HIGHLIGHTS

MASSY HY 2022

- Earnings: Earnings Per Share 3.8% higher, from $0.148 to $0.154

Continuing Operations: EPS 1.1% higher, from $0.142 to $0.140

Discontinued Operations: EPS 51.2% higher, from $0.008 to $0.012

- Performance Drivers:

- Increased Revenues

- Sale of Non-Core operations

- Outlook:

- Geographical Diversification

- Portfolio Restructuring

- Rating: Maintained at MARKETWEIGHT

GKC Q1 2022

- Earnings: Diluted Earnings Per Share 4.2% higher, from TT$0.07 to TT$0.08

- Performance Drivers:

- Increased Revenues

- Higher Expenses

- Lower Net Impairment Losses

- Outlook:

- Growth from Acquisition

- Economic Uncertainty

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of regional conglomerates, Massy Holdings Limited (MASSY) for the half year ended 31st March, 2022 and GraceKennedy Limited (GKC) for the first quarter ended 31st March, 2022. MASSY reported improved earnings owing to strong revenue and margin growth in its integrated retail segment. GKC, meanwhile, benefitted from increased revenues and lower Net Impairment Losses. Can both entities successfully manoeuvre lingering inflationary and supply chain challenges in 2022? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings Per Share (EPS) of $0.154 for the six-month period ended March 31st 2022 (HY 2022), 3.8% higher than an EPS of $0.148 reported in HY 2021.

Revenue from Continuing Operations grew 9.6% YoY, from $5.6B to $6.1B. Operating Profit After Finance Costs advanced 4.7%, while Operating Margin fell from 7.4% to 7.0%. Share of Results of Associates and Joint Ventures decreased 17.4% to $18.9M. Resultantly, Profit Before Tax (PBT) expanded by 3.5% to $452.1M. Income Tax Expense contracted to $149.8M ($10.0M or 7.2% lower). Overall, Profit Attributable to Owners of the Parent stood at $304.8M, a 3.9% increase compared to $293.5M reported in the previous period.

Integrated Retail Propels PBT

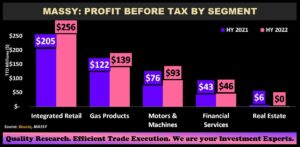

MASSY’s Integrated Retail segment (47.9% of PBT) posted the best year-on-year percentage gain, increasing 25.1% on account of improving operating margins. Segment PBT moved from $204.8M to $256.2M, with all markets recording growth especially Guyana, Trinidad and Tobago and Barbados. The launch of 5 new Massy Stores in HY 2022 provides a positive sign for investors as the Group continues to focus on its core businesses. Though resilient, the segment could confront headwinds as inflationary pressures and supply chain challenges persist.

Gas Products (26.0% of PBT) advanced 14.1% from $122.1M to $139.3M, aided by strong growth in its Trinidad and Tobago and Guyana markets. The Group’s reported acquisition of its second LPG distribution in the Boyacá region of Colombia during HY 2022 is expected to support growth in its Gas Products Portfolio.

The Group’s Motors and Machines segment (17.4% of PBT) expanded 23.5% from $75.6M to $93.4M, helped by growth in Massy Motors and Massy Machinery in Trinidad as demand for new motor vehicles and construction activity recovers. According to MASSY, its Motors and Machines Miami Distribution operations which was setup up to facilitate the distribution of Shell lubricants throughout the Caribbean and South America has already made a positive contribution to the portfolio’s HY 2022 results.

Financial Services increased 6.4% from $43.3M to $46.0M, boosted by strong performance in Massy Remittance Services in Guyana. The Real Estate segment reported a 91.5% decline in HY 2022 from $5.8M to $0.5M.

Trinidad PBT Dominance Increases

Trinidad and Tobago remains MASSY’s core generator of PBT, increasing its contribution to PBT to 41.9% as economic activity increased in the jurisdiction. Guyana continues to grow in prominence in contributing to MASSY’s PBT, contributing 21.7% to PBT as the country continues along its path of economic growth and is projected to expand by 47.2% in 2022 (IMF April 2022 outlook). Colombia now accounts for 6.1% of PBT, relative to 7.6% in HY 2022. Meanwhile, PBT contributed by the Eastern Caribbean fell to 11.7% while PBT contributed by Jamaica declined marginally to 5.3%.

The Bourse View

At a current price of $5.24, MASSY trades at a trailing P/E of 13.0 times, below the Conglomerate Sector average of 15.0 times. Notably, MASSY’s P/E ratio ex-discontinued operations stands at 16.1 times. The Board of Directors approved an interim dividend of $0.03 payable on June 15th 2022 to shareholders on record by June 1st 2022. The stock offers investors a trailing dividend yield of 2.8%, above the sector average of 2.5%. Continued growth initiatives across its core portfolios reinforce the Group’s efforts to emerge from the recent economic uncertainty a stronger entity. Tangible challenges exist, however, from rising inflationary pressures and global supply chain issues. On the basis of continued geographical diversification and revenue growth, tempered by prevailing inflationary and supply chain pressures, Bourse maintains a MARKETWEIGHT rating on MASSY.

