BOURSE SECURITIES LIMITED

17th July, 2017

Investing With Different Risk Appetites

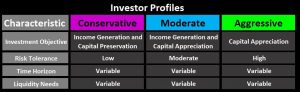

With the first half of the year now complete, this week we at Bourse consider how the portfolios of different investor types would have fared thus far. Our recent article titled ‘Half-Year Review – Market rally continues’ would have served to highlight the performance of individual asset classes for 6-months ended June 30 2017. Building a portfolio, however, often requires investments in several types of assets. Based on an investor’s time horizon, risk tolerance and liquidity needs, investors may fall into one of three broad categories – ‘Conservative’, ‘Moderate’ or ‘Aggressive’.

What is your investor profile?

Conservative: This investor’s primary emphasis is on income generation and capital preservation. The conservative investor has a reasonably low level of risk tolerance and places a lesser focus on capital appreciation.

Moderate: This investor possesses a reasonable level of risk and seeks to generate wealth through capital appreciation while maintaining a stream of income.

Aggressive: Investors in this category seek to benefit from capital appreciation and are willing and able to assume a higher level of risk. Aggressive investors generally have lower liquidity needs and actively manage their portfolios through security selection, by concentrating on specific securities in hopes of gaining higher returns.

The Conservative Investor

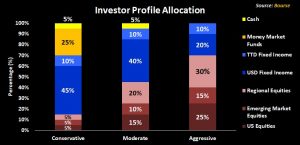

The conservative investor is risk-averse by nature. As such, a significant portion of the portfolio might be comprised of fixed income securities, due to the income generating ability of these instruments. In this model portfolio profile, fixed income securities (bonds) accounted for 55% of the portfolio, with 45% in US dollar denominated bonds and 10% in TT dollar denominated bonds. Approximately 30% of the portfolio would be held in cash and short-term instruments like money market mutual funds/repos, with the remaining 15% in equities.

The Moderate Investor

The investment objectives of the moderate investor are usually income generation and capital appreciation. Investors in this category are willing to bear a moderate degree of risk. To achieve this, investors will most likely adopt a ‘buy and hold’ strategy with periodic rebalancing as necessary.

The moderate portfolio might consist of a 50% weighting in fixed income securities, 45% equities and the remaining 5% in cash. Fixed income securities, by nature, tend to provide a stable income stream for the portfolio, if a ‘hold to maturity’ approach is adopted. The moderate investor would consider both investment and non-investment grade bonds. Investors might allocate 40% of the portfolio to US dollar denominated bonds and 10% to TT dollar denominated bonds. Although opportunities remain limited in the TT dollar environment, the moderate investor may consider money market mutual funds or other short-term investments to meet the overall goal of the portfolio. On the equity side, 15% might be allocated to US equities, 20% to regional equities and 10% to emerging market equities.

The Aggressive Investor

The aggressive investor has a higher degree of risk in comparison to the other categories. In direct contrast to the conservative investor, the focus here is capital appreciation. As such, the aggressive investor is willing to accept temporary periods of negative returns in anticipation of greater capital appreciation. In this portfolio, 70% of investments might be allocated to equities, broken down into 30% to regional equities, 25% to US equities and 15% to emerging market equities. The remaining 30% might be held in fixed income securities through a 20% holding in US dollar denominated bonds and 10% in TT dollar denominated bonds.

Performance of the various investor portfolios

With allocations as described, how did the various portfolios – conservative, moderate and aggressive – perform over the past several years? The conservative portfolio, by nature, provided the lowest average annualized return of the three, averaging 2.1% from 2013 to 2017 year-to-date (YTD) in USD terms. On the opposite end, the aggressive portfolio averaged 4.0% for the same period. The moderate portfolio returned an average 3.1% per annum. With the exception of 2015, investors would have been better off when compared to the local savings rate of 0.2% for the period. Year-to-date in 2017, the aggressive portfolio has generated positive returns of 5.5%, with the moderate and conservative portfolios up 4.9% and 3.8% respectively.

To illustrate by example, an investment of TT$100,000 at the beginning of 2013 would be worth TT$101,004 today if the funds were left in a bank savings account. Alternatively, the same investment in a conservative portfolio (with low risk) would be worth TT$110,069. On the opposite end, an investment in an aggressive portfolio would be worth TT$119,507.

Can anyone build a portfolio?

Building a portfolio can start at the smallest levels of investment, with several options available to potential investors. In general, local investors often confront two hurdles when crafting a diversified portfolio: (i) accessing US dollars for international investing and (ii) overcoming the initial concerns of limited investing experience.

Access to US dollars

The local economy continues to be impacted by lower US dollar inflows from the energy sector – the country’s largest generator of foreign exchange. Under the existing conditions, access to US dollars for portfolio investment purposes remains a low priority for banks as allocators of foreign currency. This limited access to US dollars places some constraints on the local investor’s ability to create a diversified portfolio. For those investors with USD holdings, then, it is imperative that these funds be put to work to grow USD wealth.

Investing Experience

Potential investors are sometimes overwhelmed by the notion of investing and are often concerned with having limited investment experience. For persons in this camp, a potential solution could be investing in professionally managed mutual funds. Mutual funds offer access to an array of assets classes and securities, for a smaller initial investment. Investors are also able to access their funds easily for any imminent cash requirements. Diversification is also a key benefit of mutual funds. While an individual’s portfolio may be exposed to a few selected securities, the large investment scope of these funds provide the usually beneficial feature of diversification.

For investors with longer-term objectives (such as retirement planning) retirement funds are another low-hassle option to get into investing. Like mutual funds, retirement funds also provide the benefits of diversification and professional management, but importantly also provide tax benefits, as contributions to the fund are tax deductible (subject to income tax specifications).

There are, of course, multiple providers of mutual funds and retirement funds in Trinidad & Tobago, of which Bourse is one. As an example of the returns generated over time, the Savinvest Individual Retirement Fund (managed by Bourse) provided a year-to-date return of 4.3% and a total return of 34.8% over the past 5 years, as at June 30th 2017. When compared to the TTD savings rate over the same period, investors would have benefited from being invested in this retirement fund as opposed to holding cash. Put differently, a $100,000 investment in this Fund at the end of June 2012 would now be worth $134,800 as at the end of June 2017.

Before making any major investment decision, it always makes sense to consult an independent and trusted adviser, such as Bourse, to help create a portfolio suited to your specific risk profile or choose an investment path that’s right for you.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”