BOURSE SECURITIES LIMITED

20th November 2017

SFC, GHL earnings lower

This week, we at Bourse review the performance of two stocks in the Non-Banking sector – Sagicor Financial Corporation Limited (SFC) and Guardian Holdings Limited (GHL) – for the third quarter ended September, 2017. Not surprisingly, both firms were negatively impacted by claims arising from the two major hurricanes during the period. We discuss the performance of both companies and provide an outlook.

Sagicor Financial Corporation Limited (SFC)

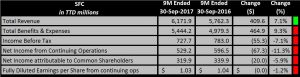

SFC reported Fully Diluted Earnings per Share (EPS) from continuing operations of TT$1.03 for the nine-month (9M) ended September 2017, 1.2% lower than TT$1.04 in 9M 2016.

Net Premium Revenue increased 13.4% from TT$3.3B in 9M 2016 to TT$3.8B in 9M 2017. However, Net Investment and Other Income stood at $6.2B, a 7.1% increase from $5.8B in 2016. Total Benefits and Expenses increased 9.3% to TT$5.4B. As a result, Income before Tax fell to TT$727.7M, a 7.1% decline from the previous year. Overall, Net Income from Continuing Operations closed at TT$529.2M, 11.3% lower relative to TT$596.5M in 2016. However, Net Income from Continuing Operations attributable to common shareholders stood at TT$319.9M for the 9M period, 5.9% lower than last year.

Outlook

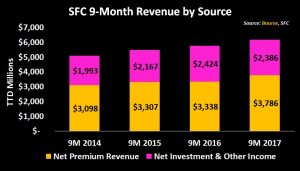

The 13.4% (TT$448.0M) growth in SFC’s Net Premium Revenue outweighed the 1.6% (TT$38.4M) decline in Net Investment & Other Income over the 9M period 2016 to 2017.Over the past four years, Net Premium Revenue has represented a greater portion of revenue, increasing 22.2% since 2014. Net Investments & Other Income has increased 19.7% as at 9M 2017 over the past four years, but accounted for 38.7% of revenue relative to 39.2% in the comparable period 2014.

SFC has seen revenue growth in all of its segments. The Life, Health and Annuity Insurance (Individual and Group) segment, which represented 81.0% of revenue in 9M 2017, has grown 16.0% over the four-year period 9M 2014 to 9M 2017 and 7.7% in the past year. The Banking segment, which accounted for 13.3% of revenue, has grown 54.1% over the four-year period. Revenue from Property and Casualty segment (3.3% of revenue) increased 15.3% for the 9M period 2017. Nonetheless, this segment would have been negatively impacted by claims arising from the hurricane activity during the period. The Group recorded a net provision of (US $7.5M) TT $50.8M relating to claims exposure. This would have contributed to the 7.1% fall in Income before Tax. The 12.4% ($353.5M) increase in Benefits was attributable to a change in actuarial provisions in the Jamaica segment.

The Bourse View

At a current price of $7.95, SFC trades at a trailing P/E of 6.3 times, below the Non-Banking sector average of 12.9 times. The Group’s market to book (M/B) ratio stands at 0.6, below the sector average of 1.3 .The trailing dividend yield of 4.3%, is above the sector average of 2.8%. SFC declares dividends in USD, which provides a hedge for investors against any possible depreciation in the TTD. On the basis of (i) continued revenue growth, (ii) relatively ‘cheap’ valuations (low P/E and M/B), (iii) an attractive dividend yield and (iv) a USD dividend hedge against the TTD, Bourse maintains a BUY on SFC.

Guardian Holdings Limited (GHL)

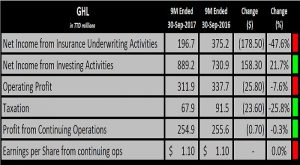

Guardian Holdings Limited (GHL) reported Earnings per Share from continuing operations (EPS) of $1.10 for the nine-month (9M) ended September 2017, in line with EPS of $1.10 reported a year earlier.

Net income from insurance underwriting activities declined 47.6% ($178.5M) to $196.7M, while Net income from investing activities increased 21.7% ($158.3M) to $889.2M. The net effect resulted in a marginal decline of 0.9% to $1.1B in Net Income from all activities. Operating Expenses increased 2.5% from $672.2M in 2016 to $689.2M in 2017. Operating Profit stood at $311.9M for the period relative to $337.7M reported in 9M 2016. Profit before Tax decreased 5.3% from $347.3M in 9M 2016 to $328.9M in 9M 2017. As a result of lower taxation, the Profit after Tax from continuing operations for 9M 2017 remained relatively flat $254.9M compared to $255.6M a year ago.

Outlook

Net Income from Investing activities continues to represent a significant proportion of GHL’s revenue, increasing from 49.4% of total Net Income in 9M 2015 to 81.9% in 9M 2017. Conversely, Net Income from Insurance underwriting activities has been declining, representing 33.9% in 2016 and only 18.1% in 2017. According to the Chairman’s Report, the sharp decline in Insurance Underwiting Activities for the period was as as result of hurricane related losses coupled with adjustments made to the Life, Health and Pensions devision .

Total Net Income from all segments (excluding Other consolidation adjustments) fell 2.1%% from 9M 2016 to the comparable period in 2017. The Life Health and Pension segment continued to be the main contributor to overall income, accounting for 60.7% of total Net Income in 9M 2017. Property and casualty fell 30.9% over the four-year period 9M 2014 to 9M 2017 and now represents for 22.8% of total Net Income compared to 36.0% in 2014. Operating Profit/ (Loss) from the Property and casualty business segment decline 58.5% from 9M 2016 to 9M 2017, owning to the one-off impact of two catastrophic hurricanes during September. However, GHL’s chairman stated that the Group has fully accounted for claims arising from the events amounting to $100.3M before tax.

. Notwithstanding the economic challenges in the GHL’s main operational territories, the Group’s core businesses maintained profitability. The upward trend in The Life Health and Pension segment could continue to promote profitability.

The Bourse View

At a current price of $15.25, GHL trades at a trailing P/E of 9.3 times, below the Non-Banking sector average of 12.9 times. The trailing dividend yield is 4.2%, above the sector average of 3.4%. GHL continues to benefit from gains in Investing Activities but remains challenged with respect to Insurance Underwriting activities. On the basis of relatively attractive valuations, but tempered by continued challenges in its Insurance Underwriting activities, Bourse maintains a NEUTRAL rating on GHL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”