BOURSE SECURITIES LIMITED

9th September, 2019

FCI Flat, JMMB Advances

This week, we at Bourse review the financial performance of FirstCaribbean International Bank Limited (FCI) and Jamaica Money Market Brokers Group Limited (JMMBGL). FCI’s overall position remained relatively flat as revenue growth and a reversal of Credit Impairment Losses were offset by rising operating costs and a deferred tax asset write-off. JMMBGL experienced significant growth stemming from securities trading as capital markets advanced.

FirstCaribbean International Bank Limited (FCI)

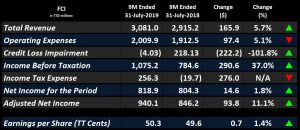

FirstCaribbean International Bank Limited (FCI) reported Earnings per Share (EPS) of TT$0.503 for the nine-month period ended 31st July, 2019, a marginal 1.4% improvement from the EPS of TT$0.496 reported in the prior comparable period.

The Bank generated Total Revenue of TT$3.08B for the period, up 5.7% or TT$165.9M year-on-year (YoY). Operating Expenses increased by TT$97.4M or 5.1% YoY, from TT$1.91B in 9M 2018 to TT$2.01B in 9M 2019. Credit Loss Impairments reversed from an expense of TT$218.1B in FY2018 to a credit of TT$4.0M, a decline of 101.8% or TT$222.2M. As a result, Income before Taxes improved 37.0% to TT$1.75B, from TT$784.6M. However, Income Tax Expenses also swung from a net credit of TT$19.7M to an expense of TT$256.3M. Overall, Net Income for the Period experienced relatively muted growth of 1.8% YoY from TT$804.3M to TT$818.9M.

According to the CEO’s statements, Net Income for the 9M 2019 period, adjusted for several one-off items, amounted to TT$940.1M (US$140.3M). This represents an 11.1% improvement from the Adjusted Net Income figure of TT$846.2M (US$126.3M) for 9M 2018.

Outlook

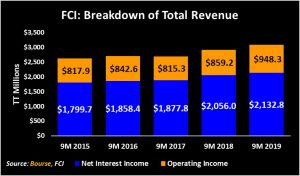

Net Interest Income continues to be the major contributor to FCI’s Total Revenue, accounting for 69.2% in 9M 2019. This revenue source has generally shown an upward trend since 9M 2015. During the current period, the Bank attributed the 3.7% YoY rise in Net Interest Income, from TT$2.06B to TT$2.13B, to improved volumes and interest margins. Operating Income experienced healthy growth of 10.4% YoY, amounting to TT$948.3M, and has shown consistent improvement since 9M 2015.

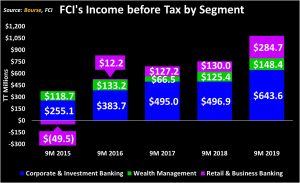

Each of FCI’s three main operating segments experienced PBT growth during the period. The main driver of PBT growth would have been the Retail and Business Banking segment. PBT contributions grew from TT$130.0M to TT$284.7M YoY (+119.0%) through a combination of Revenue growth and a significant reversal (TT$101.0M) in Credit Loss Expense on Financial Assets. The Corporate and Investment Banking Segment also supported growth, improving contributions 29.5% from TT$496.9M in 9M 2018 to TT$643.6M in 9M 2019. The Wealth Management segment continues to grow (+18.3% YoY) after experiencing a decline in profitability in 9M 2017.

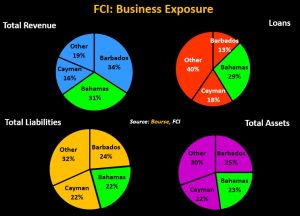

In recent years, FCI would have experienced significant headwinds due to its Barbados debt exposure as well as through hurricane activity in its various operating jurisdictions. Based on the FY 2018 Annual Report, the Bank’s Bahamas operations accounted for the second largest portion (31%) of Revenue and 29% of Total Loans. With the recent passage of Hurricane Dorian through the Bahamas, the Bank’s branches in the Abacos Islands and Grand Bahama remain closed. Given the significant exposure to the Bahamas, FCI’s performance going forward could be negatively affected.

