HIGHLIGHTS

WCO 9M 2021

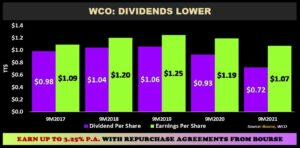

- Earnings: Earnings Per Share of $1.07, a decline from Earnings Per Share of $1.19

- Performance Drivers:

- Reduced Revenue

- Lower Margins

- Outlook:

- Economic Reopening

- Rating: Maintained at NEUTRAL

AHL 9M 2021

- Earnings: Earnings Per Share of $0.45, an increase from Earnings Per Share of $0.39

- Performance Drivers:

- Increased top and bottom line earnings

- Increased Operational Efficiency

- Outlook:

- Economic Reopening

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the financial performance of The West Indian Tobacco Company Limited (WCO) and Angostura Holdings Limited (AHL) for the nine-month period ended 30th September, 2021. WCO reported a decline in profitability while AHL reported an improvement to its earnings driven by increased demand in its international markets. Will the reopening of entertainment channels drive performances of both companies? We discuss below.

The West Indian Tobacco Company Limited (WCO)

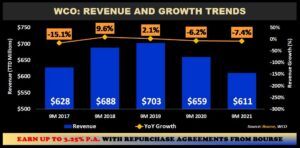

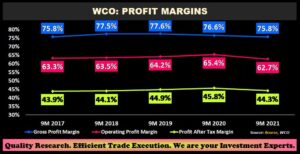

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $1.07 for the nine-month period ended September 2021 (9M2021), 10.1% lower than $1.19 reported in the prior comparable period. Revenue fell 7.4% from $659.3M in 9M2020 to $610.5M in 9M 2021, followed by a 4.4% decline in Cost of Goods Sold. Gross Profit amounted to $462.8M, down 8.3% from $504.9M in 9M 2020. Distribution costs fell 3.1% while Administrative Expenses and Other Operating expenses expanded 2.4% and 4.0% respectively. Operating profit declined 11.2% from $431.5M in 9M 2020 to $383.0M in 9M 2021. Moreover, Profit Before Taxes declined 11.4% to $382.9M. WCO reported Profit for the Period of $270.2M, down 10.4% from $301.7 reported in 9M 2020.

Revenue Lower

WCO’s revenue challenges have persisted, as the company continues to grapple with the socioeconomic impact of COVID 19. The company’s revenue growth declined 7.4% as traditional revenue channels were disrupted by lockdowns and the impact of government regulations on entertainment channels throughout the period. The illicit trade continues to be a major problem for the company, as a growing list of suspected illegal cigarettes with lower price offerings continue to enter the market. The reopening of entertainment channels on November 1st 2021 will be welcome news for both WCO and investors, which is likely to have a positive impact on revenues.

Operating Margins Slip

WCO’s Operating margin, while slipping below 63% for the first time in the past 5 comparable periods, remains fairly robust. The Company continues to maintain healthy Profit After Tax margins, within the 44%-45% range. Gross Profit Margins have also remained fairly stable despite revenue declines, standing at 75.8% in 9M 2021.

Dividends Lower

Declining earnings have impacted dividends to WCO shareholders, with the Company’s dividend falling by $0.21 over the prior comparable period to $0.72 for 9M 2021 (9M 2020: $0.93 per share). Despite lower dividends, WCO offers the highest trailing 12-month dividend yield (6.3%) on the Trinidad and Tobago Stock Exchange.

The Bourse View

At a current price of $29.87, WCO trades at a trailing P/E of 19.9 times, below the Manufacturing Sector average of 28.3 times. The company announced an interim dividend of $0.33 to be paid on November 29th 2021. The stock offers investors a trailing dividend yield of $6.3%, above the sector average of 3.6%. As the country makes key strides to reopening, there is a possibility that WCO’s revenues could gradually recover in subsequent periods. This likelihood is tempered by slowing vaccination rates and the currently rising daily number of cases, which could potentially derail reopening efforts. On the basis of strong pricing power and stable margins, but tempered by potential headwinds as it relates to the COVID-19 pandemic, Bourse maintains a NEUTRAL rating on WCO.

Angostura Holdings Limited (AHL)

Angostura Holdings Limited (AHL) reported Earnings Per Share of $0.45 for the nine-month period ended September 30th 2021, 15.4% higher than $0.39 reported in the prior period. Revenue for the period stood at $613.1M (up: 6.8%) from $574.1M recorded in 9M 2020. Cost of Goods Sold increased 5.5% to $322.0M from $305.1M. Resultantly, Gross Profit expanded 8.2% to $291.1M. Selling and Marketing Expenses and Administrative Expenses both increased 10.8% and 17.6% respectively. An Expected Credit Loss Reversal on Trade Receivables of $4.0M was recorded after a loss of $2.1M in the prior period. Results from Operating Activities came in at $111.8M, $4.8M (4.5%) higher than $107.0M reported in 9M 2020. Improvements in Finance Income, up $3.2M from the prior year ($8.9M), contributed to Group Profit Before Tax for the period which amounted to $123.2M, 6.9% higher than $115.2M in 9M 2020. Overall, AHL reported a Profit for the Period of $92.3M, a 14.4% increase compared to the previous period.

Margins Stable

According to AHL, the Group saved approximately $17M in operating expenses as a result of increased operational efficiency which in turn led to modestly improved margins year-on-year. Gross Profit Margin was 47.5% relative to 46.9% in 9M 2020, owing to increased revenues of 6.8% or $39M as demand for its branded products in international markets strengthened. Operating Profit Margin marginally decreased from 18.6% to 18.2%, whereas Profit After Tax Margin increased from 14.1% to 15.1% supported by an increase in Finance Income.

The Bourse View

At a current price of $17.10, AHL’s share price has increased 4.3% year-to-date (YTD) and trades at a P/E of 22.2 times, below the Manufacturing Sector average of 28.3 times. The stock offers investors a trailing dividend of 2.3%, below the sector average of 3.6%. The reopening of entertainment channels, coupled with new product launches and increased operational efficiencies, is likely to positively impact the Groups top and bottom line growth. On the basis of improving margins, but tempered by adverse economic conditions, Bourse maintains a NEUTRAL rating on AHL.