| HIGHLIGHTS

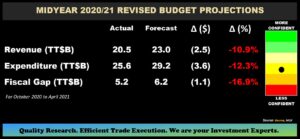

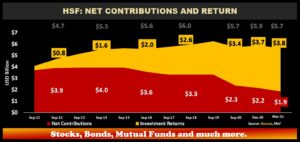

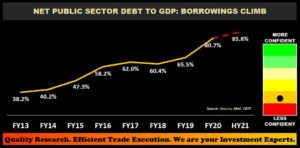

Budget, Growth and Debt October 2020 – April 2021 · Actual Revenue of $20.45B, Forecast Revenue of $22.95B · Actual Expenditure of $25.6B, Forecast Expenditure of $29.2B · Actual Deficit of $5.15B, Forecast Deficit of $6.25B · GDP contraction of 8% to 9% in FY2020 (IMF forecast -7.8%) · In funding the Fiscal Deficit: o Debt to GDP ratio of 85.5% in April 2021 (MoF) o HSF Drawdown US$198.9M in December 2020 o Asset Sales – Port of Port of Spain, NP Gas Stations Investor Considerations · Could Growth Return Quickly? Likely · Could Inflation Increase? Likely · Could Borrowing be controlled? Less Likely · Will HSF Drawdowns Continue? Likely · Will Corporate Earnings Decline? Likely

|

THE MID-YEAR REVIEW: INVESTOR CONSIDERATIONS

This week, we at Bourse evaluate the 2021 Mid-Year Review delivered by the Honourable Minister of Finance, considering the information provided from the perspective of investors. COVID-19 has affected the short-term budget equation for Trinidad & Tobago, compounding medium-term structural economic issues. Investors have been most concerned about factors such as foreign exchange availability, government borrowing and inflation/cost of living. How will developments in these areas affect company performance and investor confidence? We discuss below.

Revenues Lower

Actual Revenue for the period October 2020 to April 2021 stood at TT$20.45B, TT$2.51B (10.9%) less than the projected TT$22.96. The TT$2.51B in revenue shortfall stemmed from lower-than-anticipated tax revenue: a TT$1.8B shortfall in Royalties and TT$330M shortfall in extraordinary revenues from oil and gas industries. As indicated by the Minister of Finance, two-thirds of T&T’s energy revenue is generated by Natural Gas. For the period Oct 2020 to Apr 2021, both the price and production of Natural Gas came in below forecasts. On a positive note, crude oil prices received by T&T averaged US$52.76 per barrel during the period October 2020 to April 2021, above the budgeted forecast (US$45/barrel).

Expenditure for FY2021 was projected to amount to TT$49.6B, for a deficit of TT$8.2B relative to revenue. During the period October 2020 to April 2021, Actual Expenditure stood at TT$25.6M, TT$3.6M (12.3%) lower than the projected TT$20.6M for the period. For the period under consideration, the fiscal deficit stood at TT$5.15B, 16.9% lower than TT$6.20B initially projected.

HSF Usage Continues

As at March 31st 2021, the Net Asset Value of the Fund (NAV) stood at US$5.66B, comprising net contributions of US$1.86B and US$3.81B in capital appreciation and interest payments. Within the months of December 2020 and March 2021, withdrawals of US$198.9M and US$293.8M were made, totaling to US$492.7M for FY 2021 thus far. For FY2020, however withdrawals from the Heritage and Stabilization Fund summed to US$979.9M. As at the 4th June 2021, the NAV of the fund stood at US$5.67B. The HSF remains a readily accessible (and highly likely) source of funding, given the amendments to the withdrawal criteria in the Miscellaneous Provisions Bill in FY 2020, to fund any fiscal deficits.

Reserves Trend Lower

Investors have generally struggled to access foreign exchange, as has been the case with the wider public and business community. The material change in energy sector fortunes with respect to pricing and production of energy exports, combined with the relative stickiness in T&T’s import expenditure, have contributed to a general decline in T&T’s Net Official Reserves (NOR) since 2015. The NOR has been supported through withdrawals from the HSF, as well as increasing external borrowing via bond issuances and multilateral lending agreements. As at May 2021, Net Official Reserves stood at US$6.7B, corresponding to an Import Cover of 8.1 months.

Foreign Exchange Challenges Persist

Sales of Foreign Currency to the Public by all Authorized Dealers during Jun 2020 – May 2021 has averaged US$365.6M per month, 17.6% lower when compared to Jun 2019 – May 2020 sales which averaged US$443.5M per month. Purchases of Foreign Currency from the Public of all Authorized Dealers during the period Jun 2020 – May 2021, averaged US$266.4M per month, 19.5% lower than the average US$330.8M per month during Jun 2019 – May 2020. Sales have persistently exceeded purchases, illustrating a mismatch between the demand and the supply of foreign currency.

