HIGHLIGHTS

TTNGL Q1 2022

- Earnings: EPS 31.3% higher, from $0.32 to $0.42

- Performance Drivers:

- Higher NGLs prices

- Outlook:

- International Expansion

- Energy Production likely to rebound

- Rating: Maintained at OVERWEIGHT

Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↑5%

- Brent Crude ↑7%

- Henry Hub Natural Gas ↑7%

NEL 12M 2022

- Earnings: Earnings Per Share of $3.46, an increase from a Loss Per Share of $0.45

- Performance Drivers:

- Significant Gains on Fair Value Revaluation on Investments

- Increased Operational Expenses

- Outlook:

- Stabilization of Energy Prices

- Potential Increase in Natural Gas Supply

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of Trinidad and Tobago NGL Limited (TTNGL) for the first quarter ended 31st March, 2022 and National Enterprises Limited (NEL) for the 12 months ended 31st March, 2022. Both companies reported improvements in performance on account of robust energy markets. Will the upward momentum continue with more stable energy prices, or could domestic energy production challenges create headwinds? We discuss below.

Trinidad and Tobago NGL Limited (TTNGL)

TTNGL generated Earnings per Share (EPS) of $0.42 for the first quarter ended 31st March 2022 (Q1 2022), $0.10 higher than a previous $0.32 in Q1 2021.

Following up on a solid FY2021 performance, Share of Profit from Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL) increased by $14.6M, from $50.5M to $65.1M primarily driven by an increase in Mont Belvieu prices. Interest Income amounted to $0.03M, 22.2% higher than the prior period. Cumulatively, Total Income was $65.1M relative to $50.5M in Q1 2021. Operating Expenses summed to $0.48M, 18.1% higher than a prior $0.40M in Q1 2021. Resultantly, Profit Before Tax (PBT) expanded by 29.1% to 64.7M. Income Tax Expense contracted to $0.08M. Overall, Profit after Tax stood at $64.6M for the period under review, $14.6M more than $50.0M in Q1 2021.

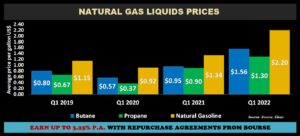

NGLs Prices Recover

TTNGL’s performance was supported by robust energy commodity prices during Q1 2022 as measured by Mont Belvieu benchmarks. Natural Gas Liquids (NGL) prices, already elevated by supply chain challenges and recovering demand, were further boosted by the Russia-Ukraine war and the impact on crude oil and natural gas markets.

Average Butane prices increased 64.2% from US$0.95 per gallon in Q1 2021 to US$1.56 per gallon in Q1 2022, while average Natural Gasoline prices increased 64.2% from US$1.34 per gallon to US$2.20 per gallon. Average prices of Propane rose 44.4% to US$1.30 per gallon in Q1 2022. Year to date, the weighted basket of NGLs has averaged US$1.66 per gallon.

NGLs Production, Exports Sluggish

Based on the latest data published by the Ministry of Energy and Energy Industries (MEEI) up to January 2022, NGL Production fell 6.7% from 0.6M barrels (BBLS) in January 2021 to 0.56M BBLS in January 2022. Exports of NGLs declined 13.9% to 0.5M BBLS in January 2022, relative to a previous 0.6M BBLS in January 2021. Production and Exports of NGLs from PPGPL in Q1 2021 were 1.7M BBLS and 1.5M BBLS respectively. The production/export weakness were offset by the aforementioned improved NGLs pricing environment.

TTNGL also reported NGL sales volumes for Q1 2022 (January-March) being 16.1% higher than the prior comparable period, driven by higher customer demand.

PPGPL International Growth Continues

The first quarter of 2022 delivered another milestone in PPGPL’s international growth strategy. In January 2022, PPGPL through its wholly owned subsidiary Phoenix Park Energy Marketing LLC (PPEM) acquired the Hull Terminal in Texas, United States. The new facility is expected to be fully integrated in Q2 2022, with throughput expanding soon after.

PPGPL continues to grow its presence in the North American energy landscape, centered on the acquisition and/or capacity development of terminal-related assets between 2022 and 2024. PPEM plans to access and aggregate NGL supply to sustain and grow its markets in Mexico, Latin America and the United States.

PPGPL’s North American-based subsidiary, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL), contributed to overall performance with higher trading volumes and improved margins positively impacting earnings. PPTTEHL contributed approximately 6% of PPGPL’s profit after tax for Q1 2022 and the Group expects positive earnings growth from this business segment.

Energy Production Recovery?

According to the Minister of Energy and Energy Industries, the Honourable Stuart Young stated during his keynote speech at the Trinidad and Tobago Energy Conference in Port of Spain that domestic natural gas production should be lifted in Q2 2022. This is expected from developments to come online including De Novo Energy Ltd.’s Zandolie project, EOG Resources Inc.’s Osprey East and West project, and bp Trinidad and Tobago LLC’s (bpTT) Cassia Compression project among others onshore. By 2027, two promising projects with the potential to materially improve natural gas production – the Shell Manatee Field and the Calypso projects – are being developed by BHP and bpTT.

The Bourse View

At a current price of $20.69 TTNGL trades at a trailing P/E of 6.1 times. The stock offers investors a trailing dividend yield of 3.6%.

