Banking Sector Stocks Stumble

| HIGHLIGHTS

RFHL HY2020 · Earnings: EPS fell 37.4% from $7.59 to $4.75. · Performance Drivers: o Increased credit loss expenses due to COVID-19 o Absence of one-off gains experienced in 9M 2019 · Outlook: o Likely headwinds to growth from (i) faltering loan demand and (ii) potential increase in Credit Loss Expenses. · Rating: Maintained at NEUTRAL. FIRST HY2020 · Earnings: EPS contacted 16.0% from $2.19 to $1.84. · Performance Drivers: o Increased credit loss expenses due to COVID-19 · Outlook: o Potential headwinds to revenue growth o Impairment expenses likely to increase · Rating: Maintained at NEUTRAL. |

This week, we at Bourse review the financial performance of Banking Sector giants Republic Financial Holdings Limited (RFHL) and First Citizens Bank Limited (FIRST) for nine month financial periods ended, 30th June, 2020. Both entities would have suffered from the economic impact of the COVID-19 virus, which weighed on income generating abilities and introduced higher credit loss expenses.

Republic Financial Holdings Limited

RFHL reported a diluted earnings per share (EPS) of $4.75 for the nine-month period ended 30th June, 2020, 37.4% lower than the $7.59 recorded in the prior comparable period.

Net Interest Income rose 5.6% to $2.97B at the end of the period, relative to $2.81B reported in the prior year. Similarly, Other Income was recorded at $1.26B, 9.2% ahead of that reported in 9M 2019. Operating Income was up 6.6% year-on-year as inorganic growth and upticks in early performance partially offset the effects of COVID-19. Operating Expenses increased 20.9%, influenced by consolidation costs and COVID-19 related expenditure. Share of Profits of Associated Companies was relatively unchanged at $4.3M. Operating Profit stood at $1.66B from a prior $2.28B, down 27.3%. On an adjusted basis discounting the one-off gain from a Write-back of Post-Retirement Medical Benefits in 9M 2019 ($438.4M), Operating Profit was down 9.9%. Credit Loss Expense moved from $154.4M to $456.8M in 9M 2020, a nearly 200% jump as RFHL reacted to the economic shock of COVID-19. Profit Before Tax contracted 43.5% relative to the prior year as it moved from $2.12B to $1.20B. On an adjusted basis PBT was down 28.8% YoY. Taxation Expense was $345.5M, 23.3% less than prior year. Overall, Net Profit After Taxation (PAT) was $853.6M, 35.7% lower than $1.33M in 9M 2019. Discounting one off gains and Deferred Tax expenses in 9M 2019, PAT would have fallen 30.8% YoY.

Revenue Growth Continues

At the surface level, top line performance for 9M 2020 appeared relatively healthy, growing 6.6% YoY and at a compounded annual rate of 6.0%. Quarter-on-quarter review, however, revealed an 18% decline in Operating Income. April to June 2020 would have brought with it the brunt of the COVID-19 impact, including stringent lockdown measures and banks responding to fight the economic impact on consumers by waiving fees, allowing loan moratoria and reducing lending rates.

Other Income was the more heavily impacted revenue segment due to RFHL’s waiver of late fees and penalties. With these measures expected to last for a duration of 6 months, the implication is that growth across this segment is likely to remain stagnant or even in negative territory in the short run. Net Interest Income, meanwhile, will be adversely affected by lower loan demand and reduced prime lending rates (from 9.75% to 7.50%).

Acquisitions Support PBT

RFHL recorded Profit Before Tax (PBT) growth in just one of its seven major operating jurisdictions in 9M 2020. Eastern Caribbean PBT increased from a prior $74M to $177M (up 88.3%). This performance was driven mainly by RFHL’s acquisition of Scotiabank’s operations in 7 regions located in the Eastern Caribbean.

Trinidad and Tobago, the largest contributor to PBT at 43%, reported the biggest decline at 64% YoY. Barbados, which accounts for roughly 12% of PBT, declined 22.3%, while Guyana which contributed the same proportion to PBT fell marginally at 0.01%.

The International Monetary Fund projects that Trinidad and Tobago’s economy will contract 4.5% in 2020 while Latin America and the Caribbean is expected to contract 9.5% from a prior estimate of -5.2%. Within the context of a more challenging environment, regional economic stagnation presents an increased risk of credit losses and generally lower consumption.