Borrowing Climbs

Similar to the broader global economy, T&T has attempted to immunize the economic repercussions of the COVID-19 virus through fiscal stimulus. With revenues curtailed, however, additional spending has been funded by increased borrowing (in combination with HSF drawdowns). At the end of fiscal 2020 (FY2020), Net Public Sector Debt to GDP stood at 80.7% (FY 2019: 65.5%). Net Public Sector Debt Outstanding at the end of FY 2020 stood at $121.1B, comparatively in FY 2019 a value of $103.2B was reported. At the mid-year review, it was reported that Net Public Sector Debt amounted to $126.2B or a Net Debt to GDP ratio of 85.8% as at April 2021.

Subsidies Intact, for now

Fuel Prices stay fixed. Tied to the proposed sale of state-owned gas stations announced in the FY2021 budget was move towards floating fuel prices, intended to come into effect from January 2021. While this initiative has since been delayed, the Minister of Finance has announced that on the 2nd of July, he will be presenting legislation in Parliament aimed at liberalizing the retail fuel industry. The passing of this legislation (Finance Bill 2021), would likely result in the current fixed retail margins for all liquid petroleum products being removed.

Trinidad and Tobago currently has one of the lowest cost of retail fuels globally, with gasoline at US$0.847 per liter relative to a global average of US$1.18 per liter. Guyana’s gasoline is priced at US$0.924 per liter while Jamaica records a price of US$1.22/liter. In terms of Diesel, Trinidad and Tobago reports a price of US$0.50 per liter relative to the global average of US$1.04 per liter. For Caribbean peers Jamaica and Guyana prices are US$0.83/liter and US$1.11/liter respectively.

Utility Tariffs. In December, 2020 the Regulated Industries Commission advised that it had commenced the process of Price Review for the Trinidad and Tobago Electricity Commission (T&TEC) and the Water and Sewerage Authority (WASA). The review, which consists of three phases, currently remains ongoing. The Minister of Public Utilities has signaled that there is need to review electricity rates, to enable T&TEC to raise its own financing to lower its dependence on the state as well as lower its outstanding debt to the National Gas Company of TT$2.2B. As it stands, T&T has one of the lowest electricity rates regionally and globally at US$0.052 per kilowatt compared to a global average of US$0.139/kilowatt. Jamaica in comparison has a rate of US$0.293/kilowatt. The Minister of Finance has reiterated the need to review subsidies on utilities, while the RIC recently stated that its tariff review could be completed within the next 12 months in a release dated June 24th 2021.

What does this mean for investors?

Growth: According to the Minister of Finance, the domestic economy contracted 8%-9% in FY2020, compared to the International Monetary Fund’s (IMF) forecast of 7.8%. For FY2021, the IMF predicted a growth rate of 2.1%. However, with the economy still attempting to navigate the restrictions imposed amid the third domestic wave of the pandemic, T&T’s rate of recovery rate for 2021 is likely to be slowed. Nevertheless, the continuation of vaccine rollouts is anticipated to support economic resumption and subsequent normalization.

Inflation/Prices: Despite guidance provided in the FY2021 budget, no adjustments to fuel prices and utility tariffs have been made just yet. With pandemic-related economic hardships prolonged and other inflationary pressures through raw material and supply chain bottlenecks already affecting prices, it is likely that adjustments to fuel and utility subsidies could be further delayed.

Borrowing: The continuation of pandemic mitigation measures, combined with production challenges within the domestic energy landscape leads to the increased likelihood of continued government borrowing. While still relatively at (relatively) comfortable levels, T&T’s indebtedness position has deteriorated swiftly since FY2018/2019.

The HSF: As at June 2021, the HSF stood at US$5.67B, with the government making a total of four withdrawals in calendar 2020 to fund the fiscal gap associated with lowered revenue and sticky expenditure. It remains likely that HSF drawdowns will continue as revenues remain constrained.

Foreign Exchange Access: With ongoing challenges to USD generation by the economy and declining Net Official Reserves, foreign exchange access is anticipated to remain challenging. Notably, the Minister of Finance declared that no significant adjustments to the official USD:TTD exchange rate were currently envisaged, signaling that an imbalance to the demand and supply for hard currency will persist.

Company Performance: The third wave of COVID-19 has resulted in a reimplementation of restrictions, delaying the pace of economic normalization for T&T. Corporate entities, particularly those in the cyclical and consumer-discretionary based industries could face challenges to revenue generation in the near-term. For companies/groups with (i) more geographically diversified operations and/or (ii) consumer non-discretionary products/services, there could be some degree of earnings resilience. Put differently, there will be winners and losers even under pandemic conditions.

As always, investors should consult with an expert investment adviser like Bourse to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”