BOURSE SECURITIES LIMITED

December 5th, 2016

Why a Retirement Fund is right for you

This week, we at Bourse discuss an often overlooked area, investing for retirement. We provide some insight on the importance of planning for retirement by taking a closer look at group retirement funds. We also examine the benefits available to both employers and employees by investing in such funds.

What is a Group Retirement Fund?

Retirement funds are investments that provide an opportunity for the investor to accumulate cash for future needs. There are two types of funds available to investors seeking to save for retirement – an individual retirement fund and a group retirement fund. While both funds are aimed at providing long-term returns, an individual retirement fund is a contract between the individual employee and the retirement provider. As such, all contributions into the fund are made by the employee.

On the other hand, a group retirement fund is a contract between the employer and the retirement provider. They often involve contributions by both the employer and employee into separate funds but for the ultimate benefit of employee. The employer has the option to match all or part of an employee’s contribution to the fund, allowing the employee to benefit from a larger retirement benefit. With an investment objective to provide superior returns in the long-term, retirement funds are invested across both debt and equity securities. For the purpose of this article, we will focus on group retirement funds.

Benefits of Group Retirement Funds

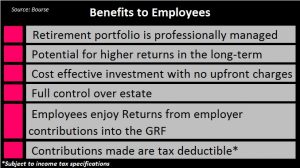

As a contributor into a registered retirement fund, employees enjoy a wide range of benefits which extend from monetary benefits in the form of taxation exemptions to qualitative benefits in the form of flexibility when choosing an annuity provider.

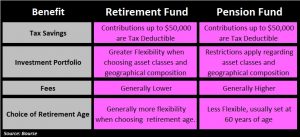

Unlike Pension funds, whose investments are governed by the principles laid down in the Insurance Act, Group Retirement Funds are subject to less regulatory limitations. Several restrictions in the Insurance Act are as follows:

- A company shall not purchase more than thirty per cent of the ordinary shares of any corporation.

- A company registered to carry on life insurance business shall not, in respect of that business, purchase the shares of a company, incorporated in Trinidad and Tobago and carrying on such business.

- A company may invest its statutory funds in assets of the following classes:

- the bonds, debentures or other securities of, or those guaranteed by international financial institution approved by the Central Bank;

- ordinary shares, preferred shares, bonds or debentures of a company incorporated in Trinidad and Tobago and approved by the Central Bank.

Pension funds may lose out on profitable investment opportunities in the form of investment grade bonds etcetera, which fall under the Act’s constraints. Group Retirement funds however, enjoy the benefit of building a portfolio across various asset classes, currencies and geographical regions which can in turn provide superior portfolio returns.

Investing in a Group Retirement Fund, as opposed to a regular pension fund can provide employees with a lower cost ratio. Pension funds bear the burden of high costs being built into plan assets including actuarial fees and other administrative fees when compared to a Group Retirement Fund, where costs incurred are mainly management fees. The Plan Assets of a retirement fund will therefore experience less erosion when compared to that of a pension fund, which can effectively boost employee’s returns upon retirement.

Employees also benefit from choosing their retirement age with group retirement funds as opposed to pension funds, which more often than not, set a maturity age of 60 years.

All of these features are embedded in Bourse’s Savinvest Group Retirement Fund. The fund affords for contributions by both employee and employer.

Taxation Benefits Evident

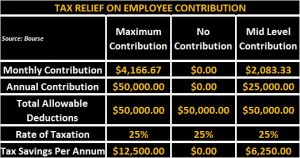

Apart from the employee’s tax exempt personal allowance of $72,000 per annum, employees can claim up to a further $50,000 per annum in tax allowable deductions by contributing to a registered retirement plan. This means that contributions up to the maximum cap of $50,000 can reduce taxes payable by 25% of the said amount, equating to savings of up to $12,500 per annum for the employee.

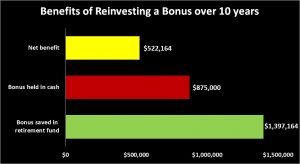

For small to mid-sized companies providing bonus incentives, retirement funds are an excellent option for its senior management to invest the extra income. In a scenario in which a senior employee stands to receive a bonus payment of $100,000, if the employee were able to redirect this bonus into a retirement fund over a 10-year period, the employee would stand to benefit from a tax shield of $125,000 over the period.

Additionally, the $100,000 bonus payment redirected to the retirement plan, if held constant over the 10-year period, would amount to $1 million in total income received. Assuming the employee has no need for additional cash, the bonus payments when invested into a retirement fund at a rate 6%, would have compounded to $1.397 million over 10 years, providing a total holding period return of 40%.

Conversely, if the employee chose to hold his bonus in cash, the employee would have paid $12,500 in taxes on an annual basis amounting to $125,000 over the 10-year period. Also, the employee’s income after taxes would equate to $87,500 annually and $875,000 for 10 years, if the funds are not reinvested.

Rather than having solely $87,500 work for you, had the full $100,000 been invested, the employee’s net benefit – the additional amount the employee would have earned through a retirement fund– would have been $522,000.

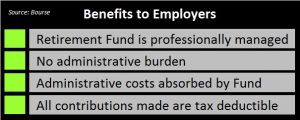

There are also benefits to employers participating in the retirement plan, some of which are set out below.

When should you start saving for retirement?

Ideally, you should start saving for retirement after receiving your first paycheck. The sooner you start saving for retirement, the more time your money has to grow. The returns on each year’s contributions will generate their own returns the following year, a wealth-effect known as compounding.

Assuming at age 25 you contribute $3,000 annually to a retirement fund and this is matched by the employer’s contribution, the total annual investment toward your retirement fund would be $6,000. If the fund’s annual return is 6%, your ending investment value would have compounded to $502,810 after 30 years at age 55 (assuming contributions remains constant). This represents a 2.8x in wealth accumulation on the contributions of both the employer and employee of $180,000. For the employee, the outlay would have been $90,000.

What happens at maturity of your retirement fund?

At maturity, up to 100% of the employee and employer’s contribution can go toward the purchase of an annuity. Alternatively, the employee has the option to receive 25% of the plan value in an upfront tax exempt cash lump sum. The remaining 75% goes toward the purchase of an annuity.

How have retirement funds performed over the past 4 years?

In the previous example where an employee earns a bonus of $100,000, had the employee placed those funds in the Bourse Savinvest Group Retirement Fund at the start of 2012, it would be worth $125,042 at the end of 2015 based on compounded returns. That same investment would range between $112,491 and $114,328 if it was invested in other established group retirement funds for the same period.

Retirement planning, though a long-term commitment, can reap substantial benefits in the future by providing financial comfort and security. As with any investment product, a trusted investment adviser, such as Bourse, should be consulted before making an investment decision.

Here is a Bourse tip, you should consider redirecting your year-end bonus through your employer retirement fund, if permitted. This will result in significant tax savings and enhance retirement benefits.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”