Manufacturing Earnings Lower

HIGHLIGHTS

WCO HY 2020

• Earnings: Earnings Per Share declined 7.2% from $0.83 to $0.77

• Performance Drivers:

o Contracted demand amid COVID-19 restrictions

o Export disruptions

• Outlook:

o Muted Revenue growth

o Likely headwinds due to the potential continuation of COVID-19 measures

• Rating: Maintained at NEUTRAL

TCL HY 2020

• Earnings: Earnings Per Share contracted by 120.0% from $0.035 to a Loss Per Share of $0.007

• Performance Drivers:

o Adverse economic conditions

o Shifts in consumer spending

• Outlook:

o Likely headwinds to Revenue Growth

o Competition from imported cement

• Rating: Maintained at SELL

The week, we at Bourse review the financial performance of two stocks within the Manufacturing Sector for the half year (HY) period ended June 30th, 2020 – The West Indian Tobacco Company Limited (WCO) and Trinidad Cement Limited (TCL). Both entities recorded lower earnings on account of economic stagnation.

West Indian Tobacco Company Limited (WCO)

WCO reported an Earnings Per Share (EPS) of $0.77 for the period ended June 30th 2020 (HY 2020), 7.2% lower than the EPS of $0.83 recorded in the prior period.

Reported revenue was $421.4M at the end of HY 2020, 10.3% lower than the $470.0M in HY 2019, affected by the closure of bars and other similar avenues which drive WCO’s product demand. Cost of Sales fell 9.5% YoY, from $104.0M to $94.2M. Gross Profit recorded a 10.6% reduction, decreasing from $366.0M to $327.3M. Collectively, WCO’s Distribution Costs, Administrative Expenses and Other Operating Expenses declined 24.3% moving from a total of $66.4M to $50.3M. Operating Profits contracted 7.5% to $277.0M from a previous $299.6M. Finance Income declined 36.0% YoY. Profit Before Tax fell to $277.8M in HY 2020 relative to $300.9M in the prior year (7.7% lower). Taxation Expenses in HY 2020 fell 7.2%. Overall, the Company’s Profit After Tax (PAT) stood at $193.6M in HY 2020, 7.9% less than the $210.2M reported in HY 2019.

Revenue Contracts

After two periods of consecutive revenue growth in HY 2018 and HY 2019, the COVID-19 pandemic has brought an abrupt end to WCO’s increasing HY revenue trend. In complying with the government’s orders to curb the spread of the coronavirus, WCO halted operations in the month of April 2020, disrupting its export operations. Domestically, bar closures for more than 2 months and a spike in unemployment would have placed pressure on sales.

Despite the best efforts of WCO, headwinds to revenue growth could persist as the unemployment effects of COVID-19 and negative economic growth persists in Trinidad & Tobago. The recent resurgence of COVID-19 cases could defer the anticipated recovery from economic reopening, while competitive pressures from substitutes in the domestic markets such as lower priced illicit cigarettes and the still-popular vaping trend remain threats to WCO’s revenue stream.

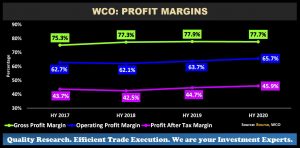

Margins Strong

WCO has remained efficient in its operations despite revenue volatility. Gross Profit Margin was 77.7% in HY 2020 (HY2019: 77.9%), while Operation Profit Margin improved to 65.7% (HY2019: 63.7%). Ultimately, WCO was able to report a Net Profit Margin of 45.9% (HY2019: 44.7%), attesting to the Company’s strong cost management initiatives.

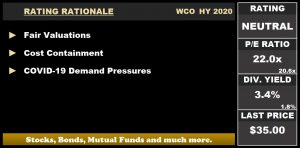

The Bourse View

At a current price of $35.00, WCO trades at a trailing Price to Earnings Ratio of 22.0 times, above the Manufacturing I Sector average of 20.6 times. The stock offers investors a trailing dividend yield of 3.4%, (sector average: 1.8%). On the basis of fair valuations and proficient cost management, but tempered by continued headwinds due to COVID-19 and substitute products emergence, Bourse maintains a NEUTRAL rating on WCO.

