BOURSE SECURITIES LIMITED

8th May 2017

Learnings From The FIRST APO

This week, we at Bourse take a closer look at results of the recently concluded First Citizens Bank Limited (FIRST) APO. We highlight possible reasons for the undersubscription of the APO and discuss what this could mean for subsequent APOs, in particular, TTNGL.

FIRST APO Undersubscribed

During the 2016/2017 budget, the Minister of Finance announced several measures to fund the Government’s fiscal gap. One such measure was the divestment of GORTT’s shareholding in First Citizens Bank Ltd (FIRST), via an Additional Public Offering (APO). In March 2017, GORTT offered 48,495,665 shares for sale at a price of $32.00 per share. The total expected funds to be raised from the offer was approximately $1.55 billion.

At the close of the offer, it was announced that 32,035,770 shares, or 66% of the issue, were subscribed. The APO was undersubscribed by 16.459 million shares, leaving a shortfall of approximately $526 million.

A less compelling Offer?

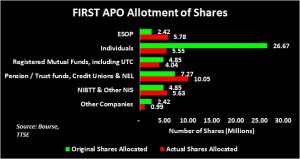

A closer look at the investor buckets/types and their respective appetite for shares would shed some light on actual investor interest. The Employee Share Ownership Plan (ESOP) was given top priority in the allocation for shares in the APO followed by Individuals, Registered Mutual Funds, Pension/Trust Funds and NEL, NIB, and Other Companies the in descending order. The ESOP category was able to access 3.3 million shares (138%) more than it would have originally been allocated (2.42 million). The Pension/Trust funds category, which included credit unions and NEL, and the NIB category were both able to access more shares than originally allocated (2.8 million and 0.8 million respectively). The individual category however, was undersubscribed by 21.1 million shares (79%).

Different perspectives of value

In an excess liquidity environment with a relative lack of cash flow-generating assets, large institutions with considerable cash holdings may have chosen to participate in the APO to earn a relatively stable dividend yield since listing (currently 4.2%). From the individual, company and mutual fund perspective, however, the offer price would appear not to have presented much of a value proposition for participation in the APO, given that the market price was also $32.00 prior to the offer.

Another possible reason for the undersubscription of the APO in certain investor categories could be the relatively stable corporate earnings performance of FIRST in the last 4 years. While stable corporate earnings may have been viewed as attractive at the institutional level, it did not appear to appeal to the individual investor in terms of opportunity for near term capital gain. Profit after Tax for FIRST moved from $609M in 2013 to $637M in 2016, growing at a compound annual growth rate of 1.5%. In the current environment of lower economic activity, loan growth is expected to remain tepid, which could in turn weigh on the earnings of FIRST, being part of the Banking sector.

Finally, basic demand and supply relationships would have also suggested that, for a given significant increase in supply of any item, there should be a fall in value, other things held constant. Put differently, to incentivize the absorption of the considerable block of shares made available to the market (20% of the total shares outstanding), the seller might have had more success by providing a price incentive to would-be buyers.

Subsequent APOs

As the dust settles on the FIRST APO, investors may quickly turn their attention to the next investment opportunity in the stock market, the pending TTNGL APO. The Minister of Finance indicated GORTT’s intention to sell its 51% shareholding in Trinidad and Tobago NGL Limited via an Additional Public Offering, similar to that of FIRST. GORTT’s 51% shareholding amounts to 78,948,000 shares (a combination of class A and B shares). The Minister had indicated that the sale was expected to raise $1.5B. If GORTT is to sell both class A (converted to B shares) and existing B shares to raise $1.5B, the APO price could be close to the IPO price of $20.00.

An offer price of $20.00 would result in a discount of 11% from the current listed price of $22.50. Notwithstanding the total quantum that may be offered to the market, the critical issue is what price will incentivise investors to purchase the shares in anticipation of near term capital gains and attractive dividend yield. We should mention that a comparison between FIRST and TTNGL must be put into context:

- At its current price of $22.50, TTNGL offers a trailing dividend yield of 6.67%. This compares favourably to the dividend yield of 4.16% currently offered by FIRST. NGL’s trailing dividend yield also compares favourably to the market dividend yield of approximately 3.26%, thereby offering investors more value.

- The share price of TTNGL has traded consistently in a narrow range ($18.25 – $25.00) since the IPO, while FIRST has traded in a wider range ($22.00 – $42.99).

- While NGL earns revenue in USD, its dividends are paid in TTD. The potential exists for dividends to be paid in USD over time, which could provide investors with a hedge against any potential depreciation of the TTD. At the recently concluded Annual General Meeting, shareholders voted in favour of dividends to be paid in either TTD or USD. FIRST pays dividends in TTD.

In determining the proposed offer price for the NGL APO, it may prove useful to consider the experience of the FIRST APO, as well as the current market conditions faced by TTNGL. Investors continue to search for value in the market, seemingly willing to be patient and wait on the side lines for suitably attractive investment opportunities.

As with any other investment, investors should contact a trusted independent investment adviser, such as Bourse, before making an investment decision.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”