| HIGHLIGHTS

Local Markets

International Markets

Investor Considerations:

|

This week, we at Bourse review local and international bond markets with inflation in focus. Increases in commodity prices, supply chain disruptions and recovering consumer demand have all contributed to increasing concerns of inflationary pressures at both the domestic and international levels. Rising inflation could, under normal circumstances, prompt responses from policymakers which would potentially hurt returns for fixed income investors. Could bond investors be affected by rising inflation in the near future, or are inflationary concerns premature? We discuss below.

Local Inflation Stays Low

Data published by the Central Bank of Trinidad & Tobago (CBTT) suggests that domestic inflation remains relatively subdued. This might come as surprise to investors, given that multiple organizations in the shipping, food distribution and retail space have noted material increases in input costs over the past months. It remains to be seen whether full or partial efforts to absorb costs (and avoid pass-through inflation to consumers) can be sustained, which will be dependent on the duration of higher input costs to businesses. Year to date, headline inflation increased from 0.8% to 1.1%, while core inflation increased from 0.0% to 1.1% in the same period. Reviews to utility tariffs, including water and electricity rates, could stoke inflationary pressures. With power and water being essential to individual, commercial and industrial activity, upward rate revisions could have material pass-through effects on prices of goods and services. Among the increases in services, the impending fuel market liberalization in T&T could also increase inflationary pressures, particularly with the jump in prices of energy commodities in 2021. During the recent Senate debate of the Finance Bill, Finance Minister Colm Imbert indicated that the government would continue subsidizing diesel fuel prices until the country’s economic situation has improved, a move which could delay partial inflationary pressures in T&T.

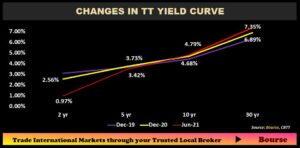

GORTT Yield Curve Steepens

The Government of the Republic of Trinidad & Tobago (GORTT) TT-dollar bond yield curve continued to steepen, with short-term yields notably lower than December 2020 levels. In March 2020, the Central Bank of Trinidad and Tobago lowered is repo rate from 5.0% to 3.5% in an effort to provide a supportive monetary environment. The 2-year yield declined from 2.56% in December 2020 to 0.97% in June 2021, while the 5-year yield declined from 3.73% to 3.42% for the same period. Year-to-date, longer-term yields have risen, with the 10-year rate increasing from 4.68% in December 2020 to 4.79% in June 2021 and the 30-year rate climbing from 6.89% to 7.35% over the same period. The steepening curve could be a reflection of rising expectations for inflation in the domestic economy, despite the lower rates being supported by monetary policy action.

US Inflation on the Rise

The US Consumer Price Index (CPI) – a gauge of changes in prices paid by a consumer for a basket of goods and services – has been trending upward in recent months. Personal Consumption Expenditure (PCE) – an alternative measure of inflation – also began 2021 relatively flat and commenced a slow upward tick in February 2021, continuing into May 2021. Despite increasing prices, the US Federal Reserve’s Chairman, Jerome Powell, has maintained the view that this is a ‘transitory’ period of inflation, seeking to assure investors that interest rate hikes are still some way off.

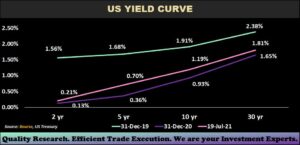

US Bond Yields Tick Higher

After declining sharply during the course of 2020, US Government Bond yields have slowly begun to climb. Low yields have, however, been supported by the Federal Reserve’s (Fed) reduction of the Fed rate to an all-time low of 0.00%-0.25%, to stimulate borrowing and growth stymied by the pandemic. The 2-year US Government Treasury yield picked up from 0.13% at end of 2020 to 0.21% as at July 20th, 2021. The 10-year and 30-year Treasury yields marginally rose to 1.19% and 1.81% respectively in July 2021, both yields above the 1% mark, from lows of 0.93% and 1.65% in December 2020. Markets currently appear to be searching for direction, with rising inflation expectations being offset by concerns of the spreading Delta variant of COVID-19.

Global Bond Markets Resilient

Following the price volatility attributable to COVID-19, bond prices have fully recovered as shown by the sample of regional US Bonds. Highly accommodative international monetary policy, characterized by an ultra-low interest rate environment, has supported sovereign and corporate bond prices of most issuers. For example, TRITOB 4.50% 2026, one of Trinidad & Tobago’s more actively traded USD international bonds, fell to a price as low of $84.00 in March 2020, recovering to a high of $110.25 in January 2021, and is currently trading around $105.70, offering investors a yield to maturity of 2.17%. The prevailing environment has led investors to move further out along the yield curve and/or lower down the credit quality spectrum in search of fixed income returns, despite the uncertainty associated with the nascent global economic recovery.

Investor Considerations

On the domestic front, inflation is likely to trend upward over the medium-term, with expected price increases to core goods and services as well as food. Bond availability remains relatively limited within the shorter-term tenors (<10 years to maturity), while the supply of Government bonds has been increasing on longer-term tenors (>15 years to maturity). High credit quality corporate bonds remain in short supply, regardless of tenor.

Against this backdrop, investors may wish to maximize risk-adjusted short-term returns, without committing to longer-term bond ownership and the associated inflation risk. To do so, fixed income investors could consider blending shorter-term investments (including repurchase agreements, income mutual funds etc.) with positions in longer-term bonds. This would reduce, on average, the inflation risk associated with holding a 100% longer-term bond portfolio.

With respect to USD fixed income investments, the environment is equally challenging for the fixed income investor to find value. Despite a much larger menu of bond options available, interest rates remain near all-time lows. In similar fashion, investors could consider mixing shorter-term and longer-term investments to diversify by time to maturity. Investors (with the appropriate risk appetite) could also consider taking a position in alternative investments focused on enhancing portfolio income.

As always, it makes sense to consult a trusted and expert investment services provider, like Bourse, to make the most informed decision.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”