HIGHLIGHTS

Local Markets

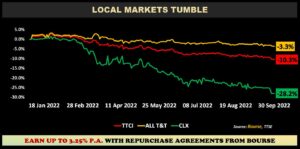

- 9M 2022 Performance:

- TTCI ↓ 10.3%

- All T&T ↓ 3.3%

- CLX ↓ 28.2%

- Performance Drivers:

- Inflationary Pressures

- Volatile Financial Markets

- Outlook:

- Economic Normalization

International Markets

- 9M 2022 Performance:

- US Markets – S&P 500 ↓ 24.8 %

- European Markets- Euro Stoxx 50 ↓ 33.5%

- Asian Markets – MXASJ ↓ 28.1%

- Latin American Markets – MSCI EM ↓ 3.5%

- Performance Drivers:

- Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Economic Normalization

This week, we at Bourse recap the performance of local and international stock markets as at the end of the 3rd quarter of 2022 (9M 2022). Equity markets continue to face considerable uncertainty, as central banks around the world attempt to control persistent inflation at the risk of sparking recessionary conditions. Could investor sentiment reverse heading into the final quarter of 2022, or will policymaker-induced uncertainty keep markets on edge? We discuss below.

Local Markets Down

The Cross Listed Index (CLX), comprising some of the largest publicly-listed regional companies, led losses among the three major indices, slipping 28.2%, as movements of index heavyweight NCBFG (â 43.8%) and its subsidiary GHL (â 15.0%) dragged market performance down.

The All Trinidad and Tobago Index (All T&T), while faring better, declined 3.3% for 9M2022. Resultantly, the Trinidad and Tobago Composite Index (TTCI) fell 10.3% to close at 1,343.16. MASSY Holdings Limited (MASSY) and First Caribbean International Bank Limited (FCI) were the volume leaders on the First Tier Market for 9M2022, with 10.2M and 8.6M shares being traded respectively.

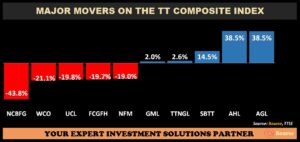

Major Movers

Agostini’s Limited (AGL) and Angostura Holdings Limited (AHL) both advanced 38.5% respectively in 9M2022. AGL was boosted by the positive earnings impact of acquisition activity, while AHL was supported by improving earnings from higher domestic and international demand. Canadian majority-owned Banking giant, Scotiabank Trinidad and Tobago Limited (SBTT), was up 14.5% for 9M2022. Trinidad and Tobago NGL Limited (TTNGL) expanded 2.6% in 9M2022, on account of improved earnings due to robust energy markets and increased profitability from its solitary investee company Phoenix Park Gas Processors Limited (PPGPL). Guardian Media Limited (GML) increased 2.0% for the period under review.

Major decliners for 9M2022 included NCB Financial Group Limited (NCBFG â 43.8%), West Indian Tobacco Company Limited (WCO, â 21.1%), Unilever Caribbean Limited (UCL â 19.8%), First Citizens Group Financial Holdings (FCGFH â 19.7%) and National Flour Mills Limited (NFMâ 19.0%).

US Markets Lower

The S&P 500 posted its third straight quarter of losses for the first time since 2009, down 24.8% in 9M 2022. The sell-off in U.S equities has been precipitated by the increasingly clouded macro picture, as inflation proves to be ‘stickier’ than anticipated. This was further exacerbated by the Federal Open Market Committee’s (FOMC) hawkish stance, with Fed Chair Jerome Powell highlighting that the Fed’s mission can’t be accomplished without catalyzing a recession even after five consecutive rate hikes.

The Energy Select Sector SPDR Fund (XLE) continues to be the sole sector Exchange Traded Fund (ETF) in positive territory for US markets, up 29.8% as energy prices remain robust. On the contrary, the communications sector, represented by the Communication Services Select Sector SPDR Fund (XLC), was the worst performing sector during 9M 2022, down 38.3%.

International Markets Stumble

European markets, as gauged by the Euro Stoxx 50, fell 33.5% in 9M2022 as geopolitical tensions continue to unsettle the region and keep fuel prices elevated. Inflation continues to plague consumers, with central banks attempting to subdue price increases with aggressive rate hikes. England was the region’s least-worst performing market, down 23.0% as uncertainty around the outlook for UK retail energy prices lingers despite the Government’s announcements of support measures including an Energy Price Guarantee. Germany and Italy were among the worst performing markets in the region, declining 35.3% and 34.9% respectively following a squeeze on energy supplies.

Asian Markets are careening towards their worst performance since the Covid-19 Pandemic began, impacted by a stronger U.S dollar and rising global recession fears.