Trinidad Cement Limited (TCL)

TCL reported a Loss Per Share of $0.007 for the 6-month period ended June 2020 (HY 2020), 120.0% lower than the Earnings Per Share (EPS) of $0.035 reported in the previous year.

TCL’s Revenue for the period was $775.6M, 10.6% lower than the prior comparable period. Cost of Sales fell 8.2%, to $537.42M in HY 2020 (HY2019: $585.7M). Resultantly, Gross Profit declined from $281.5M to $238.1M (down 15.4%). TCL’s Operating Expenses moved from $132.8M to $117.3M, 11.6% lower. Operating Earnings fell 8.5% from $120.6M in HY 2019 to $110.4M in HY 2020. Overall, Net Income for HY 2020 was $10.4M, 68.7% lower than $33.4M reported in the previous comparable period. Including the effects of Non-Controlling Interests (NCI), TCL reported a loss of $2.7M.

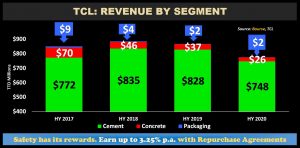

Revenue Trend Lower

TCL hasn’t been spared from the economic effects of COVID-19, compounding the relatively sluggish construction activity of a low-growth environment. Cement Sales, which typically accounts for roughly 95% of TCL’s revenue, fell 9.7% to $748M (HY2019: $828M). Concrete Sales fell 29.7% from $37M in HY2019 to HY2020’s $26M. The nature of TCL’s product offerings makes the company susceptible to shifts in the economy. Accelerating economic growth and infrastructure expenditure could benefit the Group, both of which may face challenges under prevailing conditions.

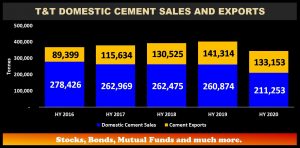

COVID-19 causes Demand Shock

Domestic sales of Cement continued on its downward trajectory, likely exacerbated by COVID-19 enforced economic closure. Domestic Cement Sales through the three-year period HY 2016 to HY 2019 shrank at a Compounded Annual Growth Rate (CAGR) of -2.1%. However, in HY 2020 Domestic Cement Sales, fell 19.0% relative to prior year. Hardware limited hours, restrictions on construction work and the slow growth of the economy would have all impacted cement sales during the period. This could potentially be recovered, with pent up activity and demand spilling into subsequent quarters.

In contrast to Domestic Cement Sales, Cement Exports were on an upward trend from HY 2016 to HY 2019. Within that period, exports rose an estimated 16.5% per year. HY 2020 saw the end of that trend, with Cement Exports falling 5.8% year-on-year. Like domestic sales, pent up demand and economic reopening could lead to some recovery in subsequent periods. This outlook comes with significant uncertainty, particularly in the context of the International Monetary Fund’s Latin America and Caribbean 2020 growth forecast of -9.4%.

Margins Trend Lower

At the operating level, TCL’s operating margins have been fairly stable ranging between 14-16% over the past four comparable periods. Profit Before Tax (PBT) Margin moved from 7.5% in the prior year to 6.0% in HY 2020 influenced by a 14.7% increase in Finance Costs. Profit After Tax (PAT) Margin meanwhile fell to a 3-year low of 1.3%.

The Bourse Review

At a current price of $2.10, TCL’s share price has appreciated 5% year to date and trades at a Market-to-Book Ratio of 1.3 times, comparatively its closest peers in the Manufacturing I trade at an average Market to Book ratio of 3.7 times. TCL has had inconsistencies in its payment of dividends, with only 2 payments in the last 10 years. Weaker economic growth has understandably weighed on TCL’s declining profitability in prior periods. With potentially higher unemployment rates, reductions in disposable income and forecast economic contraction both domestically and at the regional level, the TCL is likely to face a more challenging near-term environment. On the basis of declining profitability, inconsistent dividend payments and uncertainty surrounding the COVID-19, Bourse maintains a SELL on TCL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”