HIGHLIGHTS

TTNGL 9M 2021

- Earnings: EPS 357.9% higher, from $0.19 to $0.87.

- Performance Drivers:

- Higher NGLs prices

- Outlook:

- International Expansion

- Economic Uncertainty

- Rating: Maintained at NEUTRAL.

Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↑6%

- Brent Crude ↑4%

- Henry Hub Natural Gas ↑2%

NEL 6M 2021

- Earnings: Earnings Per Share increased from a loss of $0.18 to $1.41

- Performance Drivers:

- Increased Operational Expenses

- Gains in Fair Value Revaluation

- Domestic Natural Gas Supply Challenges

- Outlook:

- Robust Energy Prices

- Energy Production likely to rebound

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of National Enterprises Limited (NEL) and Trinidad and Tobago NGL Limited (TTNGL) for the 6-month fiscal period ended September 30th, 2021 and the nine-month fiscal period ended September 30th, 2021 respectively. Both companies reported an improvement in its performance with recovering energy prices helping considerably. Will the improving trend continue with more stable energy prices, or could domestic energy production challenges slow progress in the months ahead? We discuss below.

Trinidad and Tobago NGL Limited (TTNGL)

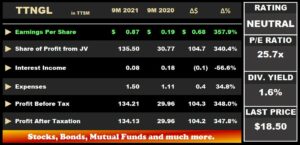

TTNGL reported earnings per share (EPS) of $0.87 for the nine-month period ended September 30th 2021 (9M 2021), a 357.9% increase from $0.19 reported in the prior comparable period. Share of Profit from its sole investee company, Phoenix Park Gas Processors Limited (PPGPL) increased by $104.7M, from $30.77M in 9M 2020 to $135.5M in 9M 2021. Interest income amounted to $0.08M, 56.6% lower than $0.18M in the prior period. Cumulatively, Total Income was $135.7M relative to $31.1M in 9M 2020, up 336.3%. Expenses summed to $1.5M, 34.8% higher than a prior $1.1M in 9M 2020. Profit Before Tax increased 348.0% year-on-year to $134.2M. Overall, TTNGL reported Profit After Taxation of $134.13M, a 347.8% increase compared to $29.96M reported in the previous period.

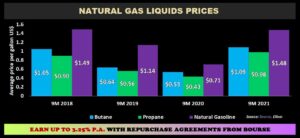

NGL Prices Recover

Phoenix Park Gas Processors Limited (PPGPL), the underlying subsidiary of TTNGL, derives its profitability primarily through the fractionation and export of butane, propane and natural gasoline. TTNGL’s performance was aided by recovering energy commodity prices during the nine-month period as measured by Mont Belvieu benchmarks. Average Butane prices increased 105.7% from $0.53 per gallon in 9M 2020 to $1.09 per gallon in 9M 2021, while average Natural Gasoline prices increased 108.5% from $0.71 per gallon to $1.48 per gallon. Propane, which accounts for 35.3% of PPGPL’s exports, experienced the largest price increase with average prices increasing 127.9% over the nine-month period to $0.98 per gallon.

Production and Export Declines

Trinidad and Tobago continues to be impacted by the fall in natural gas output in recent years. Despite higher NGL content in the gas stream provided by The National Gas Company of Trinidad and Tobago (NGC), production of NGL’s has been on a downward trend since 2019. NGL production from January-August 2021 declined 22.4% to 4.06 million barrels relative to 5.23 million barrels during the period January-August 2020. The export of NGL’s by PPGL, meanwhile, stood at 3.53 million barrels relative to 4.78 million barrels during January-August 2020, down 26.2%.

PPTTEHL Growth Continues

According to TTNGL, PPGPL’s North American Subsidiary, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL) continues to grow. The high volume operation contributed approximately 5% to PPGPL’s profit after tax. Earnings from this segment are expected to contribute positively to PPGPL’s results as the company focuses on growing its business in the international sphere.

The Bourse View

TTNGL has appreciated 8.8% year-to-date, currently priced at $18.50 with a trailing P/E of 25.7 times. The stock also offers investors a trailing dividend yield of 1.6%. Despite the recovery in commodity prices over the nine-month period, the emergence of new COVID 19 variants may pose economic headwinds as some countries begin to reintroduce lockdowns and travel restrictions.

Energy-consuming nations consisting of the U.S, India, China, Japan, Republic of Korea and the United Kingdom have engaged in a coordinated effort to release strategic petroleum reserves with the aim of moderating near-term energy prices.

