BOURSE SECURITIES LIMITED

23rd September, 2019

Pre-Budget Review – Revenue in Focus

This week, we at Bourse begin an analysis of several economic trends and consider what investors and the wider public might expect in the upcoming National Budget carded for October 7th, 2019. In the first of a series of articles, we consider the revenue side of the budget equation. Will economic growth remain muted, or will it accelerate? Will energy revenues be higher or lower than projected and how might this impact fiscal decisions for FY 2019/2020? We discuss below.

GDP Growth on the rebound

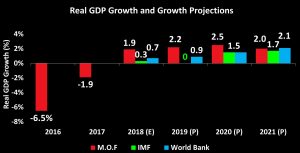

According to the Ministry of Finance, real GDP Growth recovered in 2018, measuring 1.9% year-on-year (YoY) in contrast to the contractions of 6.5% and 1.9% recorded in 2016 and 2017 respectively. Based on the most recent estimates of the World Bank (WB) and the International Monetary Fund (IMF), growth is expected to be relatively muted in 2019, but consistently improve by 2021 (WB: ↑2.1%, IMF: ↑1.7%). The expansion is expected to be supported by projected increases in exploration and production activity in the oil and gas industry.

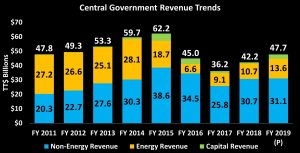

Central Government Revenue declined from $62.2B in FY 2015 to $45.0B and $36.2B in FY2016 and FY2017 respectively. Energy Revenue, which would have contributed an average of 51.2% to Total Revenue over the period FY2011-2012, accounted for 25.1% ($10.7B) of Total Revenue in FY2018. Projected revenues for FY2019 are $47.7 billion, of which energy revenue is expected to contribute 28.6% or $13.6B (according to Central Bank estimates).

Oil Production falls

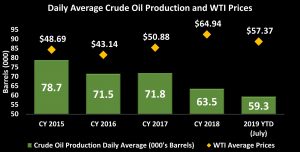

Daily Average Crude Oil Production levels have been consistently declining over the past four years, falling from roughly 78,700 barrels per day (bopd) in 2015 to a 2019 year to date average of 59,300 bopd. On the other hand, WTI prices over the same period have been recovering, recording a high of US$64.94 per barrel at the end of 2018, the same period for which Daily Production Average was lowest.

For the first quarter of the FY2019, WTI Crude Oil Prices strayed below the budgeted price of US$65 per barrel, dipping below US$45 per barrel in December 2018. Prices rebounded from December lows to around US$66 per barrel in April 2019, shortly after which the budgeted price was revised to $60 per barrel from $65 per barrel. WTI Oil has since been trading sideways within a range of US$51 – US$60, under the budgeted price of US$60.

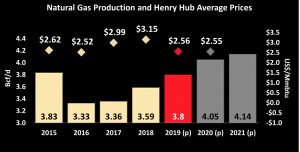

Natural Gas production stable, prices lower

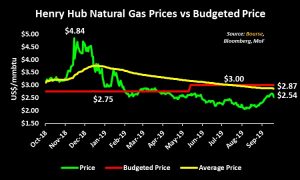

Production of Natural Gas has trended upward since 2016 and is forecast to continue on this trajectory into 2021, owing to increased exploration activity and development of existing wells by upstream companies. According to the Honourable Minister of Finance in the 2018/2019 Budget Statements, natural gas production is estimated to be 3.8B cubic feet per day (bcf/d) in 2019, and rise to 4.14 bcf/d in 2021. Henry Hub Natural Gas prices have declined 10.4% year-to-date (YTD) and the U.S. Energy Information Administration, in its latest short-term energy outlook, projects an average price of US$2.56/MMBTU for 2019 which remains relatively flat into 2020 at US$2.55/MMBTU.

The 2018/19 Budget was predicated on a Natural Gas price of US$2.75/MMBTU. This was subsequently raised to US$3.00/MMBTU in the mid-year budget review on the basis that the average fiscal YTD Henry Hub prices were well above budgeted. However, the downward trend of natural gas prices has persisted over the course of the fiscal year, with the average fiscal YTD price falling below budgeted for the first time in mid-August. As at September 20th 2019, the spot price stood at US$2.54/MMBTU bringing the average YTD price to US$2.87/MMBTU.

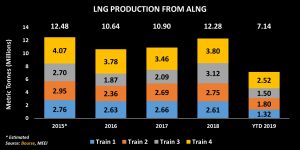

Production of Liquefied Natural Gas (LNG) dipped, along with natural gas production, in 2016 and 2017, but rebounded almost to 2015 levels in 2018 at 12.28 metric tonnes per annum (mtpa). Data from the Ministry of Energy and Energy Industries suggests that production levels of LNG between January to July have fallen 3.3% YoY from 7.39MT in 2018 to 7.14MT in 2019.

Methanol, Ammonia prices lower

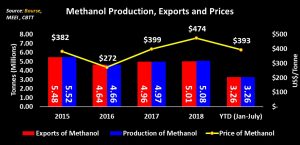

In 2016, Production and Exports of Methanol fell significantly, due to a significant fall in average prices from US$382/Tonne to US$272/Tonne. Methanol prices have since recovered, reaching a high of US$474/Tonne in 2018, and were accompanied by gradual YoY increases in Production and Export levels. Despite the YTD average price of Methanol retreating to US$393/Tonne, Production and Export levels for the period January to July 2019, have risen 8.6% and 5.3% respectively, YoY.

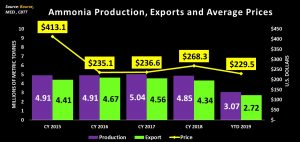

Following a significant 43.1% decline from US$413.1 per tonne in 2015 to US$235.1 in 2016, the average price of Ammonia has remained relatively stable, trading within a range of US$229.50-US$268.30. The average YTD Ammonia price sits at US$229.50, its lowest price since 2015. Ammonia Production and Export levels over the past four years have remained relatively flat with no significant deviations from its four year averages of 4.93 million metric tonnes and 4.50 million metric tonnes respectively.

Will revenue hit projections?

Amidst generally weaker conditions in energy markets, it remains to be seen whether energy revenues will in fact meet projections or fall short. With non-energy sector revenues typically being more stable, revenue shortfalls (in the absence of adjustments to expenditure) will likely have to be made up through some combination of borrowing, drawdowns on savings and/or sales of assets.

Next week, we discuss the expenditure side of the budget equation.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”