GraceKennedy Limited (GKC)

For the first quarter ended 31st March, 2022 GKC reported Earnings per Share of TT$0.08 relative to TT$0.07 in the prior period, an increase of 4.2%.

Revenue from Products and Services amounted TT$1.5B relative to a prior TT$1.3B, a 15.8% increase. Interest Revenue also improved 7.2% to TT$52.2M. Total Revenue for the period amounted to TT$1.6B, an increase of TT$212.5M or 15.5%. Direct and Operating Expenses grew 16.4% to TT$1.5B from a previous TT$1.3B. Net Impairment Losses on Financial Assets moved to TT$2.4M from a prior expense of TT$4.6M. Other Income stood at TT$39.3M improving from TT$36.8M in Q1 2021. Profit from Operations was TT$107.2M, 3.6% up year on year. Interest Income from Non-Financial Services stood at TT$5.1M while Interest Expense from Non-Financial Services amounted to TT$14.0M. Share of Results of Associates and Joint Ventures was TT$14.2M for Q1 2022, an increase of TT$1.7M relative to TT$12.5M reported in Q1 2021. Profit before Tax was TT$112.4M, increasing 2.1% compared to TT$110.1M in the prior comparable period. Net Profit for the Period was TT$82.1M. Ultimately, Profit Attributable to Owners of the Group was TT$75.9M, a 4.9% increase from TT$72.3M in Q1 2021.

Food Trading, Banking and Investments Advance

Food Trading, the largest contributor to PBT (52%), grew 4.4% in the period to TT$67M, driven by revenue growth across its business lines. Demand for GKC’s core products remained strong in its main jurisdiction of Jamaica. Growth in domestic sales were offset by rising shipping and raw material costs, particularly in U.S. and Canadian markets.

GraceKennedy Money Services (GKMS), the second largest contributor to PBT, (26%) declined 26.4% to TT$34M, primarily attributed to lower remittance flows and foreign currency volatility during the quarter.

Banking and Investments (15% of PBT) advanced 205.3% from TT$6M to TT$20M, led by GK Capital Management Limited (GK Capital), the investment and advisory arm of GraceKennedy Financial Group (GKFG). In February 2022, GK Capital received approval from the Financial Services Commission (FSC) to enter the Collective Investment Schemes (CIS) market in Jamaica. This approval will allow GK Capital to offer mutual fund products through a newly incorporated entity, GK Mutual Funds Limited which is expected to launch in the third quarter.

The Group’s Insurance Segment, which accounted for 7.0% of GKC’s PBT, expanded 137.3% from TT$4M to TT$9M in Q1 2022. GKC’s most recent acquisition, GK Life Insurance Eastern Caribbean Limited reported double-digit top-line growth as they continue to establish themselves as a major pan-Caribbean insurer.

Higher Expenses Compress Margins

A 16.2% increase in expenses due to supply chain and logistic challenges chipped away at the Group’s Net Profit and margins, which grew a modest 2.1% in the period under review.

Operating Profit margin declined from 7.5% in Q1 2021 to 6.8% in Q1 2022. The Profit Before Tax Margin followed suit, moving from 8.0% to 7.1% in Q1 2022. Continued significant raw material inflation and supply chain disruptions, exacerbated by recent geopolitical developments, could continue to impact GKC’s operations globally.

GKC to Partner with TTUTC

GraceKennedy (GKC) has announced that the investment and advisory arm of its GraceKennedy Financial Group (GKFG), GK Capital Management Limited (GK Capital), has signed a joint venture agreement with the Trinidad and Tobago Unit Trust Corporation (TTUTC). The new venture, which remains subject to regulatory approvals, will allow GKC and TTUTC to partner in the distribution of mutual funds in Jamaica. TTUTC is the largest operator and manager of mutual funds in the Caribbean, and currently manages US$3.7B for over 625,000 investors. This venture will expand their service offerings and diversify client investment opportunities to new market segments.

The Bourse View

At a current price of $5.70, GKC trades at a P/E ratio of 15.6 times, marginally above the Conglomerate Sector average of 15.0 times. The Group announced an interim dividend of TT$0.02 payable on June 16th, 2022 on record as of May 27th totaling TT$20.8M. The stock offers investors a trailing dividend yield of 1.5%, below the sector average of 2.5%.

On the basis of continued revenue growth and acquisition activities, tempered by margin pressures from rising input costs, Bourse maintains a MARKETWEIGHT rating on GKC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”