HIGHLIGHTS

FY2023 Projections

- Revenue: TT$56.2B

- Expenditure: TT$57.7B

- Fiscal Deficit: TT$1.5B

- Real GDP Growth: 3.0

Notable Fiscal Measures

- Investor Specific

-

- Enhanced SME Listing Incentives

- Will TTMB go Public?

- Wider Economic

-

- Fuel Subsidy Reduction

- Property Tax Implementation

- Personal Income Tax Allowance Increase

- Energy Sector Recovery?

This week, we at Bourse provide an overview of the FY2023 Budget, with announced fiscal measures likely to make an impact on consumers and investors alike. As we enter into the new fiscal period with forecast economic growth, what could be the themes and/or announcements that drive investor opportunities? We discuss below.

Revenue, Expenditure Forecasts Soar

FY2023 Total Revenue is projected at $56.2B, 8.9% higher than $51.6B estimated in FY2022. Forecast Revenue is expected to increase as a result of (i) windfall profits derived from robust global energy commodity prices and (ii) a modest recovery in domestic energy production. Budgeted Revenue for FY2023 was predicated on an oil price assumption of US$92.50/barrel and natural gas price of US$6.00/MMBtu. Oil Revenue is estimated at $25.0B, while Non-Oil Revenue is projected to be $30.2B.

FY2023 estimated Total Expenditure is $57.7B, up 6.7% from FY2022’s revised estimate ($54.1B), resulting in a projected FY2023 Fiscal Deficit of $1.5B. Despite the measures taken to reduce or reallocate expenditure in this Budget, projected Total Expenditure if realized would be T&T’s 3rd highest spend during a fiscal year. Considering less predictable revenues, given global developments and volatile energy markets, more meaningful downward adjustments to Expenditure may be required to achieve balanced/surplus budgets in the future.

More Positive Growth in 2023?

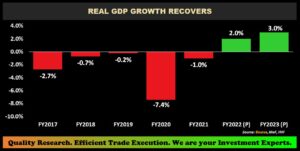

The MoF estimates Real Gross Domestic Product (GDP) growth in FY2022 of 2.0%. The energy sector is expected to grow by 5.0%, while the non-energy sector is expected to contribute 2.0%. This positive trend is projected to continue in FY2023 & FY2024, with Real GDP growth estimates of 3.0% in each year. Real GDP is projected to improve from $150B in FY2020 to $153B in 2022. It is important to note that T&T’s GDP relies heavily on the energy sector, which contributed approximately 50% of GDP in FY2022. Though the energy sector has improved, hints of a global recession and economic tensions could adversely influence this traditionally cyclical market.

Debt Metrics Improve?

Debt:GDP, as measured by the recently implemented Adjusted General Government Debt to GDP ratio, peaked at 81% during the onset of the COVID-19 pandemic in FY2020. The MoF estimates Debt:GDP in FY2022 will be 70%, a welcome moderation in the level of a key indicator of sovereign creditworthiness. The decline in the FY2022 ratio has been more a function of a sharp recovery in Nominal GDP levels (FY2022 estimate: TT$190 billion), as opposed to a reduction in the total outstanding amount of Adjusted General Government Debt (FY2022: TT$129.8 billion). Adjusted General Government Debt comprises Central Government Domestic Debt, Central Government External Debt and Non-Self Serviced Government Guaranteed Debt. The measure excludes Self-Serviced Government Guaranteed Debt; debt serviced directly by various State Enterprises and Statutory Authorities and not by the GORTT.

Fiscal Measures: A ‘Give and Take’

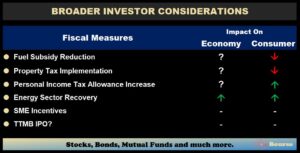

The general reaction to the fiscal measures coming out of the FY2023 national budget appears to be mixed, with some concerns on how consumers and consumption activity will adjust in the year ahead.

Notable measures intended to directly benefit consumers include (i) an increase in the Personal Income Tax Allowance and (ii) a one-time transport grant of $1000 in 2023 to all recipients of social grants.

The proposed increase in personal income tax allowance would result in all individuals earning up to $7,500 per month or greater enjoying an additional $500 monthly income tax shield. This would work out to an extra $125/month in disposable income. The transport grant of $1,000 would be available to all recipients of social grants (public assistance, disability, food support and senior citizens pensions) and works out to just over $83/month in additional income. It should be noted that the transport grant facility is temporary, remaining in place only if the price of oil remains elevated.

At the same time, other announced initiatives/measures could directly reduce disposable income available to consumers. These include a (i) reduction to the fuel subsidy (higher fuel prices at the pump), (ii) the implementation of property tax and (iii) reductions in the air-bridge/ferry service subsidy.

