BOURSE SECURITIES LIMITED

25th November, 2019

SFC, GHL Advance

This week, we at Bourse take a look at the financial performance of two major players in the Non-Banking Finance sector, Sagicor Financial Corporation Limited (SFC) and Guardian Holdings Limited (GHL), for the nine-month period ended September 30th, 2019. Both companies reported improved results against a backdrop of generally favourable conditions.

Sagicor Financial Corporation Limited

Sagicor Financial Corporation Limited (SFC) reported Total Diluted Earnings per Share (EPS) of TT$0.71 for the nine-month (9M) period ended September 30th 2019, a 4.0% improvement from the EPS of TT$0.68 recorded in the prior comparable period. Diluted EPS from Continuing Operations climbed 13.2% year-on-year (YoY), from TT$0.62 in 9M 2018 to TT$0.70 in 9M 2019.

Net Premium Revenue improved to TT$6.4B in 9M 2019, a significant 30.7% or TT$1.5B YoY increase. Net Investment and Other Income also grew 33.3% from TT$2.3B to TT$3.1B. Coinciding with SFC’s revenue growth came an increase in Total Benefits and Expenses, which moved from TT$6.7B in 9M 2018 to $8.7B in 9M 2019. SFC reported a 32.1% or TT$192.1M YoY increase to Income before Taxes. Overall, Net Income for the period amounted to TT$539.2M, 34.9% higher than the TT$399.7M recorded in 9M 2018. Continuing Operations would have contributed TT$535.7M (+41.7% YoY) to Net Income, while Net Income from Discontinued Operations fell from TT$21.6M in 9M 2018 to TT$3.5M in 9M 2019.

Revenues Grow

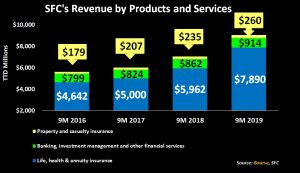

Life, Health and Annuity Insurance, which contributes approximately 83% of Sagicor’s total revenue, recorded a Four-Year Compounded Annual Growth Rate(CAGR) of 15.5%. Property and Casualty Insurance and Banking, Investment Management and Other Financial Services would have recorded four-year CAGRs of 4.9% and 10.4% respectively. Sagicor has credited its current Revenue Growth to expanding operations in the USA and its decision to cease reinsuring its premiums to third parties.

Acquisitions and Alignvest Update

Investors of both AQY and SFC approved the acquisition of SFC by AQY earlier in 2019. To date, the transaction remains incomplete. In the offer of cash settlement to shareholders, as an early exit option, the majority of investors opted to retain their SFC shares for ownership in ‘New SFC’. New SFC will have a cash ‘war-chest’, which it could be used to pay down debt and/or pursue acquisitions.

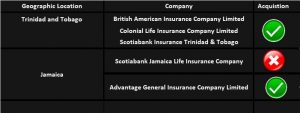

Sagicor Life Inc. on September 30 2019 entered into agreements to acquire the traditional insurance portfolios of both Colonial Life Insurance Company Limited (CLICO) and British American Insurance Company Limited (BAT).

Sagicor is still pursuing the acquisition of Scotiabank Insurance Trinidad & Tobago Limited and establishing a 20-year distribution agreement for insurance products in Trinidad & Tobago. However, the company announced that, by mutual consent, a similar arrangement which had been made with Scotia Jamaica Life Insurance Company Limited has been cancelled.

Sagicor also agreed to acquire a 60% stake in Jamaican-domiciled Advantage General Insurance Company Limited for US$31.4M from NCB Capital Markets Limited, effective September 30 2019.

The Bourse View

SFC currently trades at $10.70 and has appreciated 18.9% YTD. The stock trades at a trailing price-to-earnings ratio of 12.1 times, lower than the Non-Banking Financial Sector average of 12.6 times (excluding NEL). SFC offers investors a trailing dividend yield of 3.17%, greater than the sector average of 2.86% (excluding NEL). SFC currently declares USD dividends on a semi-annual basis, therefore protecting investors from depreciation in the TTD relative to USD. On the basis of fair valuations, the prospect of converting a TT dollar asset into a ‘hard currency’ asset through its eventual listing on the Toronto Stock Exchange, improvements in performance and the upside potential for growth from the AQY transaction and acquisition activity, Bourse maintains a BUY rating on SFC.

GHL

Guardian Holdings Limited (GHL) recorded Earnings per Share (EPS) of $1.86 for the nine months ending 30th September, 2019, a 16.3% increase from the EPS of $1.60 for the corresponding period in 2018.

Net Income from Insurance Underwriting Activities improved 7.7% from $499.8M in 9M 2018 to $538.2M in 9M 2019. Net Income from Investing Activities advanced 14%, from $812.7M to $926.9M. Operating Expenses were up 5.79% to $792.3M in 9M 2019 and Finance Charges followed with an increase from $101.4M in 9M 2018 to $109.7M for the 9M 2019 period. Overall, Operating Profit climbed to $581.92M, 23.8% higher than comparable prior year period. Share of Profit of Associated Companies was 31.3% higher than the previous year, which contributed to Profit Before Taxation rising to $604.3M from $487.2M. Profit for the Period advanced 16.9% from $371.85M for 9M 2018 to $434.52M for 9M 2019.

Outlook

GHL has delivered improved Net Income from all activities over the past 3 comparable periods, with Net Income from Investing Activities being the largest contributor to its growth. Net Income from Investing Activities increased 14.0% from its $812.7M 2018 figure to $926.9M in 2019. This recovery was attributed to an $89M increase in Net Fair Value Gains due to the recovery of the U.S. and Jamaican stock markets and improved investment income. With markets flying high in 2019, GHL’s future profit generation from

Investing Activities could potentially face headwinds should markets suffer a correction. Net Income from Insurance Underwriting Activities also improved 7.7% YoY, bolstered by an 8% improvement in both the Life, Health and Pension, Property and Casualty business segments, resulting from acquiring new business and organic growth. The Group noted that a net loss reserve of $86M before tax was established, accruing from claims for Hurricane Dorian which affected the Caribbean Basin during August to September 2019. Depending on how much of these claims are actually made, this could potentially provide some support to future profitability.

The Bourse View

GHL is currently priced at $18.51 and is trading at a trailing P/E ratio of 7.2, below the Non-Banking Finance Sector’s average of 12.6 (excluding NEL). The stock also has a trailing dividend yield of 3.89%, the highest in the Non-Banking Finance Sector and above the sector’s average of 2.86% (excluding NEL). On the basis of positive returns, but the company’s dependence on volatile international capital markets, Bourse maintains a NEUTRAL rating on GHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”