| HIGHLIGHTS

SBTT FY 2020 · Earnings: EPS up 2.2% from $0.81 to $0.83. · Performance Drivers: o Lower Revenue o Improved Impairment costs · Outlook: o Constrained Revenue Growth o Challenging Domestic Environment · Rating: Maintained at NEUTRAL. FCI FY 2020 · Earnings: EPS down 40.6% from an EPS of TT$0.21 to TT$ 0.13 · Performance Drivers: o Lower Revenue o Higher Credit Loss Expenses · Outlook: o Possible decline in Credit Impairment Loss o Sluggish Economic Recovery · Rating: Maintained at NEUTRAL. |

Scotia, FirstCaribbean Revenues Fall

This week, we at Bourse review the financial performance of two regionally-listed Canadian-owned Banks, FirstCaribbean International Bank Limited (FCI) and Scotiabank Trinidad and Tobago Limited (SBTT) for the first quarter ended January 31st, 2021. Both banks would have grappled with lower revenues as economic challenges persist in the region. Is improvement on the horizon, or will investors endure lower earnings in the coming months? We discuss below.

Scotiabank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) reported an Earnings per Share (EPS) of $0.83 for the three-month period ended 31st January, 2021 (Q12021), a modest 2.2% increase versus EPS of $0.81 in the prior period. Cumulatively, SBTT recorded $441.2M in Total Revenue for Q12021, a 7.3% decline compared to a prior $476.2M. Non-Interest Expenses shifted 5.0% lower to $200.0M in Q12021, as a result of the Bank’s implementation of cost management initiatives. SBTT recorded a 56.2% decrease in Net Impairment Loss on Financial Assets, amounting to $22.8M (Q12020: $52.0M). The Bank’s decline in expenses was able to offset the decline in revenue, resulting in an Income before Taxation (PBT) of $218.4M, 2.2% marginally higher than a prior $213.7M. Overall, SBTT reported a Profit for the Period of $146.0M, up 2.3% compared to $142.8M in Q12020.

Revenue Lower

SBTT’s most recent results broke the positive revenue trend experienced from Q12018 to Q12020, growing at an average annualized rate of 2.3%. In Q12021, with economic pressures continuing to linger, SBTT recorded a 7.3% contraction in revenue growth. Net Interest Income, which contributed 71.9% of Total Revenue, declined 6.5% YoY. Other Income (28.1% of Total Revenue), fell 9.5% in the period under review, attributable to the continuation of the Bank’s Covid-19 concessions which included the waiver of late fees as well as reduced credit card rates. SBTT’s largest operational segment by revenue, Retail Corporate & Commercial Banking (of 91% Total Revenue) declined 7.8% YoY while its Asset Management and Insurance Services segment recorded declines of 3.3% each in terms of revenue.

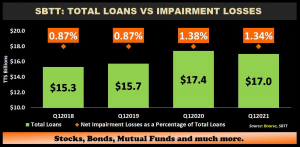

Loan Growth Stalls, Impairment Losses Decline

After three periods of consistent growth in its Total Loan portfolio from Q12018 to Q12020, SBTT recorded a 2.3% year on year decline in Q12021. SBTT did indicate that there has been an improvement in new loans coinciding with loan pay offs by customers. The decline in Total Loans for Q12021 was accompanied by a marginal decrease in the ratio of Net Impairment Losses to Total Loans, which for the period stood at 1.34% relative to 1.38% in Q12020. Despite the Group’s continued commitment to prudent loan management, the ratio of non-accrual loans to total average loans was 2.35% relative to 2.15% in Q12020. Loans to Customers accounts for 95.2% of Total Loans and declined 2.9% year on year. Loan and advances to banks and related companies was more resilient, growing 14.4%.

Stabilisation or Deterioration on the Horizon?

During ‘peak’ pandemic conditions of Q2 to Q4 2020, SBTT’s Total Revenue declined 7.4% relative to Q2 to Q4 2019. This trend continued into Q1 2021, where Total Revenue dipped 7.3%. SBTT, like most other companies, is likely to benefit from economic reopening as vaccination efforts progress. Within this context, however, is the reality that some permanent damage would have been inflicted on several business sectors. Additionally, the T&T economy continues grapple with certain structural issues pre and post COVID-19, which could adversely impact consumer demand for more discretionary-type banking products/services.

The Bourse View

SBTT is currently priced at $55.28, 4.7% lower year-to-date. The stock trades at a Trailing Price to Earnings ratio of 18.6 times, below the current Banking Sector average of 22.5 times but above SBTT’s 4-year trailing average of 17.6 times. SBTT declared an interim dividend of $0.60, payable on April 12th, 2021 consistent with that paid for Q12020. The stock offers investors a Trailing Dividend Yield of 4.1%, higher than sector average of 2.3%. Despite the challenges imposed by prevailing economic conditions, SBTT reported a growth in its asset base of 2%, with its cash base also improving 0.4%. On the basis of fair valuations, consistent dividend payments but tempered by sluggish economic recovery, Bourse maintains a NEUTRAL rating on SBTT.