The Bourse View

At a current price of $8.50, FCI trades at a trailing price-to-earnings ratio of 20.2 times, higher than the Banking sector average of 16.0 times. The stock currently offers investors a trailing dividend pay-out ratio of 5.3% (4.0% exclusive of a special dividend payment of US$0.0159 paid on 5th July, 2019) which is above the sector average of 4.0%. On the basis of a relatively attractive dividend yield and consistent USD dividend payments, but tempered by relatively high valuations and the expectation of continued economic headwinds in its main operating regions, Bourse maintains a NEUTRAL rating on FCI.

JMMB Group Limited (JMMBGL)

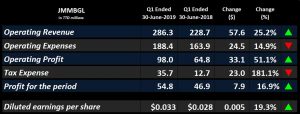

JMMB Group Limited (JMMBGL) reported Earnings per Share (EPS) of TT$0.033 for the first quarter ended June 30th 2019, a 19.3% improvement over the prior comparable period.

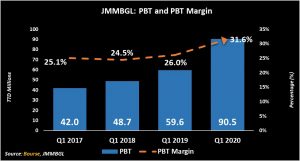

Net Interest Income for the period rose 6.1% to TT$107.6M from TT$101.4M as a result of an 8.5% YoY increase in Interest Income. Operating Revenue climbed 25.2% or TT$57.6M to amount to TT$286.3M. The growth in Revenue was accompanied by a 14.9% or TT$24.5M increase in Operating Expenses YoY which resulted in Operating Profit advancing from TT$64.8M to TT$98.0M, a significant 51.1% increase YoY. Profit Before Tax was 51.9% higher at TT$90.5M as compared to TT$59.6M last period. Resultantly, PBT Margin improved from 26.0% to 31.6%. However, Income Tax for the period more than doubled, amounting to TT$35.7M, an increase of TT$23.0M YoY. Profit for the Period experienced a 16.9% (TT$7.9M) YoY improvement, standing at TT$54.8M.

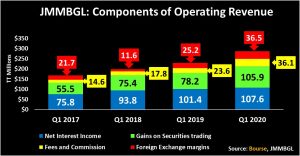

JMMGL’s Q1 Operating Revenue has been trending upward over the last four years with an average YoY improvement of 17.2%. For Q1 2020 Operating Revenue grew 25.2% driven by improvements in all components. Net Interest Income and Gains on Securities Trading continue to be the major contributors, accounting for 37.6% and 37.0% respectively, of Total Operating Revenue in Q1 2020. Most significantly, Gains on Securities Trading increased 35.4% or TT$27.M YoY to stand at TT$105.9M. Net Interest Income grew 6.1% amounting to TT$107.6M on the back of improvements in the loan and investment portfolio. Fee and Commission Income as well as Foreign Exchange Margins also saw significant YoY improvements, rising 53.0% and 44.7% respectively due to increased trading volumes and growth in managed funds and collective investment schemes undertaken by the Group.

Profit Before Tax (PBT) grew significantly in Q1 2020, climbing 51.9% YoY from TT$59.6M to TT$90.5M. As a result, PBT Margin for the period jumped from 26% to 31.6% despite a 14.9% uptick in Operating Expenses which was attributable to the expansion of commercial banking services in Jamaica and Trinidad. PBT for the last four comparable periods have displayed a steady upward trajectory.

The Bourse View

At a current price of $2.21, JMMBGL’s share price has advanced 28.0% YTD. The stock trades at a trailing P/E of 18.1 times, well above the Non-Banking Finance sector average of 12.4 times (excluding NEL). The trailing dividend yield is 1.1%, lower than the sector average of 3.1%. On the basis of continued growth in profitability and the upside potential stemming from their 20% stake in ‘New Sagicor’, but tempered by fairly lofty valuations and the potential impact of capital market volatility on security trading gains, Bourse maintains a NEUTRAL rating on JMMBGL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”