BOURSE SECURITIES LIMITED

February 26th, 2018

Can more value be derived from NEL?

This week, we at Bourse review the most recent financial results of National Enterprises Limited (NEL). NEL’s share price has slipped from $10.81 to $9.65 (down 10.7%) year-on-year, which may be reflective of investor expectations of the performance of NEL’s investee companies. We take a look at the NEL’s nine-month performance relative to the value contributed by its investee companies and provide a brief synopsis of the company’s value.

National Enterprises Limited (NEL)

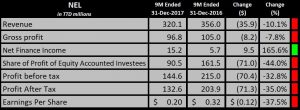

For the nine-month ended 31st December 2017, National Enterprises Limited (NEL) reported Earnings per Share (EPS) of $0.20, a 37.5% decline compared to $0.32 reported in nine-month 2016.

Revenue generated by NEL’s 51% share of National Flour Mills Limited was 10.1% lower at $320.1M compared to $356.0M reported in nine-month 2016. Gross Profit margin improved from 29% to 30%, however Gross Profit declined 7.8% from $105.0M to $96.8M. Net Finance income reported the largest improvement for the period, up 165.6% to $15.2M. Share of profit of Equity Accounted Investees, which is the largest contributor to profit (62.6%) fell 44.0% from $161.5M to $90.5M in nine-month 2017. As a result, Profit before Tax closed at $144.6M, 32.8% lower than $215.0M reported in 2016. Overall, Profit after Tax fell 35.0% from $203.9M to $132.6M, while profit attributable to equity shareholders was 36.5% lower than $191.31M reported in nine- month 2016.

Outlook

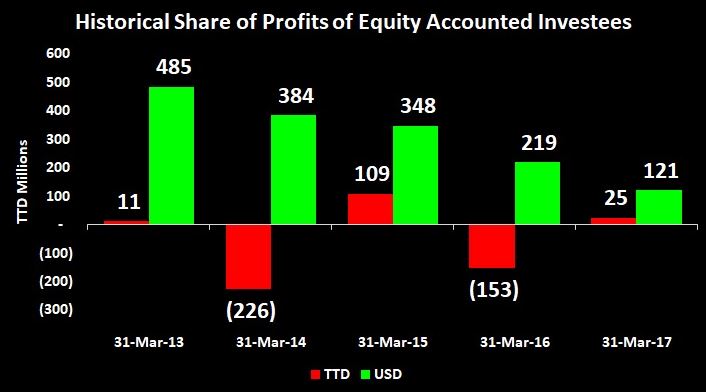

NEL’s Share of Profits of investee companies, is dominated by contributions from its energy-related investments. NEL’s energy investments, Tringen, NGC LNG, NGC NGL and Pan West Engineers and Constructors Limited have collectively contributed $121.2M (83%) to share of profit from investee companies in 2017. Despite positive contributions from energy related investments over the past three years (March 2015 to March 2017), fluctuating profitability from TSTT makes share of profit from investee companies volatility.

Going forward, NEL’s share of profits from NGC NGL and NGC LNG may be positively impacted by improvements in energy prices and production.

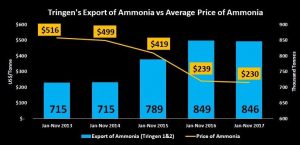

Ammonia exports (for Tringen 1 & 2) have been relatively stable in 2016 and 2017. However, Ammonia prices have been trending downward. Over the period January to November 2017, ammonia prices averaged US$230 /tonne, 55.4% lower than the average price of US$516 /tonne for January to November 2013. In January 2018, ammonia prices stood at US$309/tonne, 34% higher than 2017 levels. Although ammonia prices have recovered in recent months, it remains 40% below 2013 highs. Looking ahead, the direction of ammonia prices will likely influence Tringen’s profitability and contribution to NEL’s Share of Profit of Equity Accounted Investees.

Exports and prices of NGLs have improved, following three years of declines from 2014 to 2016. The average price of NGLs, based on a weighted basket of propane, butane and natural gasoline, was US$0.95 cents per gallon in 2017, 39.2% higher than US$0.68 cents per gallon in 2016. Exports also improved 6.8% in 2017, following a 21.5% dip in 2016.

The Bourse View

At a current price of $9.65, NEL trades at a trailing P/E of 53.6 times, higher than the Non-Banking Finance sector average of 11.9 times (excluding NEL). NEL offers investors a trailing dividend yield of 3.63%. On the basis of expected improvements in energy production, however dampened by declining contributions from non-energy investments, Bourse maintains a NEUTRAL rating on NEL.

Can more value be derived from NEL?

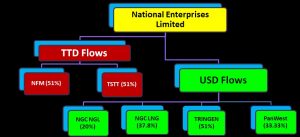

With relatively muted financial performance, investors may be pondering what, if any, measures could be implemented to derive more value from NEL. As a holding company, NEL is comprised of several companies. Some of its key holdings are in the energy sector, including NGC NGL, NGC LNG, Tringen and PanWest Engineers and Constructors Limited. All of these investments would generate US dollar cashflows. On the other hand, TT dollar holdings include National Flour Mills Limited (NFM) – a stock already listed on the Trinidad and Tobago Stock Exchange – and TSTT.

Over the last five years, the companies that generate USD flows have accounted for the majority of NEL’s Share of Profits of Equity Accounted Investees. In 2017 for example, USD flows comprised 83% of Share of Profits. Investors might very well welcome some reorganization of NEL, to the extent that USD-generating investments were carved out into a separate security (and possibly listed on the USD trading platform of the T&T Stock Exchange). At the same time, reorganization could provide shareholders with the option to either hold or sell the TT dollar component (comprising NFM, TSTT and other TT-dollar investments) of NEL’s portfolio. Ultimately, any reorganization initiative should have the effect of increasing shareholder value.