BOURSE SECURITIES LIMITED

11th November, 2019

WCO, AHL Advance

This week, we at Bourse review the performance of two companies within the Manufacturing Sector –West Indian Tobacco Company Limited(WCO) and Angostura Holdings Limited (AHL) – for the nine-month(9M) period ended 30th September, 2019. Both WCO and AHL’s performances benefitted from modest revenue growth, combined with measurable cost management. We discuss the performance of both companies and provide an outlook.

West Indian Tobacco Company (WCO)

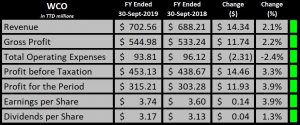

The West Indian Tobacco Company Limited (WCO) reported Earnings per Share (EPS) of $3.74 at the end of third quarter 2019, a 3.9% increase compared to the $3.60 EPS reported a year earlier.

WCO generated Revenue of $702.56M in 9M, a 2.1% or $14.34M increase over 9M 2018. Gross Profit grew 2.2% to $544.98M from $533.24M in 9M 2018. Operating expenses fell from $96.12M in 9M 2018 to $93.81M in 9M 2019, a 2.4% year-on-year (YoY) decrease. Profit Before Tax (PBT) climbed 3.3% or $14.46M YoY to $453.13M. Overall, WCO’s Profit for the Period closed at $315.21M, a $11.3M or 3.9% improvement YoY.

Outlook

At the end of 9M 2019 WCO was able to report top line growth of 2.1%, despite facing conditions which see an increasing number of substitute products coming into the tobacco market. In addition to the growing trend of ‘vaping’, which has been touted as a ‘healthy’ substitute to smoking cigarettes, WCO has also faced challenges from illicit cigarette trade activities. Nevertheless, the company has been able to report two consecutive periods of revenue growth driven by WCO’s brand relevance, which has been maintained through consistent quality.

WCO has maintained its operational efficiency through cost management, delivering fairly stable Gross Profit, Operating and Profit After Tax margins from 2017 to 2019. Gross Profit Margin has hovered between 75.8% (9M 2017) and 77.6% (9M 2019), while Operating Profit Margin has been similarly consistent between 63.3% to 65.2%. Net Profit Margins have inched up, from 43.9% (9M 2017) to 44.9% in the 9M 2019 period. WCO’s pending 3-for-1 stock split, approved in October 2018, remains delayed by Licensing issues for current Foreign Investors to hold additional shares in the company. The split is intended to reduce the price and improve liquidity of the stock, increasing WCO’s outstanding shares to 252.72M from 84.24M.

The Bourse View

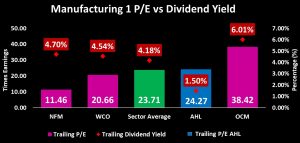

WITCO trades at a current price of $102.29 with a trailing P/E of 20.66 times, lower than the Manufacturing 1 Sector average of 23.71 times (excluding GML) and in line with its 5-year average P/E of 20.55. The dividend yield is 4.54%, above the sector average of 4.18%. Based on an attractive dividend yield but tempered by challenging operating conditions, Bourse maintains a NEUTRAL rating on WITCO.

Angostura Holdings Limited (AHL)

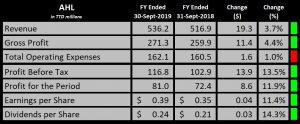

AHL reported Earnings per Share (EPS) of $0.39 for the nine-month (9M) period ended 30th September 2019, a 11.4% improvement over 9M 2018. Revenue rose 3.7% to $536.2M from $516.9M in 9M 2018. Gross Profits advanced 4.4%, moving from $259.9M in 9M 2018 to $271.3M in 9M 2019. Operating Expenses were contained to $162.1M or a 1% increase YoY. Profit before Tax climbed 13.5% YoY to $116.8M, with Profit for the Period improving 11.9% YoY ($8.6M), moving to $81.0M from $72.4M.

Outlook

AHL experienced a 13.5% YoY increase ($13.9M) in Profit Before Taxes, primarily driven by revenue growth. AHL reported improvements to the export of ‘Bitters’ as well as regional growth through the brand’s involvement with the Caribbean Premier League T20 league tournament. With the Christmas and Carnival Seasons fast approaching AHL may stand to benefits from increased seasonal demand of its products.

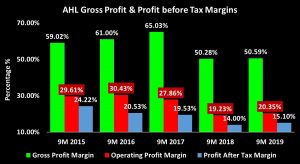

In 9M 2019 AHL generated a Net Profit Margin of 15.1%, exceeding the 14.0% achieved in 9M 2018. The strengthening Net Profit Margin reflects improved cost management by the company.

The Gross Profit Margin recorded at end of 9M 2019 of 50.59% was fairly stable relative to 2018 levels, while Operating Profit Margin increased from 19.23% in 9M 2018 to 20.35% in 9M 2019. The growth in Operational Profit Margin and Profit After Tax Margin, demonstrates cost containment by AHL, as the company has been able to cut Selling and Distribution Costs to offset increases Administrative Expenses.

The Bourse View

At a current price of $16.02, AHL trades at a trailing P/E of 24.27 times, above the Manufacturing Sector average of 23.71 times (excluding Guardian Media Limited). The stock offers a trailing dividend yield of 1.50%, below the sector average of 4.18% (excluding GML). On the basis of improving earnings, but tempered relatively high valuations and low dividend yield, Bourse maintains a NEUTRAL rating on AHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”