BOURSE SECURITIES LIMITED

October 16th, 2017

Nine-Month Market Review

This week we at Bourse review the performance of the local equity market for the nine months ended September 2017. We take a closer look at the three stock indices, namely the Trinidad and Tobago Composite Index (TTCI), the All T&T Index (All T&T) and the Cross Listed Index (CLX), as well as highlight the major movers of the various indices. Finally, we look at some key market drivers and advise investors on how to position their portfolios for the remainder of the year.

Local Market Review

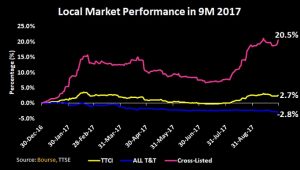

The indices witnessed mixed results for the nine months ended 30th September 2017. The TTCI – which comprises both locally listed and cross-listed stocks, advanced 2.7%. The increase was driven mainly by positive returns of the Cross Listed Index (CLX) up 20.5%, but offset by a 2.8% decline in the All T&T Index (All T&T). By market capitalization, the cross-listed securities account for approximately 28% of the TTCI, with the remainder attributed to the domestic securities. As a result, the large movement in the CLX had a smaller impact on the TTCI.

Overall market activity resulted in 14 security advances, 13 declines and 5 remaining flat. The total value traded (inclusive of mutual funds) declined 3.4% in the 9M 2017, from TT$ 893.7M to TT$ 863.0M. The total volume traded also declined 17.3% over the same period from 80.5M shares to 66.6 M shares.

Cross-Listed Stocks Surge

The strong performance of the CLX in 2016 (up 57.9%) has continued into 2017, up 20.5%. Several key performance drivers for cross-listed companies would have included (i) relatively lower valuations when compared to ALL T&T stocks, (ii) lower exposure to the Trinidad and Tobago economy (iii) USD earnings/revenues and in some cases, USD dividends, all of which provides investors with a hedge against the TTD (iv) Stronger revenue and earnings growth compared to locally listed companies.

Jamaican-based NCBFG was the star performer on the CLX, advancing 75.0%, followed by JMMBGL with 53.3%. NCBFG experienced growth in Operating Income of 16.2% and 48.1% in Net profit over the nine-month period, 2017. The Group’s EPS was also up 48.0%. JMMBGL’s Operating Revenue increased by 18.6% while EPS was up 5.6% for the first quarter, 2018. This may have been due to their significant exposure to Jamaica, where improving macro-economic fundamentals point to a continued recovery in the nation’s economy. FCI was the only stock on the Cross-Listed Index to experience negative returns (4.2%).

ALL T&T down

The All T&T Index fell 2.8% in the 9M 2017, after declining 5.9% in 2016. In contrast to the Cross-listed Index, stocks on the All T&T Index have major exposure to weaker economic conditions in the Trinidad and Tobago market. The depreciating TT dollar, limited access to US currency, higher corporate taxes and lower consumer demand continue to impact company performance negatively. Even amidst these challenging conditions, local stocks have had a few top performers. Guardian Holdings Limited (GHL) saw an improvement of 18.6%, moving from $12.65 at the end of 2016 to $15.00 at the end of the 9M 2017. LJ Williams Limited B (LJWB) and Agostini’s Limited (AGL) also improved by 18.2% and 17.3% respectively. In terms of stocks declining, One Caribbean Media Limited (OCM) was the worst performer (down 28.4%), while National Flour Mills Limited (NFM) fell 20.6%.

Takeovers and Additional Public Offerings

Investors may recall that in March of this year, the Government, through its shareholding in First Citizens Holdings Limited, offered 48,495,665 ordinary shares for sale at an offer price of $32.00 per share, via an Additional Public Offering (APO). At the close of the APO, a total of 32,035,770 shares were sold raising a value of $1.025 billion.

The second APO of 2017 was that of Trinidad and Tobago Natural Gas Liquids Limited (TTNGL). In the 2017 Mid-Year Budget Review, the Honourable Minister of Finance indicated that the National Gas Company of Trinidad and Tobago Limited (NGC) would be selling 40,248,000 class B shares or 26% of its shareholding in TTNGL, via an APO. In June of this year, the APO was launched at an offer price of $21.00 per share. The Government would have been successful in selling all of the proposed shares, thereby raising $845M.

In June 2017, Scotia Group Jamaica Limited, which owns 77% of Scotia Investments Jamaica Limited (SIJL), initiated a Scheme of Arrangement to take SIJL private by cancellation of the shares held by all minority shareholders. In August, shareholders voted in favour of the Scheme of Arrangement, pursuant to which stock units in the Company (other than those held by Scotia Group Jamaica Limited) was cancelled in consideration for cash payments of J$38.00 per stock unit. Subsequently, trading in SIJL was suspended with effect from Monday 2nd October 2017.

Stock Market Drivers

Operational challenges in the current economic environment continue to have negative effects on company earnings in many ways. As such declining corporate profits and consumer confidence is expected to have an impact on the general direction of stock prices.

Low liquidity in the Trinidad and Tobago market plays a role in price volatility. The general buy and hold nature of some of the larger institutional investors in the industry has the effect of reducing trade frequency. In such cases, securities of this nature provide a form of protection from purely valuation-driven price declines.

Given the low interest rate environment, investors may choose to remain in the stock market to increase returns. The lack of alternative investment opportunities could also prevent investors from exiting the market, even in the face of lower earnings.

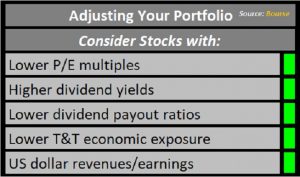

Investors can gain stable dividend income by investing in securities with lower dividend pay-out ratios. In an environment where earnings are declining, companies with healthy cash flows and a lower pay-out ratio may be able to hold the dollar value of dividend payments relatively constant, should earnings fall.

Investor Implications

Looking forward, higher corporate tax, in addition to lower consumer spending and the impact of higher fuel prices could weigh on corporate earnings. Investors are encouraged to hold stocks that (i) trade at low (PE) valuations (e.g. SFC, MASSY), (ii) offer an above-average dividend yield (e.g. SFC, TTNGL, CIF), (iii) hold a low exposure to the Trinidad and Tobago economy (e.g., SFC, NCBFG) and (iv) provide a partial hedge to the TTD through USD earnings/dividends (e.g. SFC, GKC). Investors should consult a trusted and experienced advisor, such a Bourse, to make a more informed investment decision.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”