NCBFG, GHL Decline

| HIGHLIGHTS

NCBFG 9M 2020 · Earnings: EPS fell 27.1% from $0.39 to $0.28 · Performance Drivers: o Consolidation of GHL’s operations o Declines in Gains on Foreign Currency and Investment Activity o Higher Credit Impairment Losses o Absence of one off gains in 9M 2019 · Outlook: o Possible headwinds to organic growth amid adverse economic conditions o Potential increases to Credit Impairment Losses · Rating: Maintained at NEUTRAL. GHL HY 2020 · Earnings: EPS contacted 33.0% from $1.06 to $0.71 · Performance Drivers: o Year-on-year decline in Investing Income o Uptick in Insurance Underwriting Income · Outlook: o Potential improvements to Investing Income spurred by continued recovery in financial markets o Likely improvements in Insurance Income due to NCBFG’s intention to streamline its Jamaican insurance portfolio into GHL o Potential increases to Impairment Loss on Financial Assets o Possible headwinds to organic growth amid contractionary economic conditions · Rating: Maintained at NEUTRAL. |

This week, we at Bourse review the financial performance of the Caribbean’s second largest indigenous bank NCB Financial Group Limited (NCBFG) for the nine-month period ended, 30th June, 2020 and its listed subsidiary Guardian Holdings Limited (GHL) for the six-month period ended 30th June, 2020. NCBFG’s earnings fell year-on-year in the absence of one-off gains recorded in 9M 2019, partially offset by the consolidation of GHL’s operations. GHL, meanwhile, reported lower earnings on account of a decline in Investing Income, despite a rebound in Insurance Income.

NCB Financial Group Limited

NCBFG reported an Earnings Per Share of TT$0.28 in the nine-month period ended 30th June, 2020, 27.1% lower than TT$0.39 in the prior comparable period.

The Group’s core revenue driver, Net Interest Income, improved 27.8% year-on-year (YoY) moving to TT$1.91B from TT$1.49B. Net Result from Banking and Investment Activities grew 11.8% to TT$2.68B, bolstered by GHL’s consolidation but negatively impacted by higher Credit Impairment Losses. Net Result from Insurance Activities ended the period at TT$1.07B relative to TT$332.4M in the prior period, a 222.4% increase. Overall, Net Operating Income rose 37.5% moving to TT$3.75B from TT$2.73B. Operating Expenses amounted to TT$2.74B, 41.2% greater than TT$1.94B in 9M 2019. Operating Profit improved 28.4% to TT$1.01B from a prior TT$784.8M. Share of Profit of Associates moved from TT$121.9M to TT$6.36M, a 95.0% reduction with GHL no longer being accounted for as an associated company. Profit Before Tax was $1.01B, 12.9% less than $1.16B recorded in 9M 2019. However, discounting one-off gains recorded in 9M 2019 (TT$258.0M) arising from NCBFG’s disposal of interest in an associate and revaluation of its equity interest in GHL, PBT advanced 11.9% on an adjusted basis. Net Profit fell 4.7% from $978.1M to $931.9M. Adjusting for one-off gains in the prior year, Net Profit improved 29.4% YoY bolstered by GHL’s consolidation.

GHL Acquisition Bolsters Income

NCBFG’s majority holding of GHL became effective in May 2019, with subsequent consolidation of GHL’s results benefiting NCBFG. Net Result from Insurance Activities was the biggest beneficiary of NCBFG’s consolidation of GHL operations, moving from TT$332.4M to TT$1.07B in 9M 2020 or a more than 200% YoY jump. Between the period 9M 2019 to 9M 2016, Net Interest Income grew at a compounded annual growth rate of 15.4%. Comparatively, in 9M 2020 Net Interest Income recorded a 27.8% YoY increase, propelled primarily by inorganic growth from GHL and growth in the Group’s Jamaican loan portfolio.

All segments of NCBFG were able to advance on account of the acquisition of GHL as a subsidiary, with the exception of Gain on FX and Investment Activities which fell 72.0% YoY. The performance of this segment was impacted by reduced securities trading activity and the depreciation of the Jamaican currency which has fallen an estimated 11.5% year to date.

In terms of Operating Profit, only two of NCBFG’s seven operational segments recorded YoY improvements in performance. General Insurance, the smaller of NCBFG’s two Insurance Segments recorded a 2.81 times increase in performance, expectedly bolstered by GHL’s operations.

Operating Profit from Banking and Investment Activities slipped 7.9% lower in 9M 2020 relative to the prior year as higher Credit Impairment Losses, increases in the number of Non-Performing Loans (↑ TT$174.4M or 5.0% of Gross Loans relative to a previous 3.5%) and temporary fee waivers impacted performance.

NCBFG Streamlines Insurance Operations

On the 30th June, 2020 NCBFG began the process of streamlining the insurance and annuities businesses in its Jamaican entities, with the intention of transferring 100% of the aforementioned portfolios to Guardian Life Limited (GLL). Still pending approval from the Jamaican Financial Services Commission, the completion of this arrangement is aimed at improving operational efficiency and leveraging economies of experience and scale given GHL’s position as an established regional insurance provider.

