HIGHLIGHTS

RFHL Q1 2022

- Earnings: Diluted Earnings Per Share improved 1.3% to $2.43 from $2.40

- Performance Drivers:

- Increased Income

- Lower Credit Loss Expense

- Lower Tax Expense

- Outlook:

- Economic Uncertainty

FCGFH Q1 2022

- Earnings: Earnings Per Share increased 2.9% from $0.69 to $0.71

- Performance Drivers:

- Increased Total Net Income

- Reduced Impairment Expenses

- Muted Loan Growth

- Outlook:

- Growth Potential from Acquisitions

- Economic Uncertainty

This week, we at Bourse review the performance of local Banking Sector giants Republic Financial Holdings Limited (RFHL) and First Citizens Bank Limited (FCGFH) for their first fiscal quarters ended 31st December, 2021. While both Groups benefitted from increased Operating Income and lower Credit Impairment Losses, earnings improvements were marginal. What might investors expect in the months ahead? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $2.43 for the three months ended 31st December, 2021 (Q1 2022), a marginal 1.3% improvement relative to the $2.40 reported in the prior comparable period (Q1 2021). Net Interest Income modestly increased 1.6% YoY by $15.6M. Other Income ticked up 2.3% to $466.9M, in Q1 2022 relative to $456.5M in Q1 2021. Operating Income marginally increased by 1.8% to $1.5B.

Operating Expenses for the period increased 2.7% from 849.4M in Q1 2021 to $871.9M in Q1 2022. Operating Profit for the period stood at $612.6M compared to $608.6M in Q12021, edging up 0.6%. Credit Loss Expense contracted by 8.9% in the current period. Profit Before Taxation (PBT) stood at $576.8M, 1.3% higher than $569.3M in the previous period. Taxation Expense fell 0.4% with the Effective Taxation Rate moving from 25.5% in Q1 2021 to 25.0% in Q1 2022. Overall, Net Profit Attributable to Equity holders of the Parent reportedly rose by $4.7M or 1.2%.

Revenues Inch Higher

RFHL’s Net Interest Income – which contributes approximately 68.5% to Operating Income – increased 1.6% in 2021. The Group earned Net Interest Income of $1.0B in Q1 2022, a modest increase of $15.6M from the prior comparable period. Likewise, RFHL achieved growth in Other Income (31.5% of Operating Income), expanding 2.3% or by 10.4M to $466.9M in Q1 2022. This is likely attributable to higher transaction volumes for the period, following the resumption of economic activity.

Overall, the result was underpinned by Operating Income expansion in Barbados (↑ 54.1%), followed by Guyana (↑8.6%) and British Virgin Islands (↑ 6.6%) year-on-year.

Geographic Diversification Expands

While RFHL has been expanding its efforts of regional diversification, Profit Before Tax (PBT) from its primary operating jurisdiction of Trinidad and Tobago (51.7% of PBT) contracted 12.5% YoY from $341.1M in Q1 2020 to $298.5M in Q1 2022.

The Eastern Caribbean, which represents the second largest contributor of PBT (11.2%), rose 35.1% to $64.6M. Barbados recorded a significant uptick of PBT from $2.5M to $39.0M in Q1 2022. In late 2021, Republic Bank (Barbados) Limited entered into an agreement with Victoria Mutual Investments Limited (VMIL) to sell 100% of the issued and authorized common shares in Republic Funds (Barbados) Inc., subject to regulatory approval in Barbados and Jamaica. The operations of Republic Bank (Barbados) would now be concentrated on its core business of commercial banking.

British Virgin Islands (B.V.I) expanded 29.0% year-on-year with PBT moving from $16.2M to $20.8M in the current period. Guyana (8.6% of PBT) recorded an increased PBT from $46.3M to $49.8M for the period, up 7.4%, reflecting growth in all sectors.

RFHL also experienced additional downturn across operations in other countries where economic conditions were less than favourable. Suriname’s PBT fell to $10.5M in Q1 2022 from $22.5M in Q1 2021, down 53.0%. PBT from Cayman Islands declined 2.1% to $53.0M.

