| HIGHLIGHTS

WCO FY 2020 · Earnings: EPS 1.8% lower from $1.65 to $1.62. · Performance Drivers: o Partial Closure of Entertainment Channels o Competitive Pressures · Outlook: o Stabilizing Demand o Challenging Domestic Environment · Rating: Maintained at NEUTRAL. AMBL FY 2020 · Earnings: EPS down 41.7% from $3.24 to TT$ 1.89 · Performance Drivers: o Muted Loan Demand o Challenges to Regional Equity Markets · Outlook: o Operationalization of Bank of Baroda o Acquisition of Trident Insurance Company Ltd o Challenging Domestic Environment · Rating: Maintained at NEUTRAL. |

WCO, AMBL Profits Fall in 2020

This week, we at Bourse review the financial performance of The West Indian Tobacco Company Limited (WCO) and ANSA Merchant Bank Limited (AMBL) for the financial year ended December 31st, 2020. Both companies would have faced lower revenues linked to COVID-19 induced economic challenges. With economies on course to normalise, will this translate to financial improvement in the coming months? We discuss below.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $1.62 for the financial year ended December 31st 2020 (FY2020), a modest 1.8% decline from $1.65 recorded in the prior comparable period. Revenue fell 3.8% Year on Year (YoY) from $935.4M to $899.9M, whereas Cost of Sales rose by 1.9% to $211.0M. Consequently, Gross Profit fell to $688.9M, 5.4% lower YoY compared to $728.4M reported in FY2019. WCO benefitted from reduced Distribution Costs, Administrative Expenses and Other Operating Expenses, which cumulatively amounted to $101.7M, down 17.4% YoY. Operating Profit contracted 3.0%, from $605.3M in FY2019 to $587.2M in FY2020. Interest Income decreased by 59.1% to $1.21M. Profit Before Taxation (PBT) fell 3.2% to $588.1M from $607.8M in FY2019. Overall, Profit After Taxation (PAT) declined 2.0%, to close at $410.0M in FY2020 from a prior $418.2M.

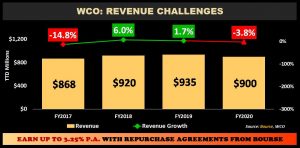

Revenue Challenged

After two years of consecutive growth – albeit at a decreasing rate – WCO recorded a 3.8% contraction in Revenue in FY2020. The company continues to confront: (i) weaker demand from the partial closure of entertainment channels during the period, (ii) continued competitive pressures from the availability of substitute produces such as e-cigarettes, (iii) lower-priced illicit tobacco products and (iv) increased prices as a result of the implementation of excise duties on tobacco products. The closure of WCO’s factory in early 2020 for five weeks also impacted the Group’s inventory levels and supply of products to British American Tobacco and Contract Markets.

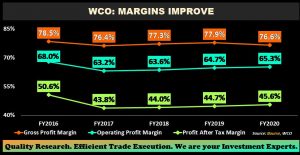

Margins Improve

WCO’s Gross Profit deteriorated slightly from 77.9% in FY2019 to 76.6% in FY2020, as Cost of Sales marginally increased despite the decline in Revenue. Lower Distribution Costs associated with lockdown measures, combined with WCO’s stated simplification of its business process, were primary drivers in controlling Total Operating Costs. Consequently, Operating Profit Margin from moved 64.7% to 65.3%in FY2020. The Group’s Profit After Tax Margin rose to 45.6% in FY2020 relative to a prior 44.7%.

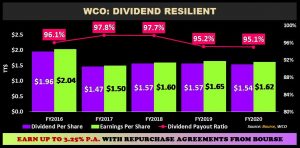

Dividend Payout Declines

WCO maintains one of the highest dividend yields on the domestic market, an attractive feature to income-oriented investors willing to bear the stock’s price risk. The company has managed to reward shareholders with a healthy dividend despite the considerable volatility of FY2020, a feat which many other companies were not able to achieve during the same period. WCO’s dividend per share paid in FY2020 was $1.54, a marginal 1.9% lower than the $1.57 paid in FY2019.

