BOURSE SECURITIES LIMITED

20th February, 2017

NEL Restrained, JMMBGL Grows

This week, we at Bourse review the performance of two companies within the Non-Banking Finance sector (though with very different business models), National Enterprises Limited (NEL) and JMMB Group Limited (JMMBGL). While lower energy commodity prices have weighed on NEL’s earnings, JMMBGL continues to improve on higher net interest income margins, among other factors. We examine both stocks and identify some of the main factors affecting their performance.

National Enterprises Limited (NEL)

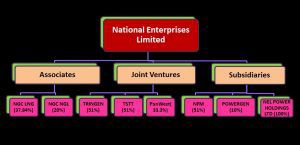

NEL reported Earnings per Share of $0.32 for the nine-month period ended December 2016, down 22% ($0.09) when compared to the $0.41 earned in the previous year. Importantly for NEL, Share of Profit of Equity Accounted Investees has historically accounted for the majority of overall profits, through its holdings in NGC LNG (37.84%), NGC NGL (20%), Tringen (51%), TSTT (51%) and PanWest (33.3%). For the nine-month period, this decreased 26.9% ($59.4M). NEL, through its consolidated holding NFM, experienced a decline in revenue of $2.8M or 0.8%. However, operating profit improved by 28.8% or $10.7M. Overall, profit for the period declined 22.4% ($58.9M), from $262.8M to $203.9M.

Outlook:

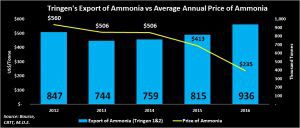

Historically, NEL’s ammonia-producing joint venture, Tringen, has accounted for the majority of Share of Profits of Equity Accounted Investees. While ammonia exports (for Tringen 1 & 2) have been on an upward trend in 2015 and 2016, prices have retreated. In 2012, average annual ammonia prices stood at US$559.92 /Tonne, whereas prices hit US$235.13 /Tonne in 2016, some 58% lower. Should prices remain at the current low levels in the near-term, Tringen’s contribution to NEL’s Share of Profit of Equity Accounted Investees will remain constrained.

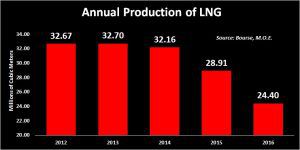

Another major contributor to the Share of Profit of Equity Accounted Investees is via NEL’s 37.8% ownership in NGC LNG, who in turn owns 10% in Liquefied Natural Gas exporter Atlantic LNG (Train 1), taking NEL’s interest to 3.78%. Production of LNG has been on a downward trend over the last 5 years. In 2012, LNG production amounted to 32.67 million cubic meters. In 2016, production levels slipped to 24.4 million cubic meters, a decline of 25%. This somewhat corresponds to natural gas production in T&T, where 2012 average daily production was 4,122 mmcf/d while 2016 average just 3,326 mmcf/d (19.3% lower) Looking ahead, the new gas fields which are expected to come on stream in 2017 and 2018 should – in the short term – arrest the declining trend of production. Consequently, NGC LNG’s contribution to NEL may improve, pending any unforeseen movements in LNG prices.

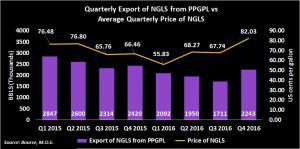

The third largest contributor to NEL’s share of profits has traditionally been its 20% interest in NGC NGL, which owns 51% of Phoenix Park Gas Processors Limited (PPGPL). PPGPL operates the country’s only natural gas processing and natural gas liquids (NGLs) fractionation plant and is the largest producer of propane, butane and natural gasoline. Total export of natural NGLS from PPGPL declined 21% in 2016, compared to 2015. NGL prices however, have recovered from its lows in quarter 1 of 2016, and has been on an upward trend throughout the year. Like LNG production, NGL production stands to benefit from the new gas fields which are expected to be commissioned in the coming months.

Historically, NEL’s 33.33% holding in Panwest, which owns 10% of PPGPL, has contributed positively to the Share of Profit of Equity Accounted Investees. Additionally, NEL’s 1% shareholding in TTNGL (which owns 39% of PPGPL), account for a further 0.38% exposure to PPGPL, taking NEL’s total holdings in PPGPL to 13.9%. In recent times, several losses related to NEL’s 51% position in TSTT have weighed on NEL’s earnings. Should these trends continue in the near term, earnings is likely to remain subdued.

The Bourse View

At a current price of $10.94, NEL trades at a trailing P/E of 182.3 times, considerably above the sector average of 10.9 times (excluding NEL). Additionally, NEL offers investors a trailing dividend yield of 2.74%. On the basis of expected higher LNG and NGL production expectations, but tempered by the negative impact of lower ammonia prices, Bourse maintains a NEUTRAL rating on NEL.

JMMB Group Limited (JMMBGL)

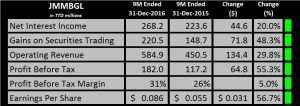

For the nine month period ending December 31st 2016, JMMBGL reported Earnings per share of TT$0.086, an increase of 57% (TT$0.031) from TT$0.055 which was reported over the nine month period ended December 31st 2015.

Net interest income increased by 20% or TT$44.63M to TT$268.24M, with net interest margin rising from 42.5% to 47.3%. This performance was due to improved interest income, while interest expenses were contained. Net interest income has increased on average by 19% since 2011. The loan and investment portfolios, which were up a combined TT$1.5 billion, would have benefitted from an improving interest rate spreads.

Securities trading increased 48.3% or TT$71.82M, while Fee and Commission income improved by 28% or TT$9.79M. Net foreign exchange trading rose to TT$49.25M from TT$41.74M and dividends increased from TT$1.58M to TT$0.87M. Furthermore, 83.4% of the company’s operating revenue was generated from net interest income (45.8%) and securities trading (37.6%) combined. The 48.3 % improvement in securities trading fees was reportedly attributable to opportunities arising from Brexit and Emerging markets, and a higher demand for Government of Jamaica bonds.

Operating revenue increased by TT$134.43 M, from TT$450.47 M to TT$584.90M, an increase of 30%. At the end of 2016, the company generated 76% of its operating revenues from its operations in Jamaica, 16% from Dominican Republic and 8% from Trinidad and Tobago.

Operating expenses increased by 21% over the prior year, moving from TT$333.23 to TT$402.85. Profit before tax increased by TT$64.8 M and the profit before tax margin also rose to 31% from 26%. Net profit rose by TT$50.29 M or 55% from the previous year.

Outlook

Ongoing progress in the Jamaican economy continue to generate benefits to the Group, including (i) improving public debt (down from 145% to 120% as a % of GDP), (ii) higher business confidence, (iii) improving credit ratings and (iv) a more accommodative interest rate environment. The Jamaican economy is poised to grow by 1.7% in the fiscal year 2016/2017, 2% in FY 2017/2018 and 2.8% in 2018/2019 according to the IMF.

The Bourse View

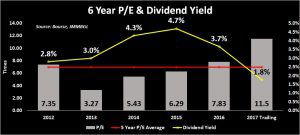

JMMBGL is currently trading at a trailing P/E of 11.5 times, significantly higher than its 6-year average of 7 times and is in line with the Non-Banking Finance sector average of 11 times . The stock offers investors a trailing dividend yield of 1.76% and currently has a market to book value of 1.5x. Year-to-date, the share price has rallied 33%, after an increase of 64% in 2016. Based on the valuations and share price appreciation, Bourse maintains a NEUTRAL rating on JMMBGL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”