| HIGHLIGHTS JMMBGL 9M 2021

NEL 9M 2021

|

NEL, JMMBGL Earnings Dip

This week, we review the performance of National Enterprises Limited (NEL) and JMMB Group Limited (JMMBGL) for the nine months ended 31st December, 2020. Both NEL and JMMBGL reported lower performance despite the recent improvement in energy markets and financial markets. Will both members of the Non-Banking Finance Sector bounce back in the coming months, or could challenges persist? We discuss below.

JMMB Group Limited (JMMBGL)

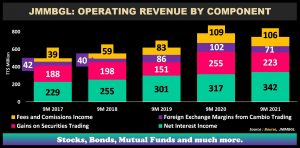

JMMB Group Limited (JMMBGL) reported an Earnings per Share of TT$0.09 in 9M 2021, 16.5% lower than TT$0.11 reported in the prior period. Net Interest Income expanded 8.0% to $342.0M from a prior $316.8M. Fee and Commission Income declined 2.7% to TT$106.4M, while Gains on Securities Trading fell 12.6%, to TT$222.9M. Overall, Operating Revenue declined 4.9% in the period as the improvement in Net Interest Income was not able to fully offset declines in Financial & Related Services. Operating Expenses contracted by 4.9% to stand at TT$480.8M, as the Group attempted to manage costs. Impairment Loss on Financial Assets climbed 86% to TT$33.5M from TT$18.0M. Consequently, Operating Profit declined 11.2% relative to the prior period. The Group recorded a Share of Loss of Associate of TT$4.8M, leading to a Profit Before Tax of TT$227.5M, 12.9% lower year on year (YoY). Income Tax fell to TT$46.1M for an Effective Tax rate of 20.2% relative to 30.9% in 9M 2020. Profit for the Period was marginally higher at $181.5M from a previous TT$180.6M. Profit Attributable to Equity holders of the Parent fell 2.0%, to close the period at TT$173.6M.

Operating Revenue Declines

Net Interest Income, accounting for 45.8% of Operating Revenue, expanded 8.0% YoY. Despite the growth shown by the aforementioned revenue segment, Operating Revenue declined 4.9% for the period. Decreases in the Group’s Gains on Securities Trading (down 12.6%) and Foreign Exchange Margins from Cambio Trading (down 30.6%) were crucial factors in JMMBGL’s 9M 2021 performance. Both segments, which are largely based on the performance of financial markets and broader economic conditions, typically contribute a collective 44% of Total Operating Revenue.

Fees and Commission Income, which represented for 14% of Operating Profit, declined 2.7% YoY, amid lower business activity despite growth in the Group’s managed funds and collective investment schemes.

Sagicor Considerations

JMMBGL’s 22.5% stake in associate company Sagicor Financial Company Limited (SFC) could potentially impact performance in subsequent periods. JMMBGL currently values its Interest in SFC at $1.66B, 53.2% above the market-based valuation ($1.08B) of the stake. Prolonged lower market prices of SFC increases the likelihood that JMMBGL would need to reflect a lower carrying value of its 22.5% stake, which could adversely affect reported financial performance.

The Bourse View

JMMBGL is currently priced at $1.85 and trades at a trailing price to Earnings (P/E) ratio of 11.1 times, in line with the Non-Banking Finance sector average of 11.8 times. The stock offers a trailing dividend yield of 0.6%, marginally lower, compared to the sector average of 1.1%. Ongoing economic and financial market normalization could support the growth prospects of JMMBGL which continues to grow its asset base (up 18.5% YoY). On the basis fair valuations, stabilizing financial markets, but tempered by sluggish economic recovery and potential downward revaluations from JMMBGL’s equity stake in SFC, Bourse maintains a NEUTRAL rating on JMMBGL.

National Enterprises Limited (NEL)

NEL reported a Loss per Share (LPS) of $0.12 for the nine-month period ended December 31st 2020 (9M 2021), 327.5% lower than an Earnings Per Share (EPS) of $0.05 reported in 9M 2020. The Group’s Dividend Income improved 19.7% to $24.4M from a previous $20.4M. Other Income declined 10.3%, moving from $5.7M in 9M 2020 to $5.1M in the period under review. Operating Expenses jumped to $98.1M, a result of declines in the fair value of investee companies, relative to 9M 2020 in which the Group reported a gain of $7.6M. Cumulatively, NEL reported a Loss Before Tax of $68.6M, 304.6% lower than a $33.5M Profit Before Tax (PBT) in 9M 2020. Overall, the Group recorded a Total Comprehensive Loss for the year of $70.1M, 327.5% lower than a Profit of $30.8M reported in the previous period.

