BOURSE SECURITIES LIMITED

20th March, 2017

NGL Share of Profits Up, GHL Advances

This week, we at Bourse take a closer look at the performances of Trinidad and Tobago NGL Limited (TTNGL) and Guardian Holdings Limited (GHL) for the year ended December 2016. While exports of Natural Gas Liquids (NGLs) remain low, energy commodity prices have steadily improved throughout the year, which resulted in an improvement of TTNGL’s Share of Profit from PPGPL. GHL benefitted from growth in Net Income from Investing Activities. We discuss the main factors which affected the performances as well as provide an outlook.

Trinidad and Tobago NGL Limited (TTNGL)

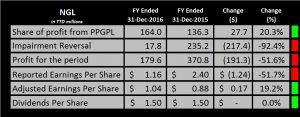

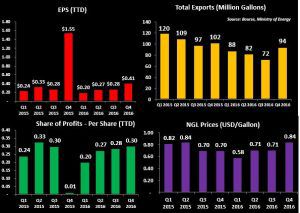

TTNGL reported Earnings per Share of $1.16 for the year ended December 2016, a decline of 51.7% from $2.40 in the previous year. A closer look at the numbers, however, reveals an Impairment Reversal of $235.2M in FY 2015, which would have had a significant positive impact on reported EPS. In 2016, Impairment reversal had a positive impact of just $17.8M. This is in relation to an impairment loss of $1.1B which was recognised in 2014. Adjusting for this non-cash, ‘non-operating’ item, Earnings per Share would have been $0.88 and $1.04 in 2015 and 2016 respectively, or an improvement of 19.2%.

TTNGL’s performance was driven by higher profits generated by its sole investee company, Phoenix Park Gas Processors Ltd (PPGPL), of which TTNGL owns 39%. In 2016, the Share of Profit from PPGPL moved from $136.3M to $164.0M, up $27.7M (20.3%).

Outlook

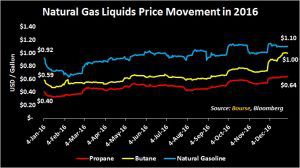

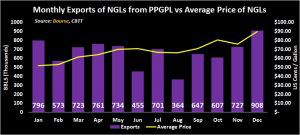

The prices of Natural Gas Liquids (NGLs), based on a weighted basket of propane, butane and natural gasoline, averaged US$ 0.713 during 2015 and US$ 0.685 in 2016, down 3.9%. PPGPL’s revenue would have benefitted from improving NGL prices throughout 2016. Based on publicly available data, exports of NGLs by PPGPL increased in the latter half of the year, which coincided with higher NGL prices.

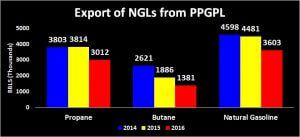

On the volume side however, export of NGLs from PPGPL remained subdued when compared to previous years. Export of propane, butane and natural gasoline declined by 21%, 27% and 20% respectively, from 2015 levels.

Looking ahead, new gas production – expected to be commissioned in 2017 and 2018 – could boost production and subsequently export levels of NGLs. On 15th March 2017, the Government of Trinidad and Tobago signed an agreement with the Government of Venezuela, with respect to the construction, operation and maintenance of a gas pipeline, connecting the Dragon Field in Venezuela to the Hibiscus Field in Trinidad. Venezuela’s Minister of Petroleum, Nelson Martinez, who signed the agreement on behalf of his Government, stated that the idea was to start producing between 200 and 300 standard cubic feet of gas per day (mmscfd), within 2 to 3 years. This coincides to roughly 7.5% of 2016 levels. This development will likely be viewed as material progress in efforts to strengthen cooperation in the energy space between hydrocarbon-rich Venezuela and Trinidad & Tobago’s well-established processing and logistics capabilities.

In 2017, propane prices have continued to improve, up 3.71%. Butane prices however, have declined 19.7% year-to-date, while natural gasoline have remained relatively flat.

The Bourse View

At a current price of $22.61, TTNGL trades at a trailing P/E of 19.5 times and offers investors a trailing dividend yield of 6.63%; the highest on the local exchange. NGL declared a final dividend of $1.00, payable on 12th April 2017.

TTNGL reported a cash position of $366M as at December 2016, or roughly $2.36 per share. As a holding company with relatively limited cash expenses, this balance could become available for distribution to investors overtime.

On the basis of (i) a high trailing dividend yield, (ii) a healthy cash position, (iii) the potential of continued stabilization / recovery of revenues through expected improvements in local energy production and global pricing and (iv) an implicit hedge against the TTD through its USD earnings, Bourse maintains a BUY rating on NGL.

Guardian Holdings Limited (GHL)

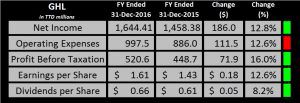

For the year ended 31st December 2016, GHL reported Earnings per Share (EPS) $1.61, an increase of $0.18 or 12.6% over the corresponding period in 2015. Net Income improved by $186.0 M (12.8%), driven by growth in Net Income from Investing Activities of $239.4M. This was offset by a decline in Net Income from Insurance Underwriting Activities amounting to $49.6M. In 2015, the Group benefitted from a non-recurring gain resulting from a change in Jamaican tax legislations. According to the Group, Net Income from Insurance Underwriting Activities would have increased year-on-year (YOY) without this impact. GHL’s Operating Expenses climbed by $111.5 M or 12.6%, which was attributed to costs associated with strategic investments, according to the Deputy Chairman. Profit Before Tax increased by $71.9 M (16.0%) in 2016. GHL faced an effective tax rate of 25% in 2016, marginally higher than the 23% in 2015. Profit After Tax increased by $43.6 M or 12.6% YOY.

Outlook

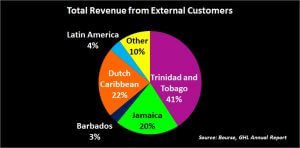

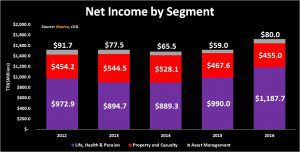

Net Income from Investing and Insurance Underwriting Activities accounted for 99.8% of GHL’s total Net Income in 2016. GHL’s Income from Investing Activities, which account for 62.5% of total income, grew by $239.4 M or 30.4%. This was attributable to improvements in the Group’s major categories of investment income and fair value gains. Looking ahead, the sustainability of this performance could be challenged, given the economic performance in Trinidad and Tobago and other territories in which GHL operates.

The Property and Casualty segment posted a $12.6 M fall in Net Income over the comparable period in 2015. The performance of this segment may be subdued in the foreseeable future due to soft market conditions and a challenging economic environment. The Life, Health and Pension segment has continued to grow at a stable rate over the last 5 years.

The Bourse View

GHL announced a final dividend of $0.45, payable on 20th April, 2017. This brings total Dividends per Share to $0.66 for FY2016, an increase of 8% when compared to $0.61 in FY2015.

At a price of $16.00, GHL trades at a trailing P/E of 9.4x, below the sector average (excluding NEL) of 10.9x. The stock offers a trailing dividend yield of 4.13%, above its sector average of 3.06%. GHL’s share price has advanced 26.5% year to date. On the basis of a relatively attractive dividend yield and moderate valuation, but tempered by an uncertain economic environment, Bourse maintains a NEUTRAL rating on GHL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”