| HIGHLIGHTS Local Markets

International Markets

|

Equity Market Rally Intact in HY 2021

This week, we at Bourse recap the performance of local and international stock markets at the mid-way point of 2021. With ongoing vaccination deployment, stimulus support in the short to medium term and as economies move towards recovery, stocks have continued their upward march from the lows of 2020. Could the surge of the Delta Variant delay economic recovery? Can positive market sentiment be sustained? We discuss below.

Local Equities Gain Momentum

After experiencing a shift in market sentiment in HY 2020 due to the economy-halting impact of COVID-19, locally listed stocks have embarked on a path towards recovery. The Trinidad and Tobago Composite Index (TTCI) appreciated 6.0%, propelled by a rally in domestic equities at the end of HY 2021, relative to a 10.7% decline in HY 2020. The All Trinidad and Tobago Index (ALL T&T) was relatively more resilient, gaining 9.2% at the end of HY 2021 compared to a 5.3% decline in HY 2020. The Cross Listed Index (CLX) remained relatively range bound, closing off HY 2021 0.3% lower (HY 2020: down 20.5%) influenced by an 11.8% decline in FirstCaribbean International Bank Limited (FCI).

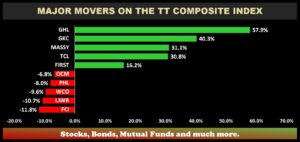

Major Movers

Supported by good earnings growth, Guardian Holdings Limited’s (GHL) 57.9% advance was catalysed in HY 2021 by its entry onto the Jamaican Stock Exchange (JSE) on May 5th 2021. Cross-Listed conglomerate GraceKennedy Limited (GKC) advanced 40.3%, following reported revenue growth and contractions to its net impairment losses within its financial services segment. GKC expanded its insurance portfolio in May 2021 by increasing its stake in Key Insurance Company Limited from 65.0% to 73.6% and announced its intentions to acquire Scotia Insurance Eastern Caribbean Limited. Massy Holdings Limited (MASSY) appreciated 31.1%, invigorated by its pending cross-listing onto the JSE. Rounding out the top 5 gainers were Trinidad Cement Limited (TCL) and First Citizens Bank Limited (FIRST) which increased 30.8% and 16.2%, respectively.

FirstCaribbean International Bank Limited (FCI) depreciated 11.8%, making it the biggest decliner for HY 2021. L.J. Williams Limited B (LJWB) lost 10.7% making it the second largest decliner. West Indian Tobacco Company Limited (WCO) slipped 9.6% followed by Prestige Holdings Limited (PHL) (HY 2021: down 8.0%) and One Caribbean Media Limited (OCM) (HY 2021: down 6.8%).

US Equities in the Green

US stocks as gauged by the S&P 500 advanced 14.4% at the end of HY 2021 (HY 2020: down 4.6%) to a record high of 4,297.5. The upbeat performance in the US markets continues to be fuelled by extraordinary expansive monetary and fiscal policies, ongoing vaccine deployment and an economic reopening. After facing volatility during the month of June following the Federal Reserve’s potentially tighter outlook on Monetary Policies, some investors view the recent hike in inflation as temporary with majority of the price surge stemming from commodities price increases.

The best performing sectors in HY 2021 were so-called ‘old economy’ industries, which were adversely impacted by the pandemic in the prior comparable period. The Energy Select Sector SPDR Fund (XLE), the worst-performing sector in HY 2020 (down 37.0%), was the best performer in HY 2021, up 42.1%. The Technology sector, as measured by the Technology Select Sector SPDR Fund (XLK), the largest gainer in HY 2020 (up 14.0%) continued to rally in HY 2021, increasing 13.6%. Despite the upbeat momentum surrounding President’s Biden Infrastructure Plan, the Utilities Select Sector SPDR Fund (XLU) rounded out HY 2021 as the worst performing sector, up 0.8%.