Economic Outlook

The Bank of Jamaica projects that for the current fiscal year (June 2020 to March 2021) the Jamaican economy could contract 5.1%, with recovery in the range of 2.5% to 5.5% in the following fiscal year. The projected decline is expected to stem from a multitude of economic sectors including but not limited to Hotels & Restaurants, Mining, Wholesale & Retail and Storage & Communication. Jamaica accounts for an estimated 75% of NCBFG’s Operating Income. With recessionary conditions prevalent in its main operating jurisdiction, the Group’s ability to generate organic growth could face some near-term challenges.

Dividends Decline

NCBFG has historically paid dividends on a quarterly basis. In the same period last year, the Group would have already declared and paid three interim dividend payments summing to TT$0.12. Comparatively, for the current financial year, the Group has issued one interim dividend payment at TT$0.05.

The decline in dividends paid follows guidance from the Bank of Jamaica that financial institutions domiciled and listed in Jamaica only pay dividends to shareholders with one percentage or less of interest in a company. The mandate arose as the COVID-19 pandemic heightened economic uncertainty in Jamaica and across regional markets.

The Bourse View

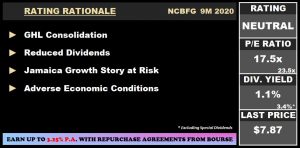

NCBFG is currently priced at $7.87 and trades at a price to earnings ratio of 17.5 times, relative to a sector average of 23.5 times (18.1 times excluding FCI). The stock offers investors a trailing dividend yield of 1.1% relative to the Banking Sector average of 3.4% (excluding special dividends). With Jamaica facing the economic pressures associated with the onslaught of COVID-19, NCBFG is likely to face headwinds to growth in the near term. On the basis of improved performance due to the consolidation of GHL’s operations, but tempered by reduced dividends and adverse economic conditions Bourse maintains a NEUTRAL rating on NCBFG.

Guardian Holdings Limited

Guardian Holdings Limited reported an Earnings Per Share of $0.71 for its half year ended 30th June, 2020, down 33.0% from $1.06 in the prior comparable period.

Net Income from Insurance Underwriting Activities grew to $551.0M in HY 2020 (up 94.4%) from a previous $283.4M. Net Income from Investing Activities was down 53.0% YoY (HY20: $315.6M, HY19 $671.0M). Net Income from Brokerage Activities improved 21.4% in HY 2020, moving to $72.7M from a prior $59.9M. Collectively, Net Income from all Activities fell 7.4% in the period. Net Impairment Gains/Losses on Financial Assets shifted from a Gain of $2.8M in HY 2019 to a loss of $24.2M in HY 2020. Operating Expenses rose 1.5% in the period, while Finance Charges were relatively unchanged. Operating Profit was $222.4M, 33.2% lower ($334.4M) than prior year. Share of Profit of Associated Companies was marginally higher ending the period at $10.7M. Profit Before Taxation fell 32.1% YoY moving from $345.0M to $234.2M. Taxation Expense was down 11.8% settling at $80.6M. Overall, Profit After Taxation fell 39.5% YoY from $253.6M to $153.6M, as declines in Income from Investing Activities and Impairment Losses weighed on performance. Profit Attributable to Equity Holders of the Parent declined 33.3% YoY.

Insurance Income Improves, Net Income Falls

Following stellar growth in HY2019, Net Income from Investing Activities fell as financial markets regionally and globally contracted amid the onslaught of the COVID-19 pandemic. Although markets recovered in the second quarter of 2020, income from the segment fell 53.0% YoY.

GHL was able to partially offset the impact of this decline through a 94.4% increase (↑ $267.6M) in Net Income from Insurance Activities. While such performance is usually attributable to inorganic growth, GHL stated that the performance of its insurance segment came as a result of improvement in its Life, Health and Pension Business segment which recorded a $203M YoY increase in income.

In the coming periods, NCBFG’s Jamaican insurance portfolio and annuities business is expected to be streamlined into Guardian Life Limited (GLL), a component of GHL’s Life, Health and Pension Business segment. This completion of this transaction could bolster the profitability of GHL’s Insurance Underwriting segment.

The Bourse View

GHL is currently priced at $19.34, having depreciated 10.7% year to date. The stock currently trades at a price to earnings ratio of 7.4 times, relative to a sector of 13.1 times and offers investors a trailing dividend yield of 2.6% (1.9% sector average). Roughly 55% of GHL’s revenue stems from Trinidad and Tobago with a further 43% coming from Jamaica and Dutch Caribbean. Forecast contractions in regional economies are likely to weigh on the performance of GHL. On the basis of relatively attractive valuations, but tempered by dividend uncertainty amid the entity’s decision to not pay an interim dividend for FY 2020 and ongoing adverse economic conditions, Bourse maintains a NEUTRAL rating on GHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”