The Bourse View

Currently, WCO is priced at $32.78, 7.4% lower Year to Date. The stock trades at a trailing Price to Earnings ratio of 20.2 times, higher than the Manufacturing 1 sector’s average of 18.0 times. WCO has approved the payment of a final dividend of $0.76, payable on May 28th 2021. Cumulatively, this brings the total dividend payment of WCO for FY2020 to $1.54. The stock offers investors a trailing Dividend Yield of 4.7%, above the sector average of 1.5%. While lower disposable income and the heightened regulations on the industry may present challenges to demand, the relatively inelastic nature of tobacco products is likely to provide some resilience to revenue. WCO could look forward to some normalization of operations as traditional distribution channels – including bars and other entertainment channels – are allowed to reopen. This would rely considerably on vaccination progress and control of COVID-19 cases in the short-term. On the basis of relatively fair valuations and strong pricing power, but tempered by still sluggish economic recovery, Bourse maintains a NEUTRAL rating on WCO.

ANSA Merchant Bank Limited (AMBL)

AMBL reported an Earnings per Share (EPS) of $1.89 for the financial year ended 31st December (FY2020), down 41.7%, relative to $3.24 in the prior year. Net Insurance Revenue fell 1.9% to $418.2M in FY2020. Finance Charges, Loan Fees and Other Interest Income declined 24.7% to stand at $153.0M, reporting a steeper decline amid the pandemic. Investment Income fell 50.3% from a previous $326.1M to $162.2M, as the domestic financial market encountered pandemic led headwinds. Revenue from Contracts with Customers amounted to $6.6M (51.7% lower). Other Income improved 19.8% from $136.7M in FY2019 to $163.7M, primarily driven by an increase in Administrative Fees and Commissions. A significant expense item, Credit Loss Expense of Net Investment in Leased Assets, Loans and Advances and Investments was 30.1% lower from $33.5M to $23.4M, largely based on a reduction of Credit Loss Expense arising from Banking Services. Total Operating Expenses increased 5.1%, leading to a Net Operating Income of $478.4M, 27.3% lower year-on-year. AMBL’s Total Selling and Administrative Expenses fell 8.9% in FY2020, taking it to $273.7M from a previous $300.4M. The Bank reported a Profit Before Tax (PBT) of $204.8M, 42.7% lower compared to a prior $357.4M. Overall, AMBL recorded a 41.6% decline in Profit Attributable to Shareholders, from $277.6M to $162.0M in FY2020.

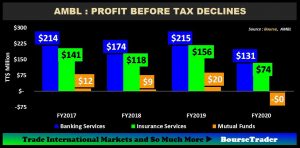

PBT Lower

AMBL’s largest profit generating segment, Banking Services (contributing 64.0% towards PBT), declined 39.1% YoY. Lower new motor vehicle sales across other segments of parent company Ansa McAl Ltd (AMCL) weighed on asset financing activities, compounded by muted demand for loans and financial market contractions. With economic conditions normalising and financial markets recovering, the Group could benefit in coming periods. Additionally, the integration of its newly acquired commercial banking license is also expected to yield rewards for AMBL. Investors may recall that the group opened the doors to its newly acquired banking franchise on March 1st, 2021.

AMBL’s Insurance Services segment (36.0% of PBT) fell 52.8% in FY2020. Life Insurance Operations, which contributed $1.8M ($92.1M, FY2019), was impacted by a reduction in Operating Income, down 22.8% amid lower demand for insurance, group annuity and pension service offerings. Approval of AMBL’s acquisition of Trident Insurance business would increase the Group’s footprint in insurance operations in the Barbados market. General Insurance which accounted for $71.7M ($63.7M, FY2019) improved 12.5% primarily owing to a 5.0% decline in segment expenses.

The Mutual Funds segment reported a Loss Before Tax during the period of $0.1M compared to a profit of $20.4M in FY2019, declining 105.0%. Operating Income generated by this segment contracted 39.3%, likely affected by lower investment income and elevated unrealized losses on investments designated at fair value through its statement of income. Expenditure, meanwhile, remained relatively unchanged.

The Bourse View

AMBL is currently priced at $40.00 and trades at a trailing Price to Earnings ratio of 21.2 times, higher than the Non-Banking Finance sector average of 13.3 times. Despite not declaring an interim dividend, AMBL declared a final dividend payment of $0.75, payable by May 21st, 2021. As such, the stock has a trailing Dividend Yield of 1.9%, higher than the sector average of 1.0%. Lower disposable income and tepid business activity as a result of the pandemic and other structural economic issues could present challenges for consumer demand. Notwithstanding the above, the recent acquisition of Bank of Baroda and ongoing acquisition of Trident Insurance provide credible avenues for growth. Against this backdrop, BOURSE maintains a NEUTRAL rating on AMBL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”