HIGHLIGHTS

NCBFG FY 2021

- Earnings: EPS 22.0% lower from $0.35 to $0.28

- Performance Drivers:

- Recovering Financial Markets

- Increased Fee and Commission Income

- Outlook:

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

FCGFH FY 2021

- Earnings: Earnings Per Share increased 10.0% from $2.40 to $2.64

- Performance Drivers

- Reduced Total Net Income

- Reduced Impairment Expenses

- Muted Loan Growth

- Outlook:

- Recovering Financial Markets

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

This week we at Bourse review the performance of NCB Financial Group Limited (NCBFG) and First Citizens Group Financial Holdings Limited (FCGFH) for the fiscal year ended September 30th 2021 (FY2021). NCBFG reported lower profitability due to an increase in expenses while FCGFH was able to benefit from a decline in Credit Impairment Losses. What might investors expect in the months ahead? We discuss below.

NCB Financial Group Limited (NCBFG)

NCBFG reported earnings per share of TT$0.28 for fiscal 2021 (FY2021), 22.0% less than TT$0.35 reported in the prior period. The Group’s Net Interest Income fell 7.4% to TT$2.14B from a prior TT$2.31B. Net Fee and commission income increased 5.2% to TT$989.5M relative to TT$940.3 in FY 2020. Gains on FX and Investment Activities expanded 159.1% to TT$1.00B from TT$386M in FY 2020. Credit Impairment Losses fell to TT$148.9M from TT$452.5M (down 67.1%).

Net Result from Banking and Investment Activities increased 28.6%, moving from TT$3.36B in FY 2020 to TT$4.32B in FY 2021. Net Result from Insurance Activities declined 29.3% to TT$1.01B, attributable to a 28.5% increase in Commission and other selling expenses and a 22.2% increase in Gross policyholders’ and annuitants’ benefits and reserves. Net Operating Income stood at TT$5.33B, 11.3% greater than the prior comparable period.

Operating Expenses increased 16.3%, with Finance Costs rising 30.1% (up $TT$18.7M) and Other Operating Expenses expanding 26.1% (up TT$356.6M). Operating Profit was TT$1.16B, 3.3% lower than TT$1.20B. Profit Before Tax was down 3.5% year-on-year to TT$1.17B despite an 8.9% increase in Share of Profits from Associates. Net Profit totalled TT$883.3M for a 25.3% decline, while Net Profit Attributable to Shareholders fell to TT$626.0M from TT$840.0M, 25.5% lower.

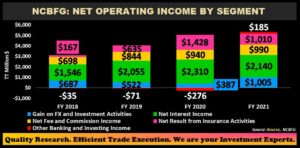

Investment Activities Drive Operating Income

Net Operating Income for the period increased 11.3%. Net Interest Income, the largest component of Net Operating Income (40.2%), contracted 7.4%.

Net Fee and Commission Income (18.6% of Net Operating Income), increased 5.3% YoY. Payment services increased 22.1% (TT$96.5M) following an increase in transaction volumes. Net Result from Insurance Activities (19.0% of Net Operating Income), contracted 29.3%. According to NCBFG, this performance was a result of reduced activities due to COVID 19 restrictions and lockdowns in Trinidad and Tobago during the financial year.

Gain on Foreign Currency and Investment Activities (18.9% of Net Operating Income) expanded 159.7% YoY. Other Banking and Investing Income increased 167.0% following a TT$303.5M decrease in Credit Impairment Losses. The Group’s Investment Securities portfolio expanded a considerable 49.8% from TT$20.1B in FY2020 to TT$30.1B in FY2021. The recovery in financial markets allowed the Group to benefit from favourable price movements, increased gains from the sale of debt securities and mark to market valuations.

Six of NCBFG’s seven operating segments recorded year-on-year improvements. Life and Health Insurance & Pension Fund Management, which accounts for 29.6% of Operating Profit, contracted 6.0% following lockdown restrictions and muted economic activity in one of its largest operational territories. Wealth, Asset Management and Investment Banking increased 53.0% as capital market conditions improved. Additionally, Consumer and SME Banking grew 19.2% from TT$998M in FY2020 to TT$1.19B in FY2021.