Mont Belvieu prices of Propane, Butane and Natural Gasoline could be impacted by changes to crude oil market equilibrium prices, with short-term price volatility being the likely result of strategic petroleum reserve deployment. PPGPL’s focus on exploring new growth opportunities along the NGL value chain may provide a platform for long-term growth for TTNGL. On the basis of recovering energy commodity prices, but tempered by increasing economic uncertainty, Bourse maintains a NEUTRAL rating on TTNGL.

National Enterprises Limited (NEL)

NEL reported an Earnings Per Share (EPS) of $1.41 for the six-month period ended September 30th 2021 (6M 2021), 883.3% higher than the Loss Per Share (LPS) of $0.18 reported in 6M 2020.

The Group’s Dividend Income increased 34.4% to $4.2M from a previous $3.1M. Other Income declined 36.2%, moving from $3.9M in 6M 2020 to $2.5M in the period under review. Operating Expenses jumped to $39.6% to $2.0M. Operating Profit fell to $4.7M, $0.9M (15.8%) lower than $5.6M in the prior year. NEL’s boost to earnings came from its gain on Fair Value Revaluation on Investments of $843.4M, up 850.8% than the Loss of $112.3M in the comparable period. Cumulatively, Profit Before Tax (PBT) stood at 848.1M in 6M 2021 relative to a Loss Before Tax of $106.8M in 6M 2020. Overall, the Group recorded a Total Comprehensive Income for the year of $847.8M or $955.3M higher than a Loss of $107.5M reported in the previous period.

Rebound in Asset Valuations

NEL’s energy portfolio encompasses the holdings of Trinidad Nitrogen Company Limited (Tringen), NGC NGL Company Limited, NGC Trinidad and Tobago LNG Limited and Pan West Engineers and Constructors LLC. Increases of fair market value of portfolio companies: Tringen (194.0%), NGC NGL Company Limited and Pan West Engineers and Constructors LLC (13.0%). The companies recorded financial performance improvements, supported by resurgent energy commodity prices as the world continues to recover from the impact of the global Pandemic.

Pandemic Pressures Impacts Energy Sector

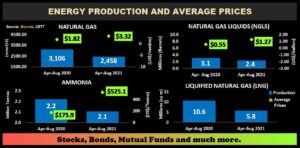

Trinidad Nitrogen Company Limited, NGC LNG, NGC NGL and Pan West are all reliant on the supply of natural gas to act as feedstock for the operations of aggregation and fractionation. Within the period April to August 2020 (6M 2020), the production of Natural Gas in T&T averaged 3,106 mmscf/d. For the current period under review (6M 2021), Natural Gas production declined 20.9% averaging 2,458 mmscf/d. Despite lower production, the average benchmark price of natural gas surged 82.4% YoY to US$3.32 for the period of April to August 2021 (6M 2021), on combination of supply concerns and rising demand.

The production of Natural Gas Liquids (NGLs) declined 99.9% in 6M 2021 (April to August 2021), to 2.4 million barrels from 3.1 million barrels in the prior comparable period. Using a weighted basket, the average prices for NGLs (propane, butane and natural gas) rose 129.9% YoY, averaging US$1.27/Gallon in 6M 2021 relative to US$0.55/Gallon in the prior period.

NEL has investment exposure to the Ammonia industry (through its 51% holding in Trinidad Nitrogen Company Limited) benefitted from higher Ammonia prices, which increased from an average of US$175.9/tonne in 6M 2020 to an average of US$525.1/tonne in 6M 2021. Ammonia production, however, declined 5.1% from 2.2 Million Tonnes (MT) in 6M 2020 to 2.1 Million Tonnes in 6M 2021. In 6M 2021, Liquefied Natural Gas (LNG) production stood at 5.8M cubic meters, 46.0% lower than 10.6M cubic meters in the prior comparable period (6M 2020).

The Bourse View

At a current price of $3.25 and having appreciated 3.8% year to date, NEL trades at a trailing P/E of 2.9 times, below the sector average of 9.0 times. The stock offers investors a trailing dividend yield of 0.9% relative to a sector average of 1.3%. The Group has declared an interim dividend payment of $0.03 per share to be paid on December 15th, 2021.

Domestic energy production challenges could be partially offset by the prevailing higher international energy price environment, while profitability of non-energy holdings such as TSTT and NFM could be impacted by lower disposable income and higher agro-commodity prices respectively in this context, Bourse maintains a NEUTRAL rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”