BOURSE SECURITIES LIMITED

8th July, 2019

HY2019 Review – Bond Markets Upbeat

This week, we at Bourse review the performance of the local and international fixed income markets for the first half of 2019. While the local market has been fairly inactive, international bond investors have enjoyed a period of persistent returns thus far. What can we expect in the second half of 2019? Let’s take a closer look.

Local interest rates stable, bond supply low

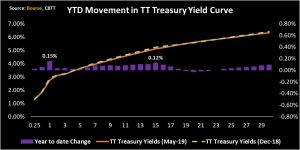

The Trinidad and Tobago (TT) Treasury Yield curve remained virtually constant year-to-date (YTD), as a limited supply of TTD bonds and persistent excess liquidity maintained downward pressure on bond yields. The greatest movements were the 1-Year Treasury yield and 15-Year Treasury yield from 2.75% and 5.10% in December 2018 to 2.90% and 5.22% in May 2019 respectively. Investment opportunities in the local fixed income market remain relatively limited. Investors have had no joy in terms of major public bond auctions such as the National Investment Fund bonds which took place in 2018.

Liquidity increased as Commercial Banks Excess Reserves rose to TT$3.9 billion in May 2019 from TT$3.5 billion in December 2018, YTD change of 13%. The Central Bank’s Monetary Policy Committee (MPC) maintained repo rates at 5.00% in June 2019, citing ‘nascent domestic recovery’, a potential fallout out from US-China trade tensions and economic spill overs from neighbouring Venezuela. Local official inflation data remains low, with year-on-year core, headline and food inflation at 1.2%, 1.2% and 1.1% respectively in May 2019.

Local Opportunities coming?

With new opportunities few and far between, investors will be looking forward to the upcoming Housing Bond issue, expected to come to market in July-August 2019. While no further information has been released since the announcement in the Minister of Finance’s May 2019 mid-year review, the proposed TT$1 billion issue is expected to offer a 4.5% coupon with a 5-year tenor.

Markets betting on US Interest Rate cuts

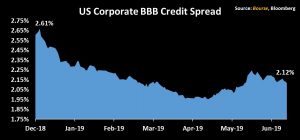

Internationally, significant changes in interest rate policy have fueled a broad-based bond market rally. US interest rate policymakers have seemingly had a change of heart, with earlier expectations of rate increases in 2019 now replaced with the real possibility of interest rate cuts before the end of the year. Recent statements from the Federal Reserve Open Market Committee (FOMC) in June 2019 have signaled a willingness to cut rates if necessary, indicating that the Fed would act as appropriate to sustain the US economy’s expansion. Market participants have now assigned a 100% probability of a rate cut at the next FOMC meeting (July 31), with approximately 98.5% of market participants anticipating a 0.25% reduction in interest rates, while 1.5% forecast a 0.50% reduction. Meanwhile, US unemployment has declined to a 50-year low at 3.6% and US inflation rate remains below the Federal Reserve’s target of 2%.

In response, bond markets have enjoyed their best first half return since 2016 in both the US dollar denominated Emerging Market (EM) Investment Grade (IG) and High Yield (HY) segments. The half-year (6M) Total Return on EM IG and EM HY bonds for 6M2019 were +9.0% and +10.0% respectively, a stark difference from the -2.7% and -5.8% experienced in 6M2018. The result has been a reduction in bond yields, creating a more challenging environment for investors in search of attractive fixed income returns.

US Treasury Yield Curve has moved from being a flattening curve and to an inverted curve in March 2019. Therefore, the investor is not being compensated for holding longer-term maturities, as a higher rate can be gained in shorter-term maturities. The 6-month Treasury Yield is 2.09%, while a 10-year Treasury is yielding 2.01%.

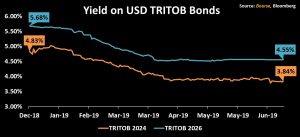

Moody’s affirms Trinidad and Tobago credit rating

Moody’s Investors Service (Moody’s) affirmed the credit rating of the Government of Trinidad and Tobago as Ba1, maintaining its stable outlook for the country in June 2019. The international rating agency assigned the rating based on (1) the country’s approximate US$6 billion cash war chest in its Heritage and Stabilization Fund (HSF), which is roughly 25% of the sovereign’s GDP, (2) an expected economic recovery driven by the energy sector, (3) an above-average import cover of 8.1 months, despite its declining trend.

The decision by the government to close the Petroleum Company of Trinidad and Tobago (Petrotrin) and create a new company, Trinidad Petroleum Holdings Limited (TPHL), was seen as credit positive and important towards the improvement of the operations of one of the country’s most impactful state-enterprises.

Trinidad and Tobago’s (TRITOB) USD Government bonds have recovered in pricing since the start of the year. TRITOB 2024 and TRITOB 2026 prices rose, resulting in the yield-to-maturity (YTM) falling for investors wishing to purchase the bonds. Yields fell from an average of 4.83% and 5.68% for the TRITOB 2024 and TRITOB 2026 respectively in December 2018 to an average of 3.84% and 4.55% in June 2019.

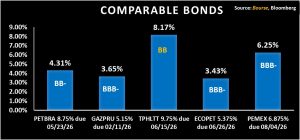

Trinidad Petroleum Holding Limited issues new debt

Trinidad Petroleum Holding Limited has issued new debt due 2026 in exchange for US$570,295,500 of debt previously outstanding by the Petroleum Company of Trinidad and Tobago (Petrotrin). The company has also received a term loan facility for US$603 million, which would be utilized to repay the balance of Petrotrin’s outstanding debt due 2019 and other expenses.

TPHL’s bonds versus international comparable companies (by industry) suggests that TPHL is offering a significantly higher return to investors. It should be noted, however, that the comparable companies:

- Are all significantly larger than TPHL

- Operate in geographies with significantly greater energy resources

- Have a long operating history when compared to the newly-formed TPHL

Investor Considerations

With markets flying high, bond investors will be searching for the next opportunity to enter the market. Investors would appear to have already priced in a potential US interest rate cut, resulting in increased market prices for US dollar denominated bonds and lower yields. Continued expectations of interest rate cuts could result in even lower yields for investors seeking to deploy funds. Fleeting opportunities to enter the market could arise from deteriorating international relations (US-China, US-Iran), geopolitical events such as elections or other short-lived occurrences.

Investors with patient capital and a hold-to-maturity approach to investing in bonds might consider going into longer-term issues to earn higher returns. For investors with a shorter-term investment horizon, solutions like income mutual funds (such as the Savinvest TT Structured Income Fund or US Investment Income Fund) or repurchase agreements (Repos) may be more appropriate vehicles to earn superior returns without committing capital for a lengthy period of time.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”