Could Dividends fall?

With COVID-19 creating a great deal of uncertainty, RFHL made the prudent decision to cut its interim dividend payment to $0.60 from the $1.25 paid since May 2011. The cut in interim dividend, combined with weaker profitability despite acquisition activity, may signal to investors an increasing likelihood of some cut to the Group’s final dividend for FY2020.

The Bourse View

RFHL is currently priced at $141.38, appreciating 7.7% year to date. The stock trades at a Price to Earnings ratio of 20.5 times (sector average 23.5 times, 18.1 times excluding FCI), with a Trailing Dividend Yield of 2.7% (sector average 3.4% excluding special dividends). The resurgence of cases in Trinidad and Tobago and the wider Caribbean poses risks to a sharp rebound in economic activity, particularly in jurisdictions dependent on tourism. On the basis of relatively high valuations, adverse economic conditions and intensifying COVID-19 uncertainty, tempered by the Group’s well-capitalized position, Bourse maintains a NEUTRAL rating on RFHL.

First Citizens Bank Limited (FIRST)

FIRST reported an Earnings Per Share (EPS) figure of $1.84 at the end to the nine-month period, June 30th 2020 (9M 2020), 16.0% lower than the EPS of $2.19 reported in the previous comparable period.

Total Net Income advanced just 0.8%. FIRST’s Impairment Expenses Net Recoveries jumped $175.0M, from $12.1M in 9M 2019 to $187.1M in 9M 2020, in anticipation of deteriorating credit conditions. Meanwhile, Expenses fell marginally by 0.05%. As a result, Operating Profits amounted to $639.9M, down 20.2% (9M 2020: $801.5M). Share of Profit in Associates and Joint Venture marginally increased by $0.3M. Profit Before Tax stood at $654.5M, 19.8% lower than $815.8M recorded in 9M 2020. Taxation Expenses fell 28.5%. Overall, Profit After Tax (PAT) closed at $466.6M, down 15.6% from $553.0M for the prior comparable period.

Profit Before Tax fluctuates

FIRST’s PBT has fluctuated over the past four comparable periods. PBT for 9M 2020 fell 19.8% primarily attributable to significant Impairment Expenses, likely exacerbated by the economic fallout from the COVID-19 pandemic. Additionally, the employment of special relief concessions likely had direct effects on FIRST’s top-line, contributing to the decline in profitability. Retail and Corporate Banking, which continues to function as FIRST’s largest contributor to PBT, declined 10.6% YoY. PBT contributions from the Treasury and Investment Banking Segment, recorded the largest decline of 31.6%, while the Trustee and Asset Management fell 2.3%.

Dividends Affected

In the context of adverse economic conditions and ongoing uncertainty FIRST has opted to take a more conservative approach in its payment of dividends. The banking entity has paid three dividend payments for FY 2020 thus far, summing to $0.92 per share relative to $1.21 per share in the same period a year ago. Despite the 24% reduction in dividend paid relative to last year FIRST still remains one of the highest dividend yielding stocks in the banking sector, at 3.0% just shy of the sector average of 3.4%.

Covid-19 Impact

As uncertainty continues to dominate the economic outlook, FIRST may face headwinds to its topline growth, in an environment where interest rates are lower and the demand for loans may decelerate. Similar to RFHL, rising COVID-19 cases and negative economic growth forecasts for Trinidad and Tobago and Barbados is likely to influence credit loss expenditure.

The Bourse View

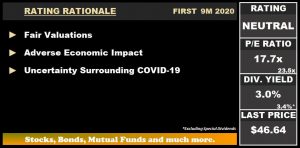

At a current price of $46.64 FIRST has appreciated 4.8% YTD and trades at a Trailing P/E ratio of 17.7 times, below the Banking sector’s average of 23.5 times (18.1 times excluding FCI). The stock also offers a Trailing Dividend Yield of 3.0%, below the sector average of 3.4% (excluding special dividends). The Group has declared an interim dividend of $0.20 per ordinary share. Looking forward, FIRST is likely to face challenges to its profitability amid volatile economic conditions. On the basis of fair valuations, but tempered by adverse economic conditions and the potential impact of COVID-19 on its operations, Bourse maintains a NEUTRAL rating on FIRST.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”