BOURSE SECURITIES LIMITED

13th March, 2017

FCI Lower, SBTT & SIJL Improve

This week, we at Bourse review the performance of FirstCaribbean International Bank (FCI), Scotiabank Trinidad and Tobago Limited (SBTT) and Scotia Investments Jamaica Limited (SIJL) for the quarter ended January 2017. FCI experienced a dip in Net Interest Income among other declines. SBTT benefitted from higher Net Interest Income, which positively impacted its Earnings per Share. SIJL continued its diversification strategy, as it aims to become less reliant on Net Interest Income. We take a closer look at the performances as well as provide a brief outlook.

FirstCaribbean International Bank (FCI)

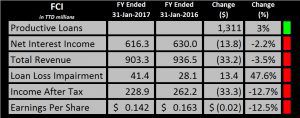

FCI reported Earnings per Share of TT$ 0.142 for the quarter ended January 2017, down 12.5% (TT$ 0.02) from TT$ 0.163 earned in 2016.

FCI’s Interest Income fell while Interest Expense increased. The combined effect was a decline in Net Interest Income of TT$ 13.8M. Operating Income also took a hit, leading to a fall in Total Revenue by TT$ 33.2M. FCI incurred a higher Loan Loss Expense of TT$ 13.3M. Consequently, Profit Before Tax fell by TT$ 57.2M. The bank was faced with a lower effective tax rate of 4%, down from 11% in 2016. As a result, Profit After Tax experienced a shortfall of TT$ 33.4M.

Outlook

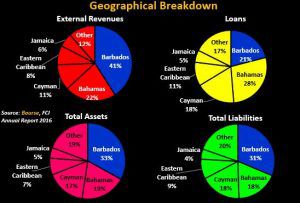

In 2016, 41% of external revenues was generated in Barbados. At the end of 2016, loans in Barbados accounted for 21% of the overall loan book.

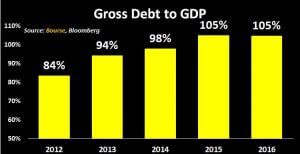

On 3rd March 2017, international ratings agency, Standard and Poor’s (S&P), downgraded the credit rating on Barbados from B- to CCC+ (Junk), with a negative outlook. This reflects a decline in the country’s capacity to service its debt obligations, which in turn will result in higher borrowing costs. The downgrade was due to increased reliance on Central Bank financing of high government deficit and falling international reserves. The rating agency expects debt to GDP to continue rising to levels as high as 111% over the next three years, up from its 2016 level of 101%. S&P noted that this level of debt is “a key credit weakness, particularly given Barbados’s narrow, open economy”.

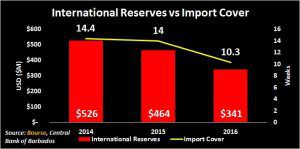

The policy of monetary authorities to maintain its currency pegged to the US dollar (at 2BB$ / 1US$) has plunged international reserves down to US$ 341M in 2016, from US$ 464M in 2015, falling 26.5% (lowest level since 2009). Consequently, import cover fell to 10.3 weeks in 2016, down from 14 weeks in 2015. Against this backdrop, S&P did not rule out a possible devaluation of the Barbados dollar.

The Bourse View

At a current price of $9.12, FCI trades at a trailing P/E of 15.6 times, above the Banking sector average of 14.5 times. The stock offers investors a trailing dividend yield of 3.7%, in line with the sector average of 3.8%. FCI rallied 69.6% in 2016 and is already up 6.5% Year-to-Date. In the event of adjustments to the Barbados dollar, FCI’s revenue will be negatively impacted. As a result, Bourse revised its rating on FCI from BUY to NEUTRAL.

Scotiabank Trinidad and Tobago Limited (SBTT)

SBTT reported Earnings per Share (EPS) of $0.96 for first quarter earnings ended 31st January 2017. This represents an improvement of $0.08 or 8.42% when compared to its EPS of $0.89 reported in the first quarter of 2016. Net Interest Income, which accounted for 69% of its total revenue, jumped 14.73% or $39.38 M, from $267.46 M to $306.85 M. Other Income posted an increase of $12.14 M, a 9.66% improvement over the corresponding period in 2016. Consequently, total revenue jumped 13.1% ($51.53 M), from $393.22 M to $444.75 M. SBTT was able to control its Non-interest Expenses, which recorded a small increase of $1.31 M compared to the corresponding period in 2016. There was an improvement in Income before Taxation and Loan Loss of 22.64% or $50.21 M. SBTT was hit by an increase in Loan Loss expense of $20.54 M or 270.84%, rising from $7.58 M in the first quarter 2016 to $28.13 M a year later. Despite being faced with a higher tax rate of 30% (compared with 27% in 2016) Income after Taxation improved by $13.33M, an increase of 8.4% from a year ago.