International Markets Rally

European equities also advanced in HY 2021 after trailing Wall Street for most of the COVID-19 crisis, reflecting the widening rally across the global equity market. European markets measured by the Euro Stoxx 50 rebounded by 9.7% in HY 2021 (HY 2020: down 12.0%). Investors in European shares have benefited from sectors considered to be sensitive to economic fluctuations with the consumer discretionary, technology, energy, industrial, financial and basic material sectors all up more than 15%. Similar to the US, the Utilities sector which is usually coveted for its consistent dividend payments, was the worst performing as concerns over inflation weighed on the appeal of the income stream. France was the best performing market in the continent, rebounding 13.8% in HY 2021 relative to a 17.3% decline in HY 2020. England expanded 10.2% influenced by its upbeat vaccination campaign relative to Europe and stability around BREXIT. However, inflation concerns and the rapid spread of the Delta variant kept gains in check at the end of the month. Spain repeated its performance as the worst performing in HY 2021, up 7.8% (HY 2020: 24.1%).

Asian Equity markets (excluding Japan) advanced 5.5% at the end of HY 2021 following a 6.1% decline in HY 2020. Taiwan and South Korea were the best performing markets, increasing 21.3% and 10.2%, respectively. Despite being drastically impacted by a Covid-19 outbreak during HY 2021, Indian equities outperformed the broader market, to advance 8.0% after recording the worst performance in the Asian space in HY 2020 (down 20.7%). China posted the smallest Asian market gain in HY 2021, up 4.5%.

After experiencing significant headwinds in HY 2020 (down 36.1%) driven by the onslaught of Covid-19 and political instability, Latin American Equity markets rebounded in HY 2021, advancing 6.9%. Mexico was the best performing market, up 13.8% during the period relative to 28.9% decline in HY 2020. Brazil, Latin America’s largest economy advanced 11.4% during the period primarily attributable to the increase in commodity prices which led to a 4.5% appreciation of the Brazilian Real. Similar to HY 2020, Colombia was the worst performing market in HY 2021, losing 20.7% following a 16.9% decline in FY 2020.

International Outlook

Ongoing economic re-openings and normalization at the broader global level have prompted growth forecast upgrades for many major countries/regions. S&P Global Rating upgraded its economic growth forecast in the US for FY 2021 from 6.5% to 6.7%, influenced by improved vaccination outlook and the continued impact from the US$2.8T fiscal package which will support the US economy. S&P Global Rating also forecast growth in the Eurozone upwards from 4.2% to 4.4% in FY 2021. The recovery is expected to move to services following a rebound in industrial activity as most restrictions to economic activity are lifted and households scale back on savings. According to the Organization for Economic Co-operation and Development, the Indian Economy contracted by 7.7% in FY 2020 and is forecast to grow 9.9% in FY 2021 (IMF April 2021: predicted 2021 growth of 12.5%).

The World Bank raised its forecast of China’s economic growth in FY 2021 to 8.5% from 8.1%. Growth will primarily depend on vaccination campaign and on state-led investments in the medium term since consumption, while growing, has not bounced back from the pandemic to levels seen in investments. Brazil’s central bank raised its economic growth outlook for FY 2021 to 4.6% from 3.6%, in the context of stronger than expected data, measures to preserve jobs, progress in the nations COVID-19 vaccinations, high commodity prices and delayed impacts from monetary stimulus.

Forecasts for accelerated growth could, however, be derailed by emerging threats from new strains of the Coronavirus. The Delta variant, for example, has been increasing rapidly in Europe prompting countries like France and Germany to implement restrictions on visitors from the UK. Continued economic normalization remains dependent on successful vaccination efforts and the ability of these vaccines in to prevent infection and/or serious complications from existing and new COVID viral strains.

Investor Considerations

While the domestic economy is likely to face prolonged impediments to growth, compounded by extended lockdown and shifts in T&T’s budget equation (as published in our article titled ‘The Mid-Year Review: Investor Considerations’ on June 28th 2021), some companies could continue to generate growth. Such companies would display characteristics including (i) geographic diversification, (ii) growth initiatives through organic and/or inorganic means, (iii) cost containment and margin improvement measures and (iv) cross listing initiatives.

Following the sustained rally in international equity markets and with fears of inflation – whether transitory or not – expected to increase volatility in the coming periods, international equity investors may be wary about short-term market corrections. Generally, however, conditions are anticipated to remain supportive of international stock markets including extraordinary fiscal stimulus, accommodative monetary policy and increasing economic activity. Investors could consider taking broader market exposure through sector, country and/or regionally-focused exchange trade funds (ETFs) to achieve some measure of diversification.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”