. In 2016, however, 41% of revenues stemmed from Jamaica while 35% was from Trinidad and Tobago. While the local economy is projected to contract by 2% in 2017, Jamaica’s economy is expected to grow by 2% this year. Improving business confidence and continued fiscal spending in Jamaica could drive its construction sector further in the coming years. TCL will need to take advantage of this opportunity to bolster revenue generation, placing greater focus in the Jamaican market.

- TCL’s geographical territory reported as ‘other’ includes countries such as Guyana, Brazil and Venezuela. While revenue contribution from this territory has remained stable in recent years, the new ownership structure and potential changes in strategic direction could present a platform to increase its market share in these countries. Additionally, the new structure could help to identify new markets, which may in turn lead to higher revenues in the future. After a 13% fall in 2014, export of cement improved in 2015 and 2016 by 9% and 4% respectively. TCL may need to continue its drive into external markets to improve profitability.

The Bourse View

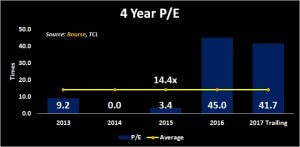

At a current price of $4.17, TCL trades at a trailing P/E of 41.7 times based on reported EPS. Historically, TCL has struggled to maintain consistency in dividend payments. After 7 years of no dividends, the Group made a payment of $0.04 on 1st July 2016. On the basis of a weaker T&T economy, more intense regional competition, and less-than-certain dividend payments to investors, Bourse maintains a SELL rating on TCL.

GraceKennedy Limited (GKC)

GKC generated Earnings per Share (EPS) of TT$ 0.213 for the year ended December 2016, an improvement of 52.6% when compared to TT$ 0.140 earned a year ago from continuing operations.

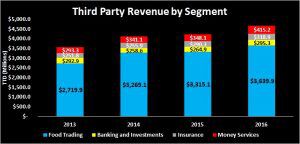

GKC’s revenue increased by TT$ 450.9M (up 52.6%) from $4,218.3M to $4,669.3M. Expenses also increased TT$ 409.2M or 10.05% year-on-year. Other income also improved, from $TT 83.1M to TT$ 126.1M, or TT$ 43M (51.7%). The main drivers of this increase was higher foreign exchange gains of TT$ 13.2M and a gain on disposal of investments amounting to TT$ 32.3M. Consequently, operating profit climbed by TT$ 84.8M (36.7%). This improvement also meant that GKC’s operating profit margin moved from 5% to 7%. Other key highlights include an increase in share of results of associated companies of TT$ 6.6M and an improvement in profit before tax of TT$ 95.2M (39.5%). GKC was faced with a lower effective tax rate of 26% in 2016 (30% in 2015), with profit after taxes of TT$ 239.9M, 49.6% (TT$ 79.5M) higher than the previous year.

Outlook

GKC’s higher revenues were driven by growth in all of its segments. Importantly for GKC, its Food Trading segment, which accounts for 78% of revenues, has continued to demonstrate strong performances in recent years. An improvement of 20% in 2014 and 1% in 2015, was followed by 10% growth in 2016. Looking ahead, this business line is expected to continue on a positive growth trajectory.

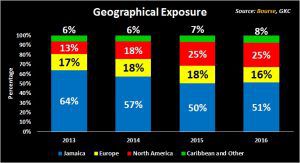

Jamaica remained the dominant market in 2016. In recent years however, the Group has been diversifying to markets which earn hard currency, with greater focus on its North America market. This market, along with its European exposure, should help hedge against depreciation of the Group’s base currency, the Jamaican dollar.

The Bourse View

On 28th February 2017, GKC’s Board of Directors approved an interim payment of TT$ 0.02, payable on 18th May 2017. It should be noted, however, that GKC pays its dividends in USD, providing an opportunity for investors to access US dollars via a TT dollar or Jamaican dollar investment. GKC’s trailing dividend yield is 2.13%, falling below the market average of 3.11%.

At a current price of $2.63, GKC trades at a trailing P/E of 12.34 times, in line with the Conglomerates sector average of 12.5 times. However, GKC’s 3 year average P/E stands at 9.23 times. The stock trades at a market to book of 1.2x, in line with its sector average of 1.4x. GKC’s price and P/E have both increased in recent years, reflecting investors’ positive sentiments surrounding the firm. In 2015 alone, the stock appreciated some 98%. Based on the firm’s continued improvement in profitability, but tempered by a low trailing dividend yield and a relatively high 3-year P/E, Bourse maintains a NEUTRAL rating on GKC.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”