Outlook

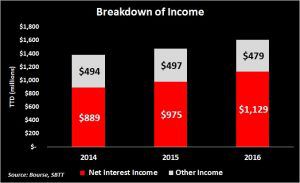

Over the last three years, SBTT has had a steady increase in its Net Interest Income, rising by 27% or $240.16 M. In the first quarter of 2017, the positive change in Net Interest Income was $39.4 M. This was attributed mostly to improvements in the company’s retail loan portfolio and investment securities which advanced by $467.1 M and $60.64 M respectively. Other Income has remained steady over the course of three years. Furthermore, due to the company’s ability to control its non-operating expenses, its productivity ratio has improved to 38.8% during the first quarter, which compared favorably to the 43.6% reported in the prior period. Notably, the company’s efficiency ratio has been better than its local competitors; First Citizens Bank Limited (FIRST) and Republic Financial Holdings Limited (RFHL).

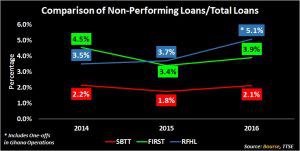

In terms of non-performing loans as a percentage of gross loans, SBTT recorded a ratio of 2.1%, a marginal increase from 1.8% reported a year earlier but still better than its domestic competitors.

The Bourse View

Despite the slowdown in economic activity, SBTT has been able to increase its EPS by $0.08. To this end, it is likely that its FY EPS could come in somewhere between $3.65 and $3.70. At a current price of $58.75, this would represent a forward P/E of around 16 times.

On 7th March 2017, SBTT declared an interim dividend of $0.50, payable on 13th April 2017. This payment represents an increase of 25% when compared to $0.40 paid in 2016. Its trailing dividend yield currently stands at 3.57%, which is marginally lower than the Banking sector average of 3.82%. SBTT trades at a trailing P/E of 16.23 times, above its sector average of 14.36 times This however is marginally below its three-year average of 18.1 times. Despite some positive developments, the company’s ability to generate further loans will be challenging given the contraction in the local economy, which is likely to persist in the near future. In light of market conditions and fair valuations, Bourse maintains a NEUTRAL on SBTT.

Scotia Investments Jamaica Limited (SIJL)

SIJL generated Earnings per Share of TT$ 0.019 for the quarter ended January 2017, an improvement of 25% (TT$ 0.004) when compared to the TT$ 0.015 earned a year ago.

SIJL’s Net Interest Income moved from TT$ 19.2M to TT$ 18.6M, falling TT$ 0.6M (3.45%). The improvement in Gains on Financial Assets of TT$ 2.9M (210%) had the biggest impact on the increase in Total Income. Other key highlights include an increase in Fee and Commission Income of TT$ 0.65M and a loss from Foreign Exchange Trading Income of TT$ 0.4M. Total Operating Income increased by TT$ 1.4M (3.6%).

Operating Expenses fell by TT$ 0.74M (2.7%). Consequently, Profit Before Tax climbed from TT$ 11.1M to TT$ 13.3M, an improvement of TT$ 2.2M (19.3%). SIJL was faced with a lower effective tax rate of 41% (from 44%), thereby leading to Profit After Taxes of TT$ 7.9M, up TT$ 1.7M (27%).

Outlook

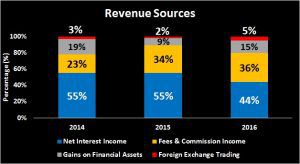

SIJL has been on a continuous drive to diversify its revenue streams away from Net Interest Income, with more focus on Fees and Commission Income. In 2014 and 2015, Net Interest Income accounted for 55% of total revenue, whereas it accounted for 44% in 2016. On the other hand, Fees and Commission Income moved from 23% of total revenue in 2014, to 34% in 2015 and stood at 36% in 2016. For the quarter ended January 2017, Fee and Commission Income accounted for 43% of total revenue.

The Group’s strategy can also be seen in the growth in total funds under management, whereby in 2014, this amounted to JMD $158 billion. By 2015, this grew to JMD$ 162 billion and stood at JMD$ 176 billion in 2016, up 8.6% Year-on-Year (Y-O-Y). Concurrently, asset management fees followed a similar trend, improving 18% and 13% in 2015 and 2016 respectively.

Looking ahead, SIJL will need to continue growing its funds under management in order to benefit from higher fee and commission income, as it strives to diversify its revenue source. The Group managed to reduce operating expenses by 2.7% Y-O-Y. Expense management will also be important in order to maintain or increase efficiency.

The Bourse View

SIJL declared an interim dividend of TT$ 0.02, payable on 19th April 2017. At a current price of $2.19, the stock offers investors a trailing dividend yield of 4.35%, above the Non-Banking Finance sector average of 3.1%. Although dividends are declared in JMD, it is paid in USD, thus providing investors with the opportunity to invest TTD, and earn USD through its dividend payments.

The current price of $2.19 results in a trailing P/E of 12.7 times, above its sector average of 10.7 times (excluding N.E.L.). This is also above SIJL’s 3-year average P/E of 9.4 times. On the basis of SIJL’s stable earnings and attractive dividend yield, but relatively high P/E multiple, Bourse maintains a NEUTRAL rating.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”