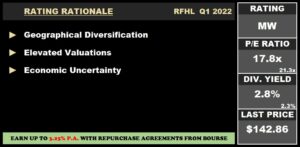

The Bourse View

At a current price of $142.86 and having appreciated 1.9% year to date, RFHL trades at a trailing P/E of 17.8 times, below the sector average of 21.3 times. While below the current banking sector average, RFHL is trading at an earnings multiple above its recent pre-COVID average during 2017-2019 of 13.1 times. The stock offers a trailing dividend yield of 2.8% relative to a sector average of 2.3%. The current pandemic continues to weigh on regional economic activity, coupled with the impact of the global supply constraints. RFHL should prove generally resilient even in challenging times with its expanded geographical footprint, though its main market T&T continues to struggle in the near-term. On the basis of continued geographical diversification of operations and growth from acquisition activity but tempered by elevated valuations and subdued economic activity, Bourse assigns a MARKETWEIGHT rating on RFHL.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) reported an Earnings Per Share (EPS) of $0.71 for the three months ended 31st December, 2021 (Q1 2022), up 2.9% relative to $0.69 reported in the prior comparable period (Q1 2021).

Net Interest Income contracted 5.2% from $381.8M in Q1 2021 to $362.1M in Q1 2022. Other Income expanded 24.8% or $34.9M to $175.3M. Resultantly, Total Net Income increased 2.9% to stand at $537.4M. Credit Impairment Losses Net Recoveries declined 133.7% following a Credit Impairment Loss reversal of $5.4M in Q1 2022, relative to a Credit Impairment Loss in the prior period of $16.0M. Non-Interest Expenses increased 8.1% from $277.4M in Q1 2021 to $299.8M in Q1 2022. Ultimately, Operating Profit increased 6.1% to $243.0M.

FCGFH reported a total Share of Profit in Associates and Joint Ventures of $5.4M, up 34.4% from a prior $4.0M. Profit Before Taxation stood at $248.4M. Taxation Expense increased 6.6% to $66.8M, with the Group’s effective tax rate increasing marginally from 25.4% in Q1 2021 to 26.9% in Q1 2022. Overall, Profit After Taxation increased 4.4% to $181.6M, relative to $173.9M in Q1 2021.

Credit Impairment Losses Decline

FCGFH’s Total Loans fell 2.7% year-on-year from $18.8B in Q1 2021 to $18.3B in Q1 2022, as economic activity and demand for loans remain muted. The Group recorded a reversal in its Credit Impairment Losses in the amount of $5.4M, signalling an improvement of their loan portfolio.

Segment Performance Mixed

FCGFH grew its Profit Before Tax (PBT) by 6.6% YoY. Underpinning this performance was an 11.8% increase in its Retail & Corporate Banking segment, historically the largest contributor to PBT, accounting for 75.0% of PBT before eliminations. Treasury & Investment Banking, the second largest contributor to PBT (20.6% before eliminations) declined 13.3% YoY. Trustee & Asset Management (4.5% of PBT before eliminations) fell 6.7%, likely owing to reduced business activity.

The Bourse View

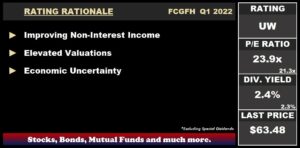

At a current price of $63.48, FCGFH trades at a P/E ratio of 23.9 times, above the Banking Sector average of 21.3 times. The Group declared an interim dividend payment of $0.40, payable on March 4th 2022 to investors on record by February 16th 2022. The stock offers investors a dividend yield of 2.4%, in line with the sector average of 2.3%.

FCGFH’s acquisition of Scotiabank’s operation in Guyana, if successful, would allow the Group to expand its geographic footprint while benefitting from the country’s rapid economic growth (IMF growth projection for 2022: 48.7%).

Relative to its historical P/E multiple (average P/E 2017-2019: 14.0 times), FCGFH appears to be more expensive from a valuation perspective, likely due to investors factoring in the growth potential from its pending acquisition of Scotiabank Guyana’s operations. On the basis of marginal earnings improvement, elevated valuations and a weaker loan environment, Bourse assigns an UNDERWEIGHT rating on FCGFH.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”