BOURSE SECURITIES LIMITED

7th August, 2017

Banks report higher revenues

This week, we at Bourse review the nine-month results for the period ended June 2017 of two stocks within the Banking sector, Republic Financial Holding Limited (RFHL), and First Citizens Bank Limited (FIRST).

Republic Financial Holding Limited (RFHL)

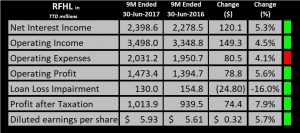

Republic Financial Holdings Limited (RFHL) reported diluted Earnings per Share (EPS) of $5.93 for the nine-month period ending June 2017, an increase of 5.7% compared to the EPS reported for the same period in 2016.

RFHL’s Net Interest Income (NII) grew 5.3% to $2.39B for the nine-month period ended on June 2017. Growth in Other Income, combined with the increase in NII resulted in Operating Income increasing by $149.3M to $3.49B. Operating expenses partially offset these Operating Income gains, rising to $2.03B, an increase of 4.1%. As a result, Operating Profit grew 5.6% to $1.47B at the end of the nine-month period. There was a notable reduction in Loan Loss Impairment expense to $130.0M from $154.8M in the prior period. Profit after Taxation ended the nine-month period at $1.01B, an improvement of 7.9%.

Outlook

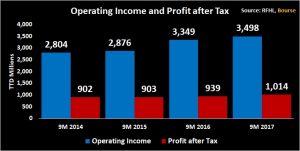

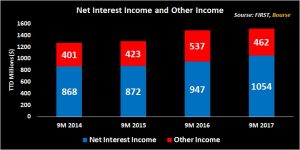

RFHL has been able to grow both Operating Income and Profit after Tax in each consecutive year since the third quarter of 2014. Operating Income advanced 24.7% while Profit after Tax grew 12.4% from nine-month 2014 to nine-month 2017. The growth in Operating Income was attributed to the growth in RFHL’s Net Interest Income from the 3rd quarter 2014 to the corresponding period in 2017. Other Income fell over the same period. RFHL has been able to grow its loan and portfolio business despite the economic headwinds in its operating territories, particularly its main market Trinidad and Tobago.

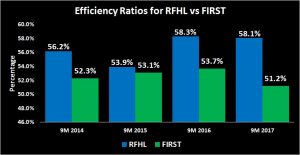

While RFHL had success growing Operating Income, controlling Operating Expenses and loan impairments have been a challenge. Operating Expenses have risen from $1.57B in the nine-month 2014 to $2.6B in the corresponding period in 2017, an increase of 65%. Consequently, RFHL’s operating efficiency ratio has deteriorated from 56.2% to 58.1% over the same period. This compares unfavourably to its competitors Scotia Bank of Trinidad and Tobago Limited and First Citizens Bank Limited, which reported operating efficiency ratios of 38.7% and 51.2% respectively. Loan impairment expenses have also increased from $79.2M at the end of the third quarter 2014 to $129.9M at the end of the third quarter 2017. Higher loan loss expense may be a consequence of the challenges in the economies RFHL operates in, more so the Trinidad and Tobago market where unemployment is rising and businesses are under pressure due to difficulty accessing foreign exchange and the economic downturn.

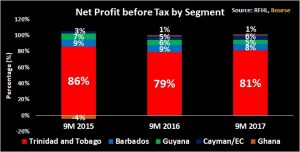

Due to RFHL’s diversification strategy, there has been less reliance on the Trinidad and Tobago market for Net Profit before Tax. Countries such as Ghana and the Cayman Islands/ Eastern Caribbean have accounted for a growing share of Net Profit before Tax from the third quarter period in 2014 to the equivalent period in 2017. While currently RFHL operates in several territories as part of its diversification strategy, there have been some economic challenges. In the long term however, this strategy should be beneficial. With improving economic prospects in some of the territories RFHL operates in, alongside cost containment and astute management of its loan and investment portfolios, RFHL’s performance should improve in the future.

The Bourse View

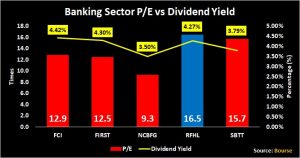

At a current price of $101.90, RFHL currently trades at a trailing P/E of 16.49 times above the Banking sector average of 13.35 times. The market to book value is 1.74, in line with the sector average of 1.72 times. RFHL has a dividend yield of 4.27%, above the sector average of 4.06%. On the basis of an attractive dividend yield but tempered by high valuations and economic challenges in RFHL’s operating territories, Bourse maintains a NEUTRAL rating on RFHL.

First Citizens Bank Limited

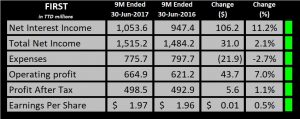

First Citizens Bank Limited (FIRST) reported an EPS of $1.97 at the end of the nine months period ended June 2017, a marginal increase of 0.5% compared to the EPS of $1.96 reported during the same period in 2016.

First’s Net Interest Income grew 11.2% to $1.0B at the end of the third quarter. Despite a decline in Other Income of $75.1M, Total Income grew to $1.51B, an increase of 2.1%. Expenses declined 21.9M to $775.7M, however loan impairment expenses rose $9.2M. As a result, Operating Profit rose to $664.9M, an increase of $43.7M. Due to a higher effective tax rate of 27% compared to 22% a year prior Tax Expense increased to $183M, as a result Profit after Tax grew to $499M, an increase of 1.1%.

Outlook

Total Net Income grew 19.4% ($246.4M) from the nine month period ended June 2014 to the corresponding period in 2017. This growth is mainly attributable to growth in Net Interest Income, which grew 21.3% or $185.4M for the period. Other Income grew 15.2% or $61M over the same period. Net Interest Income improved by 11.2% year-on-year. According the Chairman, this growth was due to the expansion in the Investments and Loans portfolios of 7.0% and 5.7% respectively.

FIRST’s efficiency ratio, a measure of how well the bank manages its expenses, stood at 51.2% as at June 2017. This was an improvement from 53.7% reported in June 2016. With respect to other locally listed banks, FIRST efficiency ratio was marginally above the average of 49.3% as at June 2017. Looking ahead, expense management will be of key importance to overall profitability.

The Bourse View

At a current price of $31.65, FIRST trades at a trailing P/E of 12.51 times, below the banking sector average of 13.38 times. The market to book value is currently 1.20 times, below the sector average of 1.73 times. FIRST has a trailing dividend yield of 4.30%, above the sector average of 4.06%. Bourse maintains a NEUTRAL rating on FIRST.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”