| HIGHLIGHTS

GKC FY 2020

PHL FY 2020

|

GKC Progresses, PHL Declines

This week, we at Bourse review the financial performance of GraceKennedy Limited (GKC) for its financial year ended 31st December 2020 and Prestige Holdings Limited (PHL) for its financial year ended 30th November, 2020. While, pandemic pressures led to contracted demand for PHL’s offerings, GKC was able to benefit from a shift in demand to at home consumption for food items. What might investors expect in the months ahead? We discuss below.

GraceKennedy Limited (GKC)

GKC reported Earnings per Share (EPS) of $0.28 for the financial year ended December 31st 2020 (FY 2020), 38.8% higher than the EPS of $0.20 reported in FY 2019. Product and Services Revenue improved 12.3% from $4.43B to $4.98B, while Interest Revenue inched 4.7% higher to $195.9M. Overall, Total Revenue increased 12.0% to $5.17B from $4.62B. Direct and Operating Expenses grew 9.4% to $4.8B and Net Impairment Losses on Financial Assets rose 7.3% to $23.5M. Consequently, Total Expenses expanded by 9.3%. Profit from Operations increased 57.0% from $280.4M to $440.3M. Resultantly, GKC’s Operating Profit Margin moved from 6.1% to 8.5% in the period under review. Interest Income from Non-Financial services was up 7.0% year on year (YoY), followed by a 4.0% increase for Interest Expense from Non-Financial Services. Share of Results of Associates and Joint Ventures rose 4.8% to $24.4M. Profit Before Tax (PBT) amounted to $435.0M, up 58.4% from $274.5M in the corresponding period. Ultimately, Net Profit Attributable to Owners of GKC stood at $278.6M, 38.6% higher than $201.0M reported in the prior period.

PBT Records Stellar Improvement

GKC’s Profit Before Tax (PBT) seemingly thrived under pandemic conditions, accelerating its growth rate to 58.4% YoY in FY 2020 relative to a prior three year compounded annual growth rate (CAGR) of 2.9%. The Group’s largest segment, Money Services (accounting for 41% of PBT), grew 28% in FY 2020. Increased demand for remittance services played a pivotal role in the performance of this segment. Within the period, the Group benefited from being a primary remittance provider of the Government of Jamaica’s CARE program, with over 118,000 payment transfers being processed.

Food Trading, the second largest contributor to PBT (40%), grew 96% in the period, driven by revenue growth and improved margins across the Group’s international and domestic business lines. GKC’s increased product penetration through US, Canadian and UK based retailers, contributed to revenue growth. Additionally, the Group reported improved sales for its packaged food offerings through online shopping platforms, as pandemic conditions prompted a shift to at home consumption of food products. GKC was also able to record growth in domestic sales through its HiLo supermarkets.

Insurance, which accounted for 10% of GKC’s PBT, expanded 21% during FY 2020. Underpinning this performance was GKC’s 65% acquisition of Key Insurance in March 2020, in addition to reported improvements in investments and cost management. Banking and Investments (8% of PBT) declined 9%, as increased provisioning offset revenue growth. Despite this, First Global Bank Limited reported the opening of 7,000 new accounts, while brokerage business also grew in FY 2020.

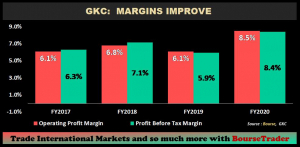

Margins Improve

Between FY 2017 and FY 2019, GKC’s Operating Profit and PBT margins averaged 6.3% and 6.5%, respectively. GKC reported considerable improvement to its margins in FY 2020, with the Operating Profit improving from 6.1% to 8.5% and the PBT margin moving from 5.9% to 8.4%. In the coming financial year, GKC aims to maintain its commitment to margin improvement through its digital transformation and the merger of two of its Jamaican factories, aimed at reducing cost and increasing competitiveness.

The Bourse View

At a current price of $4.50, 16.9% higher YTD, GKC currently trades at a Price to Earnings ratio of 16.1 times, higher than the Conglomerate sector average of 14.5 times. GKC offers investors a trailing dividend yield of 1.6%, relatively lower than the sector average of 2.0% and has declared an Interim Dividend of JMD$0.45 (USD$0.00302), payable on April 6th 2021. After recording an impressive performance in FY 2020, the normalisation of pandemic-related consumption patterns could present some headwinds to GKC’s ability to replicate its current performance. On the basis of USD dividend payments, ongoing margin improvements, but tempered by relatively high valuations and likely sluggish regional economic recovery, Bourse maintains a NEUTRAL rating on GKC.

