HIGHLIGHTS

International Markets

- January 2022 Performance:

- US Markets – SPY ↓ 7.0% YTD

- European Markets – VGK ↓ 5.1% YTD

- Asian Markets – AAXJ ↓ 4.5% YTD

- Latin American Markets – ILF ↑ 7.2% YTD

- Local Markets

-

- TTCI ↑ 1.7%

- All T&T ↑2.3%

- CLX ↑ 0.4%

- Performance Drivers:

- Increased Volatility

- Inflationary Pressures

- Outlook:

- Economic Uncertainty

This week, we at Bourse review the performance of the international equity markets in what has been an uncharacteristically weak first month of trading in 2022. What has caused markets to recede? Is this a buying opportunity, or should investors be cautious? We discuss below.

Inflations, Growth Concerns Increase

Most major equity markets traded lower to start 2022, driven by multiple concerns around economic activity. While pandemic-related issues continue to linger, investors have seemingly turned their attention to the threat of inflation and interest rate adjustments to economic growth.

With US inflation at multi-decade highs, the US Federal Reserve has communicated a fairly clear path to interest rate increases. At a meeting on January 26th 2022, US Federal Reserve Chairman reinforced the end of the Fed’s bond buying program – a tool to support financial system liquidity and lower interest rates – in March 2022. Additionally, Chairman Powell noted (i) upside risk to inflation, with the possibility that inflation may be prolonged, (ii) that the US economy no longer needs sustained high levels of monetary policy support and (iii) the Fed could raise the federal funds rate at its March meeting with ‘appropriate conditions’.

Earlier in January, the International Monetary Fund released its 2022 outlook, which broadly slashed growth estimates for the current year. Global growth is now expected to slow to 4.4% this year, weighed by downgrades for the United States and China. The IMF cut its growth forecast for the US by from 5.2% to 4.0% in 2022.

China’s growth forecast was cut by 0.8% to 4.8% in 2022. The Euro area was reduced modestly by 0.4% to 3.9% and Latin America’s growth cut by 0.6% to 2.4% in 2022.

Geopolitical relations have also come to the fore, with heightened tensions between Russia and Ukraine leading to concerns of political unsettling in the region.

Responding to all of these factors, Regional Exchange Traded Funds (ETFs) have tumbled year to date (YTD), reflecting considerable worry among investors.

As at Friday 28th January 2022, Asian Markets are currently down 4.5% YTD. European Markets fell 5.1% YTD while US Markets declined 7.0% YTD as uncertainty increases. Latin America stood out as the only region to record positive YTD results, up 7.2% compared to a contraction of 5.5% in the year ago period.

Major Averages Down

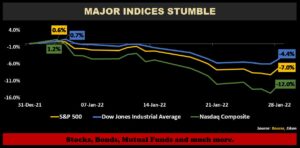

U.S stocks are off to a rough start in 2022, amid decelerating growth, inflationary pressures, hawkish central banks and the recent surge in bond yields. The S&P 500 index declined 7.0% year-to-date (YTD) in January, while the tech-heavy Nasdaq Composite Index fell 12.0% into correction territory. The blue-chip Dow Jones Industrial Average (DJIA) is down 4.4% YTD.

US Markets Retreat

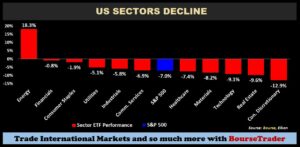

The S&P 500 neared correction territory this week – defined as a 10% decline from a recent peak. Year-to-date, the S&P500 Index is down 7.0%. 10 of the 11 sectors on the S&P 500 retreated from their 2021 highs, with cyclical sectors such as Technology and Consumer Discretionary leading the losses.

The Energy Select Sector SPDR Fund (XLE) continues to be the strongest performing sector in 2022 (up 18.3% YTD) after advancing 46.1% in 2021. This performance continues to be supported by elevated energy prices, global supply chain bottlenecking and increasing fears of supply disruption in Eastern Europe. On the contrary, the consumer discretionary sector, represented by the Consumer Discretionary Select Sector SPDR Fund (XLY), was the worst performing sector year to date (down 12.9% YTD) after rallying 27.5% in 2021. This comes on the back of weakened economic activity following the rapid spread of the Omicron variant.

Within the popular technology sector, popular names have been hit the hard in the first month of trading. Shares of the streaming giant, Netflix, Inc (NFLX) led the decline in technology stocks, falling 36.2% year-to-date (YTD). Tesla Inc. (TSLA) shares are 19.9% lower, after the company noted in its fourth-quarter earnings report on Wednesday 26th January, that its factories have been running below capacity for several quarters due to supply chain issues, which are likely to continue throughout 2022. Amazon.com, Inc (AMZN, â 13.6%), Paypal Holdings, Inc (PYPL â 13.3%), Meta Platforms, Inc (FB , â 10.3%), Microsoft Corporation (MSFT , â 8.3%), Alphabet Inc. (GOOGL â 7.9%) followed by Apple Inc. (AAPL â 4.1%) are all portfolio favourites which have taken a beating in 2022 thus far.

Local Markets Advance

The Trinidad and Tobago Composite Index (TTCI) advanced 1.8% YTD, supported by improvement in domestic equities. The All Trinidad and Tobago Index (All T&T) expanded 2.3%, while the Cross Listed Index (CLX) increased 0.4% YTD.

Some notable transactions by publicly listed companies in 2022:

- Effective, January 27th, 2021 Massy Holdings Ltd cross-listed onto the Jamaican Stock Exchange (JSE) and now trades under the symbol ‘MASSY’ with a debut price of J$2,463.08. MASSY closed at J$2502.28 (or equivalent TT$108.75), increasing 1.6% on Friday. The approval of the 20-for-one stock split which was voted at the annual meeting on January 21st, will take effect on March 11th.

- On January 21, 2022, Phoenix Park Gas Processors Limited (PPGPL) through its wholly owned subsidiary Phoenix Park Energy Marketing LLC (PPEM), completed its acquisition of an NGLs terminal located in Hull Texas, USA. PPGPL is a state-controlled company and is owned by NGC NGL Company Limited (51%), Trinidad and Tobago NGL Limited (TTNGL: 39%) and Pan West Engineers & Constructors LLC (10%).

Is this a buying opportunity?

Despite the large fluctuations in the market, market corrections are usually a normal (and healthy) part of investing in equities. The recent dip in the S&P 500 marks the 5th time this has happened since May 2015.

Market declines of this magnitude have become less frequent in recent history, with just a few notable periods when looking at the S&P500 Index including:

- February 24th 2020 (33.9% decline, 33 days)

- September 20st 2018(19.8% decline, 95 days)

- January 26th 2018 (10.2% decline, 13 days)

- November 3rd 2015 (13.3% decline, 100 days)

With many of the drivers of the recent market correction (inflation, interest rates and growth concerns) likely to prevail for some time to come, equity markets could – barring a sharp turnaround in investor sentiment – continue to struggle in the coming weeks/months. For the longer-term investor, however, such a market correction is often viewed as an opportunity to add some favoured stocks/ETFs to your portfolio.

We reiterate our guiding principles for investing in 2022: (i) diversification by sector, (ii) diversification by region and (iii) diversification by asset class.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”