BOURSE SECURITIES LIMITED

27th March, 2017

AMCL Impacted by One-Offs, AMBL Flat

This week, we at Bourse review the performances of ANSA McAL Limited (AMCL) and one of its subsidiaries, ANSA Merchant Bank Limited (AMBL) for the year ended December 2016.AMCL incurred two significant one-off events which negatively impacted Earnings per Share, while AMBL’s profits marginally improved. We take a closer look at the performances and provide a brief outlook.

ANSA McAL Limited (AMCL)

AMCL reported Earnings per Share of $4.01 for the year ended December 2016, a decrease of 9.9% from $4.45 recorded in the previous year. During the year, the Group incurred two one-off events, a fire at Carib Glass Limited and an increase in corporate taxation. This resulted in a reduction in Profit After Tax of $76M. Without these two one-offs, the Group would have generated Earnings per Share of approximately $4.45.

AMCL’s revenue amounted to $6.0B, a reduction of 3.4% year-on-year (Y-O-Y). Operating Profit also declined by 5.7% or $67.8M. Despite the shortfall in Operating Profit, the Group maintained its operating margin at 19%. Profit Before Tax moved from $1.16B to $1.10B. As stated earlier, the Group incurred higher corporate taxation, which resulted in an increase in the effective tax rate of 27% in 2016 (from 23% in 2015). Profit After Tax decreased by $88.2M or 9.9%.

Outlook

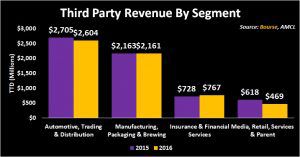

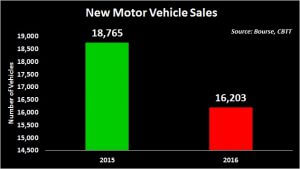

In 2016, the Group’s revenue from its Automotive, Trading and Distribution segment, which accounts for 43% of total revenue, declined by 3.7%. With respect to Automotive, the fall in new car sales from 2015 to 2016 of 2,562 vehicles (13.7%) would have weighed on revenue. Looking ahead, it is unlikely that this trend will be reversed, given the persistent economic downturn coupled with foreign exchange pressures. New car sales totalled 1,993 vehicles in January and February 2017, 22% lower when compared to the same period in 2016.

The Manufacturing, Brewing and Packaging segment accounted for 36% of revenues in 2016. Despite the fire at Carib Glass Limited, revenue in this segment remained relatively flat. During the year, the Group made two acquisitions, Easi Industrial Supplies Limited (T&T) and Indian River Beverage Corporation (USA). The Group expects both acquisitions to generate US dollar earnings, which would boost overall revenue within the segment and provide a hedge against further depreciation of the TT dollar.

Revenue from the Insurance and Financial services segment grew by 5.3% in 2016. This segment would have benefitted from the strong performance of Ansa Merchant Bank Limited (AMBL), which experienced an increase in Total Operating Income of 12.9%.

A fall in revenue of 21.7% in Guardian Media Limited (GML) would have negatively impacted the Media, Retail, Services and Parent segment. Revenue in this segment deteriorated by 24.1%. Looking ahead, it is likely that this segment will continue to struggle in the current economic environment.

The Bourse View

The Group declared a final dividend of $1.20, payable on 8th June 2017. This brings total dividends in FY2016 to $1.50, up from $1.40 in FY2015.

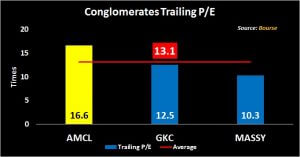

At a current price of $66.43, AMCL’s reported EPS of $4.01 results in a trailing P/E of 16.6 times. This is above its 3-year average of 16.1 times. The stock’s P/E is also above the Conglomerate sector average of 13.1 times. AMCL’s trailing dividend yield stands at 2.3%, below its sector average of 2.8%.

On the basis of increased potential for revenue growth, but tempered by a pessimistic economic environment and a relatively high valuation, Bourse maintains a NEUTRAL rating on AMCL.

Ansa Merchant Bank Limited (AMBL)

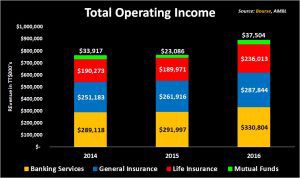

Ansa Merchant Bank Limited (AMBL) generated Earnings per Share of $2.94 for the year ended December 2016, an improvement of 1.7% from the previous year. Total Operating Income increased by $92.7 million, driven by growth across all segments including Insurance Revenue and Loan Fees. Approximately 50% of the growth in revenue was a result of a $46 million improvement in foreign exchange trading and gains. AMBL incurred higher Insurance Claims and Interest Expenses of $18.7M and $16.5M respectively. Net Operating Income climbed by $40.2M. Other key highlights include higher personnel expenses, which was driven by an increase in salaries and bonus expense of $13.9M. Profit Before Tax stood at $322.M. In 2015, AMBL benefited from a reduction in deferred taxes of $18M, which was not repeated in 2016. This resulted in a higher effective tax rate of 22% in 2016, from 17% in 2015. Profit After Tax moved from $247.4M to $251.7M.

Outlook

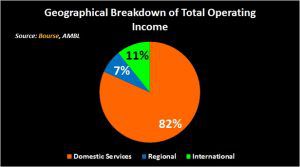

After a relatively flat performance in 2015 the Banking Services Segment experienced a 16% increase in Operating Income in 2016. This segment accounted for the majority of Operating Income (37%) in 2016. The improvement in Operating Income can be attributed to foreign currency trading and gains as the local currency depreciated last year. Any further deterioration in the local currency will continue to benefit this segment as 11% of Total Operating Income is generated in the International Market. Furthermore over 70% of AMBL’s financial assets are denominated in US dollars.

Operating Income for the Life and General Insurance services segments improved in 2016 after a flat 2015 performance. Continued slowdown in the local economy could impact these segments as the purchasing power of consumers weaken.

The Bourse View

At a current price of $40.00, AMBL trades at a trailing P/E of 13.6 times, above the Non-Banking Finance sector average of 10.8 times (excluding N.E.L) and is also the highest among its peers. The stock offers investors a trailing dividend yield of 3.0%, in line with the average trailing dividend yield of 3.2% in its sector. On the basis of a fair valuation, but tempered by weak economic fundamentals in its main market, Bourse maintains a NEUTRAL rating on AMBL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”