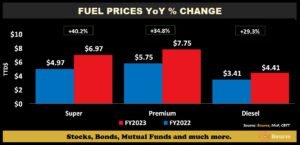

The Honourable Minister of Finance announced increases to the prices of super and premium gasoline prices rising by $1/L. Cognizant of the impact on general freight and consumer transport prices, Diesel prices were raised by $0.50/L, as it accounts for 40.0% of total fuel consumption in T&T. These latest increases bring the year-on-year changes in super, premium and diesel prices to $2/L (40.2%), $2/L (34.8%) and $1/L (29.3%) respectively.

As an example, an individual driving from Chaguanas or Arima to the Port of Spain (POS) Ferry terminal typically covers 60km roundtrip on a daily basis. On a monthly basis, then, individuals (working in POS) would traverse about 1,200km getting to and from Chaguanas/Arima to POS. An individual driving a super gasoline-fuelled vehicle with an average fuel consumption of 27 miles per gallon (10.5litres/100km) would now be spending an estimated additional $252 (10.5L x $2 x [1200/100]) on fuel than a year ago.

The Government of Trinidad and Tobago expects to commence the collection of property taxes in FY2023, following several years of development. Having surpassed the minimum valuation threshold of 200,000 valuations, Residential properties will be the first class of properties subject to the ‘new’ tax, followed by commercial, industrial, and agricultural properties. While this represents an additional revenue stream for the state, it would also result in an additional tax obligation for the population.

To a lesser extent, the reduction in subsidy to inter-island travel by sea/air also reduces disposable income to consumers. Travel via the airbridge will be increased by TT$50 (One-Way) from the current price of TT$150. Inter-island sea bridge fares will also be increased between $25 to $50 one-way.

Investor- Specific Initiatives

Following the successful Additional Public Offering (APO) of First Citizens Group Financial Holdings (FCGFH), investors may be left wanting for more capital market opportunities in FY2023.

The Trinidad & Tobago Mortgage Bank (TTMB), a newly-created entity formed from the merger between the Trinidad & Tobago Mortgage Finance Company (TTMF) and the Home Mortgage Bank (HMB), is now expected to commence operations early 2023.

While intentions of an Initial Public Offering (IPO) of the TTMB were previously announced in the FY2022 budget statement, no mention of IPO timing was made in FY2023. Estimates of the value of shares held by GORTT in the newly-formed TTMB are in the range of TT$600-700M. Regional rating agency CariCRIS reaffirmed its corporate credit rating for HMB (CariA- on September 22nd 2022) and downgraded the credit rating of the TTMF (from CariAA- to CariA+ on October 5th 2021) on account of deteriorating asset quality metrics.

Increased SME Incentives

A full tax holiday extension for newly-listed Small and Medium Enterprises (SME) listing on the Trinidad and Tobago Stock Exchange (TTSE) from 5 to 6 years was announced. These tax concessions would apply to Corporation tax, Business levy and Green Fund levy, with the intention of assisting SME growth while also facilitating development of local capital markets.

Despite the attractive incentive packages, the last SME listing would have taken place in 2019. Currently, just 2 listings exist on the SME sector of the TTSE; CinemaOne Limited (CINE1) and Endeavour Holdings Limited (EHL) with a combined current market capitalization of $268M.

The Bourse View

At a macro level, near-record national Revenue and Expenditure should bode well for economic activity in T&T’s upcoming fiscal year. While Expenditure has proven to be fairly ‘sticky’ in nature, however, Revenue has been the historically more volatile component of the budget equation. Meeting these lofty Revenue targets will be highly reliant on very favourable conditions in the Energy sector, including: (i) projected domestic energy production recovery and (ii) resilient energy commodity prices in an environment fraught with uncertainty. Non-Energy sector Revenue, while less volatile, may be tested by more cautious consumers.

At a more granular level, the proposed fiscal measures and other initiatives – when combined with prevailing inflationary pressures and the swirling global recessionary conditions – could result in a weaker consumer in the year ahead. The ‘give’ measures of increased personal income tax allowances and fuel grants are highly likely to be more-than-offset by ‘take’ initiatives such as property taxes and fuel subsidy reductions.

Though consumers and investors will approach FY2023 with perhaps a degree of cautious optimism, the downside risks remain palpably evident.

For more insight and perspective into (i) how the FY2023 budget could impact investors and consumers and (ii) how investors may want to navigate the current financial markets, join us for our free Bourse Investor Webinar on Thursday October 6th 2022. Email info@boursefinancial.com to register.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”