The current robust energy price environment should be supportive to PPGPL’s earnings and by extension TTNGL in the coming periods. This should be enhanced by any modest recovery in natural gas production within the domestic energy landscape. Continued pursuit of value-added growth, both regionally and internationally along the Group’s energy value chain, should aid in the development of long-term shareholder value.

On the basis of robust energy commodity prices, expected stabilization/recovery of domestic energy production, recovering dividend payments and a focused expansion strategy by investee company PPGPL, Bourse maintains an OVERWEIGHT rating on TTNGL.

National Enterprises Limited (NEL)

NEL reported an Earnings Per Share (EPS) of $3.46 for the unaudited twelve-month period ended March 31st 2022 (12M 2022), 868.9% higher than a Loss Per Share (LPS) of $0.45 reported in FY 2021.

The Group’s Dividend Income decreased 47.4% to $13.7M from a previous $26.0M. Other Income fell 24.3%, moving from $7.3M in FY 2021 to $5.5M in the period under review. Operating Expenses climbed to $5.3M, 6.9% higher than $5.0M in FY 2021. Consequentially, Operating Profit declined 51.0% from $28.3M in FY 2021 to $13.8M in the most recently concluded period. Gains on Fair Value Revaluation on Investments expanded a significant 795.4% to $2.06B from a previous loss of $296.3M in FY 2021. Profit Before Tax stood at $2.08B relative to a Loss Before Tax of $268.7M in FY 2021. Overall, the Group recorded Total Comprehensive Income of $2.08B, 868.2% higher than a Loss of $270.4M reported in the previous period.

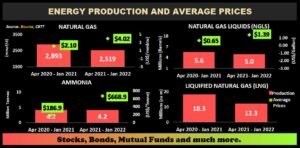

Energy Prices Buoyant

Trinidad Nitrogen Company Limited, NGC LNG, NGC NGL and Pan West all depend on the supply of natural gas as feedstock for processing activities. Within the period April 2021 – January 2022 Natural Gas production in T&T averaged 2,519 mmcf/d, 12.9% lower than an average of 2,893 mmcf/d in the prior comparable period. Benefitting from supply chain constraints and geopolitical tensions in Eastern Europe, the average price of Natural Gas improved 91.4% YoY to US$4.02/MMBtu relative to a previous average of US$2.10/MMBtu.

The production of Natural Gas Liquids (NGLs) contracted by 10.7%, from 5.6M barrels/day to 5.0M barrels/day over the comparable period. Using a weighted basket, the average prices for NGLs (propane, butane and natural gas) expanded 113.8%, averaging US$1.39/Gallon from a prior US$0.65/Gallon.

NEL’s investment exposure to the Ammonia industry (through its 51% holding in Trinidad Nitrogen Company Limited) benefitted from higher Ammonia prices, which increased from an average of US$186.9/Tonne to US$668.9/Tonne. Ammonia production has remained relatively flat across comparable periods.

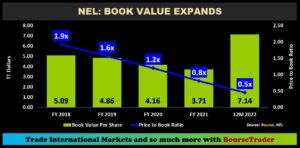

NEL’s book value per share rebounded sharply in the most recently concluded period, driven by valuation increases in its investee companies arising from improved energy commodity prices. The Group’s Book Value Per Share (BVPS) advanced from $3.71 in FY 2021 to $7.14 in the most recent period. The upward revaluation of NEL’s investee company holdings reflects a more positive outlook for its energy-related holdings, with better prospects for improved profitability and cash flows.

NEL’s price to book ratio has declined from 1.9x in FY 2017 to a current level of 0.5x, representing a sharp discount that investors are paying for the stock relative to the book value of its net assets on a per share basis. For investors seeking stocks with cash-flow characteristics, the turnaround in energy and energy commodity markets increase the likelihood of higher dividends in the near-term from NEL. With energy prices set to stay high for the foreseeable future, NEL appears to offer more attractive value, if even on a cyclical basis.

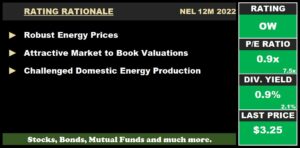

The Bourse View

At a current price of $3.25, NEL trades at a trailing P/E of 0.9 times, below the Non-Banking Sector average of 7.5 times. The stock is currently trading at a market-to-book value of 0.5 times, well below its recent historical average of approximately 1.4 times. The stock offers investors a trailing dividend yield of 0.9% relative to a sector average of 2.1%. In his keynote address at the Trinidad and Tobago Energy Conference and Trade show, Prime Minister the Honourable Dr. Keith Rowley noted that with new natural gas production coming on stream in 2022 and 2023, gas production is projected to increase from present levels to 3.2 billion standard cubic feet per day (bscfd) by 2024.

Additionally, the EIA forecasts Henry Hub natural gas prices to average $8.59/MMBtu in the second half of 2022 and $4.74/MMBtu in 2023. These developments may provide a case for improvement in NEL’s investee companies in the short term, while the restructuring of its portfolio of investee companies may provide growth in subsequent periods. On the basis of stronger energy prices, attractive market to book valuations and the increasing likelihood of improved dividends, Bourse maintains an OVERWEIGHT rating on NEL.