BOURSE SECURITIES LIMITED

24th July 2017

Investor Opportunities in Fixed Income

This week, we at Bourse take a closer look at domestic and international bond markets with a focus on areas in which investors can unlock value. We review the performance of both markets for the year thus far and identify income-generating opportunities that would be an attractive addition to an investment portfolio.

TT Dollar bond yields hold steady

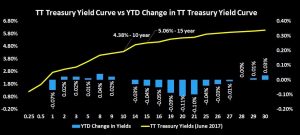

Year-to-date, yields on TT dollar-denominated bonds – the annual return investors receive if holding the bond to maturity – have remained stable on short, medium and long-term bonds. The 1-year TT Government of the Republic of Trinidad & Tobago (GORTT) bond yield and the 10-year TT GORTT yield stood at 2.72% and 4.38% respectively as at June 2017, when compared with 2.79% and 4.38% in January 2017. This constancy in bond yields might have been due to several factors, including (i) persistent excess liquidity in the financial system and (ii) a limited supply of TTD bonds.

With respect to monetary policy, the Central Bank’s Monetary Policy Committee (MPC) maintained its benchmark Repo rate at 4.75% at its May 2017 meeting, citing lower oil and natural gas production and weak inflationary pressures as key drivers behind the decision.

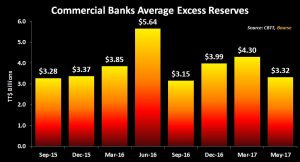

Moreover, the committee also noted slowing credit growth in the economy. As a result, liquidity in the financial system remained at comfortable levels as at May 2017, averaging TT$ 3.32 billion.

With regards to the supply of TTD bonds, the ongoing dearth of Government issues continues to present challenges to cash-rich institutional and individual investment portfolios. Year-to-date, there has been one public auction of a GORTT bond, in February 2017; a TT$ 1 billion 8-year bond with a coupon rate of 4.10% and issued at par value or a price of $100 (a yield to maturity of 4.10%). Private issues, while more active than public auctions, remain relatively limited by both corporate issuers and GORTT.

Investing your TT dollars

Despite the relatively low returns being provided by TT dollar fixed income investments, investors will still be better rewarded by investing, as opposed to leaving cash idle at a bank account. Average money market mutual fund rates year-to-date were 1.32%, compared to average TTD deposit rates of 0.20%.

At present, a 10-year GORTT bond may offer investors an annual return of 4.38% assuming the investor holds the bond until its maturity. However, the supply of/access to TT dollar bonds remains quite limited in the domestic market. As such, investors may want to consider alternative low-risk, fixed return investments such as money market/income mutual funds and/or repurchase agreements (Repos). Like bonds, both investment alternatives offer (i) superior rates of return when compared to traditional banking products, (ii) flexible investment periods to suit investor needs and (iii) low risk.

USD Bond markets buoyant

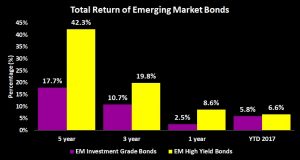

Despite three interest rate hikes by the US Federal Reserve (the FED) since December 2016, USD bond markets have remained buoyant, with bond prices unshaken. Bond markets continue to advance as the latest US consumer inflation data was reported at 1.6% in June 2017 – below forecast estimates for four consecutive months. International bond markets accordingly trimmed expectations that the FED will raise interest rates for a third time in 2017. The probability of a US interest rate hike now stands at 39.2% for its December 2017 meeting.

Year to date, emerging market (EM) US-dollar high yield and investment grade bonds have returned an average of 6.6% and 5.8% respectively.

Regional Prospects

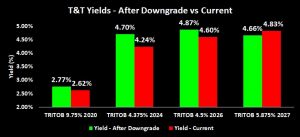

On April 21st, 2017, Trinidad and Tobago was downgraded one notch by S&P to “BBB+” from “A-” and by Moody’s to “Ba1” from “Baa3”. The driving factors behind the downgrades included a contraction in the energy sector and its subsequent impact on the country’s Gross Domestic Product (GDP) and debt burden. With expectations of a downgrade widely held by investors, prices of GORTT US dollar-denominated bonds would have trended lower, with corresponding higher yields. Since the downgrade, however, yields on these bonds have stabilized. As an example, the yield on Trinidad and Tobago’s (TRITOB) 4.50% due 2026 climbed to a high of 4.87% after the downgrade and are now trading at a yield to maturity of 4.60%.

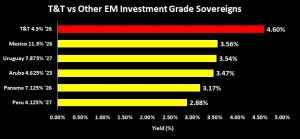

Despite this correction, when compared to the yields offered by other regional investment grade sovereign issuers, GORTT’s US dollar-denominated bonds remain relatively ‘cheaper’, offering more attractive yields than issuers such as Mexico’s 2026 bond (3.56%) and Peru’s 2027 bond (2.88%).

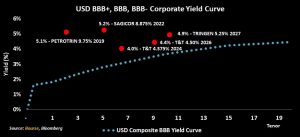

In the quasi-sovereign and corporate market segment, there are still regional US dollar bonds providing reasonably attractive returns, including the Sagicor 8.875% coupon bond due 2022, Petrotrin’s 9.75% coupon bond due 2019 and the more recently issued Trinidad Generation Unlimited’s (TGU) 5.25% coupon bond due in 2027.

Investor Implications

As USD bonds continue to hold their value, some investors may be concerned about buying at the ‘top’ of the market. With bonds, however, investors adopting a hold-to-maturity approach should be less concerned by volatility in market prices. Should bond prices move up or down, investors will continue to receive the fixed coupon and the face value at maturity (holding credit constant). This is in contrast to investors who exit their positions prior to maturity, which will be subject to current market prices at the time of sale. For the hold-to-maturity minded investor, ensuring that you are comfortable with the credit risk and yield to maturity (annual return) of the bonds in your portfolio should remain primary guides to making your investment decision.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”