FirstCaribbean International Bank Limited (FCI)

FirstCaribbean International Bank Limited (FCI) reported Earnings per Share (EPS) of TT$0.13 for the three-month period ended January 31st 2021 (Q12021), 40.6% lower compared to TT$0.21 recorded in Q12020. Total Revenue contracted by 14.4%, from a previous TT$1.07B to TT$913.6M in Q12021. Operating Expenses declined 5.9%, to stand at TT$636.7M in Q12021. Credit Loss Expense on Financial Assets jumped 67.2% to TT$48.8M in the period under review, compared to a prior TT$29.2M. Income Before Tax (PBT) stood at TT$228.0M, 36.8% lower than TT$361.1M in Q12020. FCI reported an Income Tax Expense of TT$21.0M (27.4% higher). Overall, the Group reported a Net Income for the Period Attributable to Equity holders of TT$201.9M in Q12021, down 40.1%, from a prior TT$336.9M.

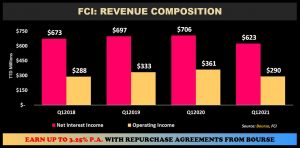

Revenue Stumbles

After reporting revenue growth from Q12018 to Q12020 at an average annual rate of 6%, Total Revenue contracted 14.4% YoY in Q12021. Regionally, COVID-19 continues to put pressure on tourism-dependent economic activity. Net Interest Income, FCI’s largest revenue contributor (Q12021 Revenue: 68.2%) contracted 11.7% in the period under review. Similarly, Operating Income which accounted for 31.8% of Total Revenue declined 19.6% as FCI continued its covid-19 relief measures for consumers. Notably, in the period FCI’s Loan portfolio grew 3.8% in the quarter. This growth may be linked to loan restructuring provision afforded to pandemic affected individual and corporate clients of the Bank.

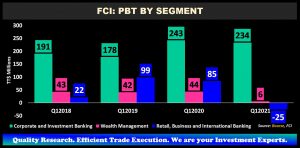

PBT Contracts

Notwithstanding the modest decline in operating expenses, FCI’s PBT declined 36.8% during the period owing to increased provisioning for potential credit losses and lower revenue. Corporate and Investment Banking accounted for a Profit Before Tax of $234M, 3.7% lower YoY as declines in revenue and a swing in Credit Loss Expense from a gain in Q12020 to a loss in Q12021, weighed on the performance of this segment. Retail, Business and International Banking – accounting for 23.6% of Income Before Tax in Q12020 – contracted to a Loss Before Tax of $25M in Q12021. Wealth Management which was historically FCI’s smallest contributor to PBT (Q12020: 11.7%) now accounts for the 2nd highest portion of PBT (Q12021: 2.8%) and declined 86.1% YoY.

Economic Pressures Linger

Over the period Q2 to Q4 2020, FCI’s total revenue declined 10.7% relative to Q2 to Q4 2019. Comparatively, in Q12021, Total Revenue contracted more precipitously by 14.4% YoY amid a lower interest rate and economically challenged environment. For the same Q2 to Q4 2020 period, Credit Impairment Loss on Financial Assets increased by 44.0%. FCI’s Credit Impairment Loss accelerated to 67.2% in Q12021. With vaccine campaigns ongoing in Barbados (roughly 17.8% of its population has been inoculated) and Bahamas set to receive 99,600 vaccines by the end of May, there is cautious optimism that a recovery in tourism is on the horizon for both economies.

Despite experiencing a 23.0% decline in price from $9.15 to $6.95 from 2017 to 2020, the market has consistently priced FCI at a relatively stable market to book ratio at an average of 1.61 times over the last 3 years. Currently, the stock trades at a market to book ratio of 1.62 times below the sector average of 2.09 times.

The Bourse View

FCI is currently priced at $6.95 and trades at a market to book ratio of 1.6 times relative to a sector average of 2.1 times. The Bank decided to not pay an interim dividend, likely to conserve capital for any contingencies related to the COVID-19 fallout. Despite this, the stock currently has a trailing dividend yield of 2.4%, marginally above the sector average of 2.3%. With ongoing COVID-19 vaccine rollouts and the continued gravitation to the new normal, it is likely that tourism and economic conditions in the Group’s operating jurisdictions could recover in subsequent periods. The IMF estimates Barbados and The Bahamas to expand by 7.4% and 4.6%, respectively, in 2021. Following the rejection of the sale of a 66.73% stake in FCI to GNB Financial Group Limited (GNB) in February 2021 by regulators, it remains to be seen whether Canadian-based CIBC will continue to seek opportunities to attract alternative buyers. On the basis of ongoing vaccine campaigns, but tempered by sluggish economic recovery, Bourse maintains a NEUTRAL rating on FCI.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”