BOURSE SECURITIES LIMITED

31st July, 2017

WCO, TCL Revenues Dip

This week, we at Bourse review the six month performance of The West Indian Tobacco Limited (WCO) and Trinidad Cement Limited (TCL). Both companies have felt the impacts of a slowdown in economic activity and increased competitive pressures. We discuss the performances and provide a brief outlook.

The West Indian Tobacco Company Limited (WCO)

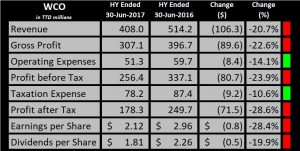

The West Indian Tobacco Company Limited (WCO) reported Earnings per Share (EPS) of $2.12 for the six months period ending 30th June 2017, a decline of 28.4% when compared to the EPS of $2.96 reported in the corresponding period in 2016.

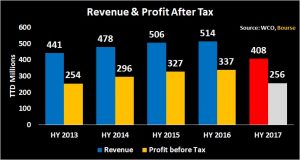

WCO’s revenue fell to $408.0M, a reduction of $106.3M (20.7%) compared to the same period in 2016. WCO reported a Gross Profit of $307.1M, a 22.6% decline compared to the equivalent period in 2016. However, given the larger percentage fall in Revenue than Cost of Sales, Gross Profit margin declined from 77.1% in HY 2016 to 75.2% in HY 2017. Declines in Administrative, Distribution and Other Operating Costs led to Total Operating Expenses retreating 14.1% to $51.2M. Profit before Tax declined to $256.4M, a reduction of 23.9% ($80.7M). Taxation expense was $78.1M, $9.2M lower than a year prior. Profit after Tax declined $71.4M to $178.2M, a reduction of 28.6% compared to the same period in 2016.

Outlook

WCO’s decline in revenue is likely attributable to the economic climate both within the wider economy, policy changes and competitive forces. WCO continues to grapple with heightened competition from illicit tobacco products, which appears to be impacting sales. A 15 percent increase in the excise taxes on imported and locally manufactured cigarettes, imposed on October 20th 2016, has led to revenue pressures, with WCO facing the decision to either absorb some or all of this higher cost of sales or pass this cost onto consumers. Geographic concentration has not worked to the advantage of WCO, with the Trinidad and Tobago market accounting for 89.3% and 88.3% percent of WCO’s revenue in HY 2016 and HY 2017 respectively.

WCO’s reliance on imported raw materials in an environment where foreign exchange has become an issue for importers could contribute to ongoing pressures on earnings, particularly where the majority of sales are in local currency.

WCO announced a second interim dividend of $1.05 per share payable on August 21st 2017, 16.6% ($0.19) less than the $1.26 second interim dividend paid in 2016. The trailing 12-month dividend currently stands at $5.43, resulting in a trailing dividend payout ratio of 102.8%. Should declining earnings persist, dividends per share paid to investors could continue adjusting downward.

The Bourse View

At the current price of $125.82, WCO trades at a trailing P/E of 23.8 times, above the Manufacturing sector 1 average of 22.3 times. The current P/E ratio is also above WCO’s three year P/E average of 21.4 times. The dividend yield currently is 4.32%, above the sector average of 3.61%. On the basis of a still-attractive dividend yield, but tempered by falling earnings, a commensurate decline in dividends and a relatively high P/E ratio, Bourse maintains a NEUTRAL rating on WCO.

Trinidad Cement Limited (TCL)

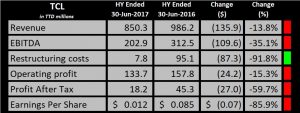

Trinidad Cement Limited (TCL) reported EPS of $0.012 for the six months period ended June 30th 2017. EPS declined 85.8% compared to the EPS of $0.085 reported over the corresponding period in 2016.

TCL’s revenue decreased 13.7% to $850.3M. EBITDA dropped to $202.8M, a decline of 35.0% or $109.6M. Restructuring costs were $87.3M lower, on account of reduced Stockholding and Inventory restructuring costs ($72.9M) and Manpower restructuring costs ($14.4M). Despite these cost reductions, Operating Profit retreated to $133.7M, a decline of 15.31% when compared to the same period in 2016. Net finance costs increased to $89.3M from $73.6M, in part attributable to a $45M one-off expense related to prepayment of an existing loan. As a result, Profit before Tax fell to $44.3M, down $39.9M from the same period in 2016. Taxation expense declined to $26.1M, a reduction of $12.8M. Profit after Tax declined 59.7% or $18.2M, when compared to the corresponding period in 2016.

Outlook

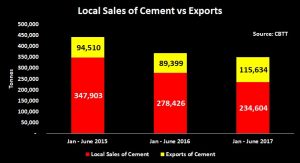

Recessionary conditions in TCL’s main market Trinidad and Tobago has adversely affected the construction sector and cement sales. Local sales of cement has declined 13.7% year-on-year from for the period January to June inclusive (2017 vs. 2016) and 32.6% from the comparable periods in 2015 and 2017. Besides declining activity in the construction sector, TCL continues to confront competition from imported cement.

According to the Central Bank of Trinidad & Tobago’s May 2017 Monetary Report (CBTT), the domestic economy is expected to modestly recover in the second half of 2017. For TCL, future improvements in earnings will depend on how successfully TCL can compete against imported cement, construction activity in the local economy and product export initiatives.

The Bourse View

At the current price of $4.14, TCL trades at a trailing P/E of 153.33 times. The trailing dividend yield is 0.48%. On the basis of declining earnings, a challenging business environment and the absence of regular dividend payments, Bourse maintains a SELL rating on TCL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”