BOURSE SECURITIES LIMITED

21st October, 2019

SBTT, PHL Advance

This week, we at Bourse review the financial performance of Scotiabank Trinidad and Tobago Limited (SBTT) for its 9-month fiscal period ended July 2019 and Prestige Holdings Limited (PHL) for its 9-month period ended August 2019. SBTT would have advanced on account of lower comparable tax expenses, while PHL’s profitability improved through higher revenues and more effective cost management.

ScotiaBank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) reported Earnings per Share (EPS) of $2.97 for the 9M 2019 period, an 8.3% year-on-year (YoY) increase from the EPS of $2.74 reported in the prior comparable period.

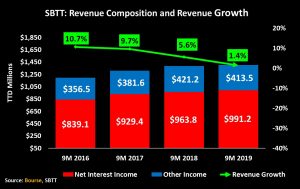

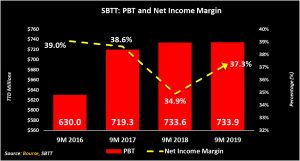

SBTT generated $991.2M in Net Interest Income in 9M 2019, a moderate 2.8% ($27.4M) improvement from the $963.8M earned in 9M 2018. Other Income declined 1.8% or $7.7M YoY, amounting to $413.5M for the period. Total Revenue overall improved marginally (up 1.4% YoY) from $1.39B to $1.40B. Net Impairment Loss on Financial Assets would have declined by $1.4M or 1.3% YoY while Non-Interest Expense increased by $20.9M or 3.8% YoY. Both these factors contributed to a 3.0% YoY increase in Total Expenses, which stood at $670.9M. Income before Taxation increased $0.21M YoY to $733.9M. SBTT reported a $40.3M YoY decrease in its Provision for Taxation. Overall, SBTT generated a $40.3M or 8.3% YoY increase in Income after Taxation, from $483.3M to $523.6M.

Outlook

SBTT’s Net Interest Income has grown at a 5-Year Compounded Annual Growth Rate (CAGR) of 7.51%, contributing approximately 70% of Total Revenue annually. Other Income, with a 5-Year CAGR of 3.84% contributes an average 30% of Total Revenue. Revenue growth has remained positive, albeit at a slower rate in recent years, slowing from 10.7% in 9M 2016 to 1.4% in 9M 2019. This has likely been a result of economic challenges in Trinidad & Tobago.

SBTT’s Income before Taxation (PBT) increased marginally in 2019 by $0.21M YoY. Despite an almost identical PBT garnered in both periods, SBTT’s Net Profit Margins varied from 34.9% in 2018 to 37.3% in 2019. The improvement in Net Profit Margin would have been a one-off tax credit generated in the first quarter of FY2019. Cost management remains strong, evidenced by its low Productivity Ratio which rose marginally in 9M 2019 to 40.1% from 39.1% in 9M 2018.

While Retail, Corporate and Commercial Banking contribute the majority of SBTT’s PBT, Insurance Services would have generated roughly 14.3% of total PBT in FY 2018. SBTT has agreed to sell its insurance operations to Sagicor Financial Corporation Limited (SFC) for US$96M. SBTT indicated that existing ScotiaLife Trinidad and Tobago staff will join SFC, or a new licensed insurance sales entity, for the provision of enhanced insurance products and services to its customers in Trinidad and Tobago. The arrangement is, however, contingent on the completion of the acquisition of SFC by Alignvest Acquisition II Corporation, which is expected within Q4 2019.

The Bourse View

At a current price of $59.75, SBTT’s share price has declined 7.0% YTD. The stock trades at a trailing P/E of 15.6 times, below the Banking sector average of 16.5 times. SBTT’s trailing dividend yield is 5.02% exceeding the sector average of 3.85%. On the basis of a relatively attractive dividend yield and valuations, but tempered by slowing revenue growth Bourse maintains a NEUTRAL rating on SBTT.

Prestige Holdings Limited (PHL)

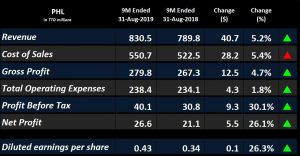

Prestige Holdings Limited (PHL) reported Earnings per Share (EPS) of $0.43 for the 9M period ended 31st August, 2019, a 26.3% increase over the $0.34 reported for the prior comparable period.

PHL’s Revenue grew 5.2% YoY, to a value of $830.5M. Cost of Sales also increased, climbing 5.4% to $550.7M. Gross Profits increased 4.7% ($12.5M) YoY increase to $279.8M. Net Operating Expenses for the 9M 2019 period increased marginally by 1.4% YoY closing the period at $235.8M. PHL’s Profit Before Taxation amounted to $40.1M, a commendable 30.1% increase from the comparable period last year. Profits after Tax improved 26.1% ($5.5M) YoY to $26.6M compared to $21.1M earned 9M 2018.

Outlook

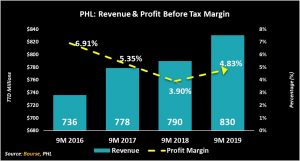

Despite successive years of Revenue growth, PHL’s profitability has come under pressure from challenges in acquiring foreign currency and limited ability to adjust product prices in more challenging economic circumstances. As a result, profit margins would have fallen over the years, with Profit Before Tax (PBT) margin reaching a low of 3.9% in 9M 2018. In 2019, however, the company experienced some reprieve, with PBT Margin improving to 4.83% in 9M 2019 through better cost management.

In 2019, PHL was able to improve margins through the introduction of new revenue-generating initiatives and more stringent cost management. Thus far, PHL would have seen a 0.9% YoY increase in both its Operating Profit Margin and its Net Profit Margin. This is a positive turn around for the company after experiencing consecutive years of margin compression and declining profits.

The Bourse View

At a current price of $8.10, PHL trades at a trailing P/E multiple of 15.79 times, above the Trading sector average of 13.58 times. The stock offers a trailing dividend yield of 3.95%, above the sector average of 3.19%. On the basis of improved performance and a relatively attractive dividend yield, tempered by foreign exchange constraints and still weak domestic economic conditions, Bourse maintains a NEUTRAL rating on PHL.

JMMBGL Additional Public Offering

Jamaica Money Market Brokers Limited (JMMBGL) has announced an additional public offering (APO) of 266,737,797 ordinary shares on the local and Jamaican market. Key investors will be allotted 150M shares, 80M to existing shareholders and the remaining 36,737,797 to non-reserved share applicants. JMMBGL reserves the right to increase the maximum issued shares to 325M, in which case the allotment to non-reserved share applicants would increase to 95M shares. The proposed issuance is expected to increase the number of outstanding shares by 16.4%, or 19.9% if the issue size is increased to 325M shares. Subject to regulatory approval, the invitation will be open to local investors during the period 22nd October to 11th November, 2019. JMMBGL has offered a subscription price of TT$1.90/J$38.00 per share for Existing Shareholders, Team Members and Key Investors, and TT$1.94/J$38.75 per share for new share applicants. The subscription prices of TT$1.90 and $1.94 represent discounts of 6.9% and 4.9% respectively to the current price of JMMBGL (TT$2.04) on the local exchange. On the Jamaican exchange, the subscription prices represent discounts to the current price (J$40.09) of 5.2% and 3.3% respectively. JMMBGL is expected to raise capital in the amount of TT$510.2M/J$10.06B to support its growth initiatives and investment opportunities.

Stay tuned for next week’s article where provide a more in-depth analysis of the offer and give our Bourse View.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”