South Korea equities led losses among the region, declining 40.2% in 9M 2022, as the country’s currency (Korean Won) fell to a 13-1/2-year low. Taiwan equities slumped 32.5%, driven by concerns about the Federal Reserve’s aggressive rate hikes and recession fears leading regulators to tighten rules on short selling as a way to stabilize market sentiment. Asian equity markets (excluding Japan) declined 28.1% in 9M2022.

China’s market was down 25.8% for 9M2022, relative to a gain of 4.0% in 9M2021, weakening on the back of rolling Covid-19 lockdowns and the property sector slump. Hong Kong markets declined 26.9% in 9M2022.

India equities remained relatively more resilient, falling 9.9% in 9M2022, compared to a 22.0% gain in the prior period. While unable to offset negative global sentiment, India’s stock market decline has been cushioned to an extent by its growth and earnings outperformance.

Latin American markets declined a relatively minor 3.5% in 9M2022, following a drop of 9.1% in 9M2021. Brazil was the best performing market, rebounding 8.0% during the period. Brazilian elections and the upcoming presidential runoff between Jair Bolsonaro and Luiz Inacio Lula da Silva to be held on October 30th 2022 could move markets in the final quarter. Chile advanced 4.7% as world’s largest red metal producer benefitted from increased commodity prices, while wrestling with a volatile peso and runaway inflation. Colombia rounded out 9M2022 as the worst performing Latin American market, down 29.4% as inflation continued to trend upwards and sentiment towards its new President Gustavo Petro declined amid his ambitious social agenda.

Investment Outlook

Domestic companies continue to face the challenge of accelerating price pressures, with varying degrees of ability to pass on higher input costs (transportation, raw materials etc.) to consumers. According to the Central Bank’s Monetary Policy Announcement, headline inflation rose to 5.9% in July 2022 from 4.9% in June 2022. This phenomenon may be compounded by the effects of fiscal measures announced in the FY2023 budget, which are likely to weaken consumption and disposable income. While some companies may fare better than others, the overarching outlook for companies heading into the final quarter is one where preserving operating margins (and by extension profitability) could be challenged.

International Markets are expected to remain volatile, as central banks including the US Federal Reserve signalled that they will stay the course in rising interest rates, reducing support for economic growth in an effort to tame inflation.

While the FOMC delivered its third consecutive 75-basis-point rate hike in September, the Fed’s updated economic projections and insistence that price stabilization (and not growth) was its priority, cast further doubts on the outlook for U.S markets. The Fed now expects below-trend economic growth over the next few years, a significant rise in the unemployment rate, and inflation to stay notably above its 2% target until at least 2024.

In Europe, the outlook remains gloomy as energy shocks amplify the erosion of household discretionary income, increasing the possibility of a sharp decline in economic activity. The World Bank improved its forecast for Europe and Central Asia, expecting a contraction of 0.2% in 2022 (previous -2.9%) and growth of 0.3% in 2023 due to better-than-expected resilience and growth in some of the region’s largest economies.

The World Bank on Thursday 6th October, slashed its growth forecast for India to 6.5% year-on-year for 2022/23, from an earlier estimate of 7.5%, warning that spill-overs from the Russia-Ukraine war and global monetary tightening will weigh on the economic outlook.

China’s economic growth projection was lowered by the World Bank to 2.8% compared with its previous forecast of 5.0% in April 2022, as the economy struggles with a real-estate crunch and zero-tolerance approach to COVID-19.

Equity Investor Considerations

With heightened uncertainty on recession fears, high inflation and rising interest rates, investors may want err on the side of caution. For the Conservative or Low Risk Investor, opting for safety may be the most prudent approach in the current volatile markets, by reallocating portfolios to lower risk securities and settling for a lower return on investments. This includes moving to cash or near-cash holdings such as income mutual funds, repurchase agreements where their investment capital is secured.

Investors with moderate risk tolerance can consider highly diversified and resilient sector or country ETFs as a way to quickly diversify their investment portfolios. A selective approach to individual stocks may also be preferred, focusing on companies with (i) resilient profitability, (ii) demonstrable competitive advantages and/or market share and (iii) healthy free cash flow.

Investors with a higher risk tolerance may look past current market conditions with a longer-term investment horizon, viewing this as a compelling buying opportunity. This investor could consider adding more aggressive growth mutual funds and ETFs, willing to take on more risk in order to potentially earn higher returns in the long-run. It should be noted that this approach does not eliminate/mitigate the risks pervading financial markets, but instead positions a portfolio to benefit from the recovery of some/all of its holdings over time. As always, it makes good sense to consult with an expert investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”