Operating Expenses Higher

NEL’s $105.7M increase in Operating Expenses stemmed from employment of the fair value method of accounting, implemented in FY2019. The decline in the fair value of the Telecommunication Services of Trinidad and Tobago Limited (TSTT), reflected in the 35.4% decline in Investment in Subsidiaries, outweighed gains arising from an appreciation of National Flour Mills (NFM) and NEL Power Holdings Limited (NPHL). Similarly, Investment in Joint Ventures and Associates including Trinidad Nitrogen Company Limited, NGC NGL and PanWest Engineers and Constructors LLC, fell 11.4%

Energy Fortunes Languish

NEL’s reliance on energy sector fortunes have taken a toll on its performance in recent years. Trinidad Nitrogen Company Limited, NGC NGL Company Limited, NGC Trinidad and Tobago LNG Limited and Pan West Engineers and Constructors LLC are the four companies that primarily constitute NEL’s energy portfolio. In FY2019, the aforementioned entities reported Dividend Income of $78.1M, declining 78.0% to $17.2M in FY 2020. With energy markets under pressure in recent years, the profitability of these companies were naturally impacted. While there has been some turnaround in the pricing of some energy commodities over the past several months, production at the domestic level remains a high hurdle.

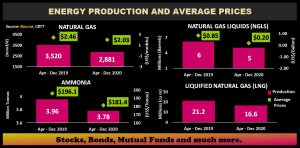

Pandemic Pressures Impacts Energy Sector

Trinidad Nitrogen Company Limited, NGC LNG, NGC NGL and Pan West are all dependent on the supply of natural gas to act as feedstock for fractionation activities. Within the period April to December 2019 (9M 2020) Natural Gas production in T&T averaged 3,520 mmscf/d. Comparatively, in the same nine-month period for 2020 it averaged 2,881 mmscf/d, 18.1% lower. With the decline in natural gas supply already impacting downstream energy participants, if it were to persist, could further impact NEL’s performance. Benefitting from improvements in the energy market, the price of Natural Gas has averaged US$2.78/MMBtu in 2021, thus far.

The production of Natural Gas Liquids (NGLs) declined 19.8% in 9M 2021 (April to December 2020), to 5.01 million barrels from 6.25 million barrels in the preceding comparable period. Using a weighted basket, NGL prices averaged depreciated 76.5% YoY, averaging US$0.20/Gallon in 9M 2021 relative to US$0.85/Gallon in previous period. For 2021 thus far, the weighted price of NGLs has averaged US$1.07.

NEL has investment exposure to two ammonia operating plants TRINGEN I and TRINGEN II, through its 51% holding in Trinidad Nitrogen Company Limited. Ammonia prices declined from an average of US$196/tonne in 9M 2020 to an average of US$181/tonne in 9M 2021. Following the decline in market prices, Ammonia production has trended downwards domestically, moving from 3.96 Million Tonnes (MT) in 9M 2020, to 3.78 MT in 9M 2021.

In 9M 2021 Liquefied Natural Gas (LNG) production stood at 16.6M cubic meters, 21.9% lower than 21.2M cubic meters in the prior comparable period. In 9M 2020, Atlantic’s Train 1 produced 3.63M cubic meters as compared to 1.03M cubic meters in 9M 2021.

Despite the pressures arising from challenged domestic natural gas production, maintenance works on Tringen I, in addition to a proposed Turnaround of $300M to be spent on keeping Atlantic’s Train 1 operational, may provide some support to the fair valuation of investee companies.

The Bourse View

NEL is currently priced at $3.12 and trades at a market to book ratio of 0.77 times relative to a sector average of 1.28 times. Utilizing a sum of parts valuation approach to estimating intrinsic value, NEL’s estimated price would fall within a range of $3.40 – $3.90, higher than its current market price. NEL offers a trailing dividend yield of 1.6% relative to a sector average of 1.1%, based on a last paid dividend of $0.05 in March 2020. While the stabilization of energy prices provides a case for improvement in its investee companies, the domestic environment of lower natural gas production creates headwinds to any swift rebound in fortunes for NEL. Accordingly, Bourse maintains a NEUTRAL rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”