BOURSE SECURITIES LIMITED

06th November 2017

PPGPL Drives TTNGL, WCO Struggles

This week, we at Bourse take a closer look at the performances of Trinidad and Tobago NGL Limited (NGL) and The West Indian Tobacco Company Limited (WCO) for the third quarter ended 30th September 2017. Energy commodity prices have steadily improved throughout the year, resulting in an improvement of TTNGL’s Share of Profit from Phoenix Park Gas Processors Limited (PPGPL). WCO’s earnings declined for the period due to continued business challenges. We discuss the main factors, which affected the performances as well as provide an outlook.

Trinidad and Tobago NGL Limited (NGL)

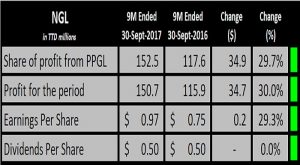

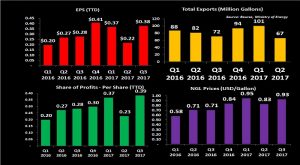

NGL reported Earnings per Share (EPS) of $0.97 for the nine-month period ended September 2017, up 29.3% when compared to the EPS of $0.75 earned in the comparable period in 2016. Total income increased $35.3M, moving from $117.7M in 9M 2016 to $153.0M in 9M 2017. The 30.0% increase was driven by improved profits from its 39% holdings in Phoenix Park Gas Processors Ltd (PPGPL). NGL’s Share of Profit from PPGPL climbed 29.7% for the period. PPGPL’s core business is natural gas processing, NGL aggregation, fractionating and marketing, with their primary products being Propane, Butane and Natural Gasoline.

Outlook

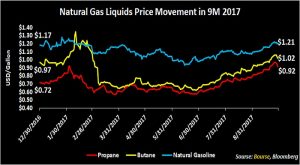

The price of Natural Gas Liquids (NGLs) based on a weighted basket of Propane, Butane and Natural Gasoline averaged US 87.84 cents per gallon for the first 9 months of 2017, up 37.3% when compared to the same period in 2016. NGL prices improved steadily throughout 2017, with Propane, Butane and Natural Gasoline up 27.8%, 5.2%, and 3.4% respectively.

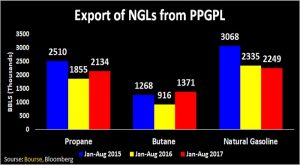

On the volume side, total exports of NGLs from PPGPL improved 12.7% during the first 8 months of 2017, when compared to the same period in 2016. However, export levels remain subdued when compared to 2015 levels (down 15.9%). In 2017, exports of Propane and Butane increased 15.0% and 49.7% respectively while Natural Gasoline decreased 3.7%. Moving forward, gas production is expected to improve as a number of new gas fields come on stream throughout 2017 to 2020. This could lead to improvements in production and export levels of NGLs, which will in turn be beneficial to PPGPL.

The Bourse View

At a current price of $23.58, NGL trades at a trailing P/E of 17.09 times and offers investors a trailing dividend yield of 6.36%, the highest on the local exchange. NGL declared an interim dividend of $0.50 per share, which was paid on September 6th, 2017. This brings NGL’s trailing dividend to $1.50 for 2017, in line with 2016. NGL reported a cash position of $260.9M as at September 30th 2017, or roughly $1.69 per share. As a holding company with relatively limited cash expenses, this balance could become available for distribution to investors overtime.

On the basis of (i) a high trailing dividend yield, (ii) a relatively healthy cash position of $1.69 per share, (iii) the potential of continued stabilization / recovery of revenues through expected improvements in local energy production and global pricing and (iv) an implicit hedge against the TTD through its USD earnings, Bourse maintains a BUY rating on NGL

The West Indian Tobacco Company Limited (WCO)

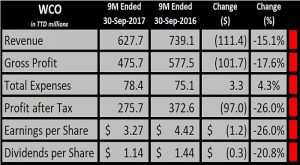

WCO reported Earnings per share (EPS) of $3.27 for the nine-month period ended September 2017, down 26.0% ($1.20) when compared to the prior year’s EPS of $4.42.

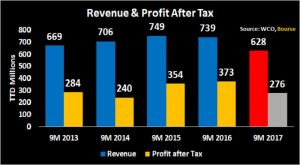

Revenue declined 15.1% to $627.7M in 9M 2017 from $739.1M a year ago. As a result, Gross Profit fell 17.6% to $475.7M while Gross profit margin declined 2.3% for the period. Operating profit fell to $398.2M in 9M 2017 from $502.8M in 2016. Operating Profit margin was down 4.66% moving from 67.9% in 9M 2016 to 63.3% in 9M 2017. Overall, Profit after Tax fell 26.0% ($96.9M) from $372.6M in 9M 2016 to $275.7M in the corresponding period 2017. As a result Profit after Tax margin stood at 43.9% for 9M 2017, down 6.51% when compared to 9M 2016’s 50.4%.

Outlook

WCO continues to grapple with difficult economic conditions coupled with higher taxes on tobacco, and competition from illicit products. WCO’s reliance on imported raw materials in an environment where constrained access to foreign exchange could contribute to ongoing pressures on earnings production.

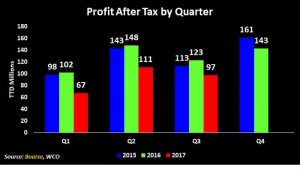

The decline in Profit After Tax represents the third consecutive quarter where earnings were lower in 2017 when compared to the corresponding period in 2016. The fall in earnings was accompanied by three consecutive declines in dividend payments. WCO has traditionally maintained a dividend payout ratio of over 90%. The trailing payout ratio is 103.2%. If revenue continues to fall, coupled with an unmatched decline in expenses, earnings and subsequently dividend payments are likely to continue to fall.

The Bourse View

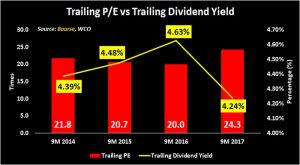

At a current price of $121.00, WCO trades at a trailing P/E of 24.3 times. This is above the Manufacturing (1) sector average of 22.3 times (excluding Guardian Media Limited) and the four year average of 21.7 times. The 26.0% decline in EPS was followed by a 20.8% decline in dividend payments. As a result, WCO’s trailing dividend yield fell to 4.24% from 4.63% in the corresponding period, 2016.

On the basis of (i) declining revenues and reduced earnings, (ii) lower dividend payments, and (iii) a relatively high valuation, Bourse revises its rating on WCO from NEUTRAL to SELL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”