Prestige Holdings Limited (PHL)

Prestige Holdings Limited (PHL) reported a Diluted Loss per Share of $0.29 for the financial year ended November 30th 2020 (FY 2020), 149.4% lower, compared to an Earnings Per Share of $0.58 recorded in the previous period. Revenue fell 19.4%, from a previous $1.11B in FY 2019 to $896.9M, as a result of a 34-day mandated closure and dine-in restrictions. Despite a 18.5% reduction in Cost of Sales to $602.1M, Gross Profit declined 21.3% to $294.8M. PHL’s Operating Profit was significantly lower, down 90.8%, to stand at $5.5M in FY 2020 (FY 2019: $59.4M), attributable to an extraordinary item of $18.6M from its Impairment of Goodwill of its Subway restaurants. Finance Costs jumped 319.0%, from $5.1M to a current $21.2M. The Group recorded a Loss Before Tax (LBT) of $15.7M, compared to a profit of $54.4M in the prior period. Overall, PHL reported a Loss Attributable to Owners of the Parent Company of $17.7M, 149.6% lower in FY 2020.

Revenue Lower

After recording a growth rate of 6.8% in FY 2019, PHL’s revenue generating abilities were altered in FY 2020 with COVID-19 mitigation measures leading to a 19.7% decline in the Group’s top line. PHL’s Revenue stream comprises of two segments, Quick Service Restaurants (79% of Revenue) and Casual Dining (21% of Revenue). Both segments were forced to halt operations for 34 days in FY2020 as pandemic prevention measures were implemented.

The Group’s Quick Service Restaurants segment declined 18.7% in the year, despite the company’s attempt to promote its delivery, drive thru and curb-side channels of services. Casual Dining, on the other hand, declined 22.1% in the period under review, reflective of challenges associated with reduced operational days, imposed dining and alcohol consumption restrictions.

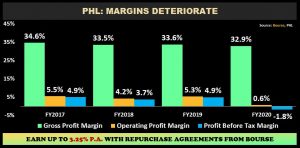

Margins Temporarily Lower

The Gross Profit Margin in FY 2020 was 32.9% relative to 33.9% in the prior year, as the Group’s decline in Revenue more than offset reductions in Cost of Goods Sold.

PHL’s Operating Profit Margin was adversely affected in FY 2020 as the Group reported a number of extraordinary expenditures. Linked to economic and operational challenges associated with the pandemic PHL reported an Impairment of Goodwill expense of $18.6M linked to its Subway franchise. Additionally, the Group accounted for a net impact of $22.7M on its Other Operating Expenses based on the implementation of IFRS 16. Impacted by these expenditure items PHL’s Operating Profit Margin moved to 0.6% from a prior 5.3%.

A Finance Cost of $21.2M (4 times higher than FY 2019) was influenced by an Interest Expense linked to Lease Liabilities which contributed to a cost of $16.1M. The impact of this expenditure item pushed PHL’s Operating Profit to Loss Before Tax.

Outlook

Despite, the challenges posed by the pandemic in FY 2020, PHL continues to maintain a strong brand reputation with Quick Service brands KFC and Starbucks as well as Causal Dining Brands Pizza Hut and TGI Fridays. In the context of social restrictions, PHL has moved towards the implementation of online ordering and increased delivery offerings. Additionally, the Group actively continues to market deals and restaurant specials in attempts to strengthen and maintain revenue performance. In the continuing year, the Group intends to expand the operational reach of Starbucks with the launch of four new locations.

The Bourse View

Currently PHL is priced at $7.70, and trades at a market to book ratio of 1.60 times compared to the Trading Sector average of 1.09 time. The Group declared a final dividend of $0.06 per share payable on 18th May 2021, 50% less than the $0.12 paid in FY 2019. As such, PHL has a trailing dividend yield of 0.8%, less than the sector average of 2.7%.

PHL’s franchise portfolio brand strength and continued normalisation of economic activity may support the Group’s recovery prospects. However, the increasing likelihood of higher costs of living through looming adjustments to utilities and fuel prices could put pressure on consumer discretionary spending power, which would translate into lower demand for its Quick Service and/or Casual Dining segment offerings. On the basis of normalising operations but tempered by foreign currency supply challenges and lingering economic pressures, Bourse maintains a NEUTRAL rating on PHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”