| HIGHLIGHTS

NEL FY 2021

|

Improvement Ahead for NEL?

This week, we at Bourse review the performance of National Enterprises Limited (NEL) for the year ended 31st March, 2021. NEL reported an improvement in its performance, however, the loss on the fair value revaluation on its investee companies continued to weigh on profitability. Will domestic energy production challenges continue to affect the group, or could improving energy market conditions improve NEL’s outlook? We discuss below.

National Enterprises Limited (NEL)

NEL reported a Loss per Share (LPS) of $0.45 for the financial year ended March 31st 2021 (FY 2021), relative to a LPS of $0.55 in the previous period. The Group’s Dividend Income improved 9.0% to $26.0M from a previous $23.8M. Other Income increased by $0.5M to $0.7M. As such, Revenue advanced 6.4% to $33.8M from a previous $31.3M. Operating Expenses contracted to $5.0M, 8.4% lower than $5.5M in FY 2020. NEL reported an Operating Profit of $28.3M, 9.5% higher than $25.8M in the prior year. Loss on Fair Value Revaluation on Investments amounted to $296.9M, 15.5% lower than the Loss of $351.2M in FY 2020. Cumulatively, NEL reported a Loss Before Tax of $268.7M, 17.4% lower than a Loss of $325.4M in FY 2020. Overall, the Group recorded a Total Comprehensive Loss for the year of $270.4M, $57.1M lower than a Loss of $327.5M reported in the previous period.

Revaluation Losses Persist

A Loss of $296.9M on Fair Value Revaluation on Investments – albeit 15.5% lower than FY 2020 – was primarily responsible for NEL’s Total Comprehensive Loss in FY 2021. NEL’s reliance on the cyclical energy sector has weighed on the Group’s performance in the recent years, heightened by the impact of COVID-19 and the current state of T&T’s energy fortunes. NEL’s energy portfolio comprises Trinidad Nitrogen Company Limited (Tringen), NGC NGL Company Limited, NGC Trinidad and Tobago LNG Limited and Pan West Engineers and Constructors LLC.

On a positive note, Tringen experienced a 50% YoY increase in its carrying value. This was, however, outweighed by declines in the values of NGC LNG, NGC NGL and Pan West, owing to lower than expected sales by Pheonix Park Gas Processors Limited (PPGPL) and an impairment of Atlantic LNG Train 1. The decline in the fair value of the Telecommunication Services of Trinidad and Tobago Limited (TSTT), reflected in a 35% decline in Investment in Subsidiaries, outweighed gains arising from a 100% appreciation of National Flour Mills (NFM) and a 34% increase in NEL Power Holdings Limited (NPHL).

Energy Production Subdued

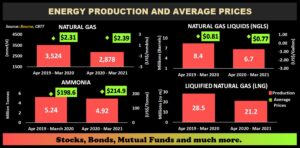

Tringen, NGC LNG, NGC NGL and Pan West are all dependent on the supply of natural gas which acts as a feedstock for their respective activities. During NEL’s FY 2021 (Apr 2020 – Mar 2021), T&T’s natural gas production averaged 2,878 mmcf/d, 18.3% lower than an average of 3,524 mmcf/d in FY 2020. Despite lower production, the average benchmark price of natural gas improved 3.6% YoY to US$2.39/mmbtu for the same period.

Natural Gas Liquids (NGLs) production contracted by 20.2% in FY 2021 (Apr 2020 – Mar 2021) from 8.4M barrels/day to 6.7M barrels/day. Using a weighted price basket, NGL prices depreciated 4.4% YoY, averaging US$0.77/gallon in FY 2021 relative to US$0.81/gallon in the previous period.

NEL has investment exposure to the ammonia industry (TRINGEN I and TRINGEN II plants) through its 51% holding in Trinidad Nitrogen Company Limited. Ammonia prices increased by 8.2%, from an average of US$198.6/tonne in FY 2020 to an average of US$214.9/tonne in FY 2021. Following the volatility in prices during the earlier parts of FY 2021 and the availability of feedstock, Ammonia production has trended downwards, moving from 5.24 Million Tonnes (MT) in FY 2020, to 4.92 MT in FY 2021.

In FY 2021 Liquefied Natural Gas (LNG) production stood at 21.2M cubic meters, 25.3% lower than 28.5M cubic meters in the prior comparable period. In FY 2020, Atlantic’s Train 1 produced 4.69M cubic meters as compared to 1.03M cubic meters in FY 2021.

NEL’s book value has trended downwards from FY 2017 to FY 2021, reflecting the impact of its investee company revaluations. NEL’s book value per share (BVPS) declined from $4.16 in FY 2020 to $3.71 FY 2021. The company’s price to book ratio has declined from 2.09x in FY 2017 to a current price to book value of 0.97x.

Outlook

After experiencing significant volatility in calendar 2020, energy prices have rebounded sharply in FY 2021, buoyed by global economic reopening. The price of natural gas (Henry Hub) has averaged US$2.80 during NEL’s fiscal Q1 2021 (Apr – Jun 2021), 64.7% higher YoY. Similarly, the weighted basket price of NGL has averaged US$1.19/gallon in Q1 2021, appreciating 152.1% YoY and the price of Ammonia has averaged US$401.0/Tonne appreciating 115.7% relative to Q1 2020. The upbeat momentum of energy prices could provide some earnings support to NEL’s investee companies in the coming periods. Notwithstanding this, continued pressures on domestic production of feedstock natural gas could weigh on NEL’s energy portfolios in the near term.

In the medium-term, the proposed turnaround of Atlantic LNG Train 1’s operations – notwithstanding feedstock availability – could provide some support to the NEL’s financial earnings. Additionally, the completion of negotiations on a gas supply contract between Tringen and the NGC has positively lifted Tringen’s outlook.

NGC NGL, which accounted for 61.3% of NEL’s dividend income in FY 2019 and 77.9% in FY 2020, could be poised for an improvement in profitability in the coming periods, stemming from PPGPL’s international focus and a robust recovery in product prices. With Mont Belvieu prices projected to remain relatively stable in the near term and energy commodity demand to remain resilient as economies normalize, PPGPL is anticipated to record continued stabilization in its performance.

Despite improved performance in 2020, NFM has indicated that the company continues to experience pressures in terms of cost. When coupled with relatively stable demand in a fairly subdued economic environment, NFM’s profitability could be affected in the near-term.

The Bourse View

NEL is currently priced at $3.58 and trades at a market to book ratio of 0.97 times, relative to a sector average of 1.48 times. The stock price has advanced 14.4% year-to-date. NEL offers a trailing dividend yield of 0.0% relative to a sector average of 0.6%. While the stabilization of energy prices provides a case for improvement in its investee companies, the domestic environment of lower natural gas production could present some near-term challenges. NEL intends to focus on its efficiency and innovation through market positioning for greater participation in the full value chain and develop forward-looking partnerships for competitive clean energy. The Company has also expressed its intention to continue restructuring its portfolio of investee companies to improve balance and create value. This may warrant a change in investor expectations on NEL, focusing less on its once dividend-rewarding nature and more on the prospects of measured growth over the medium-term. Bourse maintains a NEUTRAL rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”