The Bourse View

NCBFG is currently priced at $8.01, with the stock relatively flat (down 1.6%) year-to-date. The stock trades at a price to earnings ratio of 29.5 times, well above the sector average of 20.0 times and offers investors a dividend yield of 0.3%, below the sector average of 2.4%. The gradual easing of restrictions across operating jurisdictions is a step in the right direction for economic activity and NCBFG’s fortunes. On the basis of recovering financial markets but tempered by relatively high valuations and still-meaningful economic uncertainty, Bourse maintains a NEUTRAL rating on NCBFG.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) reported an Earnings Per Share of $2.64 for the financial year ended 30th September, 2021 (FY 2021), 10.0% higher compared to $2.40 in the comparable period.

Net Interest Income stood at $1.5B, 7.8% lower than $1.63B reported in the prior year. Fees and Commissions marginally declined 0.4% to $431.0M and Other Income fell 20.6% to $123.8M. Cumulatively, Total Net Income declined 4.2%, moving from $2.2B in FY 2020 to $2.1B IN FY 2021. Credit Impairment Loss on Loans significantly fell to $0.41M, 99.8% lower from a prior expense of $216.7M in 2020. Administrative Expenses and Other Operating Expenses increased 3.3% and 8.6% respectively in the financial year, related to greater costs on Covid-19 protection measures. FCGFH reported a total share of profit in associates and joint ventures of $20.9M, from 19.3M in the prior year. Profit Before Taxation (PBT) advanced 8.5% from a previous $831.6M to $902.1M. Profit Attributable to Equity holders of the Group increased from $391.0M in FY 2020 to $429.9M in FY 2021.Overall, Profit After Taxation jumped 10.0% to $667.3M, relative to $606.9M in FY 2020 owing to the reduction in impairment expenses.

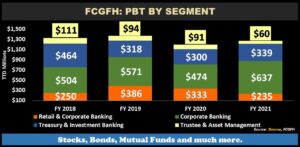

Segment Performance Mixed

Corporate Banking continues to be the dominant contributor to PBT, accounting for 50%. The segment reported an increase of 34.5% to $637.3M in FY 2021 from $473.9M in FY 2020, underpinned by an increase in Total Net Income. Treasury and Investment Banking accounted for the second largest proportion of PBT (27%), and advanced to $339.3M in the current period, up 13.2% relative to the comparable period. Retail Banking (18% of PBT) and Trustee and Asset Management (5% of PBT) segments both experienced declines of 29.5% and 34.0% respectively in FY 2021. Retail Banking performance was likely linked to the reduction in its ‘loans to customers’ portfolio, which fell 4.7% YoY.

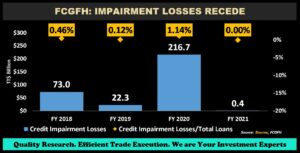

Credit Impairment Expenses Reduced

FY 2021 reduction in Total Net Income by 4.2% raises questions as to whether further income generation challenges could be confronted in following periods.

FCGFH Loans to Customers decreased 4.7% over the period from $19.0B to $18.1B in FY 2021, likely attributable to the prevailing economic uncertainty surrounding Covid-19, signalling reduced demand for loans. FY 2021 Credit Impairment Losses declined to $0.4M from $216.7M, or 1.14% the value of its Total Loan Portfolio in FY 2020.

A further net credit impairment write-back on investments was recorded increasing $9.6M to 13.0M in 2021, reflecting continued repayments and recoveries. The dramatic improvement in Credit Losses during the current period could signal some stabilization in the lending environment.

FCGFH’s acquisition of Scotiabank’s operation in Guyana, if successful, would meaningfully expand the Group’s geographic footprint. The Group currently has established operations in Barbados, Costa Rica, St. Lucia, St. Vincent and the Grenadines and its key jurisdiction in Trinidad and Tobago. FCGFH would have also made a foray into the Jamaican financial services landscape with its recent investment in Barita Investments.

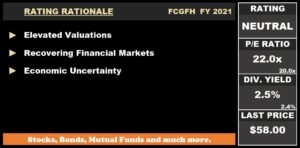

The Bourse View

FCGFH is currently priced at $58.00 trades at a P/E ratio of 22.0 times, higher than the Banking Sector average of 20.0 times. The Group declared a final dividend payment of $0.45 per share to be paid on December 30th, 2021, a total dividend payment of $1.46 will be paid for FY 2021.

The stock offers a dividend yield of 2.5%, in line with the sector average of 2.4%. On the basis of better performance in its non-retail segments and recovering financial markets, but tempered by elevated valuations and prevailing economic uncertainty as it relates to Covid-19, Bourse maintains a NEUTRAL rating on FCGFH.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”