HIGHLIGHTS

RFHL HY 2022

- Earnings: Diluted Earnings Per Share improved 5.9% to $4.46 from $4.21

- Performance Drivers:

- Increased Revenues

- Lower Credit Loss Expense

- Outlook:

- Normalization of economic activity

- Rating: Maintained at MARKETWEIGHT

FCGFH HY 2022

- Earnings: Earnings Per Share increased 9.1% from $1.21 to $1.32

- Performance Drivers:

- Lower Total Net Income

- Reduced Impairment Expenses

- Muted Loan Growth

- Outlook:

- Growth Potential from Acquisitions

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of local Banking Sector giants Republic Financial Holdings Limited (RFHL) and First Citizens Group Financial Holdings Limited (FCGFH) for their six months (HY 2022) ended 31st March, 2022. Both Groups benefitted from increased Operating Income and lower Credit Impairment Losses, despite FCGFH’s fall in Net Interest Income relative to RFHL. What might investors expect in the months ahead? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $4.46 for the six months ended 31st March, 2022 (HY 2022), up 5.9% relative to the $4.21 reported in the prior comparable period (HY 2021).

Net Interest Income marginally increased 1.1% YoY by $21.6M. Other Income rose 7.8% to $980.1M, in HY 2022 relative to $908.8M in HY 2021. Operating Income improved by 3.2% to $3.0B. Operating Expenses for the period increased 3.7% from $1.7B in HY 2021 to $1.8B in HY 2022. Operating Profit for the period stood at $1.2B compared to $1.16B in HY 2021, up 3.5%. Credit Loss Expense contracted by 28.1% in the current period. Profit Before Taxation (PBT) stood at $1.1B, 7.6% higher than $1.0B in the previous period. Taxation Expense increased 12.2% with the Effective Taxation Rate moving from 26.2% in HY 2021 to 27.6% in HY 2022. Overall, Net Profit Attributable to Equity holders of the Parent rose by $41.4M (↑6.0%) to $728.7M.

Revenues Higher

RFHL’s Net Interest Income – which contributes approximately 67.2% to Operating Income marginally increased 1.1% in HY 2022. The Group earned Net Interest Income of $2.01B in HY 2022, relative to $1.98B the prior year. Similarly, Other Income (32.8% of Operating Income) expanded 7.8% to $980M in HY 2022. This was likely driven by the increased transaction volumes as economic activity continues to normalize.

Overall, RFHL has been able to improve income across its revenue streams with Operating Income rising from $2.89B to $2.99B in the period under review. This result is underpinned by Operating Income expansion in the Eastern Caribbean (↑9.6%), Ghana (↑8.9%), Guyana (↑7.8%) and Trinidad and Tobago’s (↑4.8%) operations year-on-year.

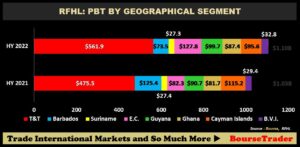

PBT Expands

RFHL recorded an expansion in its operations with PBT advancing 7.6% to $1.1B in the period under review. PBT from Trinidad and Tobago, the Group’s primary operating jurisdiction (50.8% of PBT) advanced 18.2% YoY to $561.9M from a previous $475.5M. The Eastern Caribbean replaced Barbados as the second largest contributor of PBT (11.6%), advancing 55.3% in the period under review from $82.3M to $127.8M.

British Virgin Islands (BVI) expanded 11.6% YoY, moving from $29.4M to $32.8M in HY 2022. Guyana (9.0% of PBT) reported increased PBT from $90.7M to $99.7M, up 9.9%.

Despite growth in these territories, RFHL experienced some downturn in other countries where economic conditions were less than favourable. PBT from Barbados fell 41.4% to $73.5M while PBT from The Cayman Islands fell 17.0% to $95.6M.

The Bourse View

At a current price of $140.01, RFHL trades at a trailing P/E of 16.9 times, below the Banking Sector average of 18.2 times. The Board of Directors declared an interim dividend of $1.05, payable on May 31st 2022 to shareholders on record by May 13th 2022. The stock offers investors a trailing dividend yield of 2.9%, above the sector average of 2.5%. Despite a still uncertain environment, RFHL grew its total assets and loan portfolio by 5.8% and 1.5% respectively, highlighting the Group’s resilience. As economic activity begins to normalize across its operating jurisdictions, Credit Losses are likely to moderate, potentially providing support for earnings in subsequent reporting periods. On the basis of geographical diversification of operations, improved earnings and fair valuations, Bourse maintains a MARKETWEIGHT rating on RFHL.

First Citizens Group Financial Holdings Limited (FCGFH)

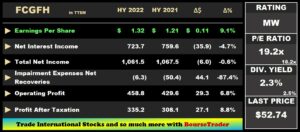

First Citizens Group Financial Holdings Limited (FCGFH) recorded Earnings per Share (EPS) of $1.32 for the six months ended 31st March, 2022 (HY 2022), up 9.1%, relative to $1.21 reported in the prior comparable period (HY 2021).

Net Interest Income declined 4.7%, moving from $759.6M in HY 2021 to $723.7M in the current period. Other income advanced 9.7%, amounting to $337.8M. Overall, Total Net Income was 0.6% lower, standing at $1.06B, relative to $1.07B in the previous period. The Bank benefited from lower Impairment Expenses net Recoveries of $6.3M, down 87.4% compared to a prior expense of $50.4M. Expenses amounted to $596.4M, $8.8M or 1.5% lower year-on-year. Consequently, Operating Profit increased 6.8%, moving from $429.6M to $458.8M in HY 2022. Share of Profit from Associates and Joint Ventures fell 0.7% to $10.5M in the current period. Profit Before Taxation climbed 6.6% to $469.3M from a prior $440.1M. Taxation expense stood at $134.1M in HY 2022. Overall, Profit After Taxation advanced 8.8% from $308.1M in the prior period to $335.2M.

Credit Impairment Expenses Reduced

FCGFH’s Loans to Customers fell 3.2% during the period from $18.7B in HY 2021 to $18.1B in HY 2022, potentially reflecting still-sluggish economic conditions. Credit Impairment Expenses, meanwhile, declined 87.4% relative to HY 2021, indicating improving (or less severe) credit conditions and more resilient loan performance. The normalization of economic activity both locally and regionally may serve as a tailwind for improvement in general credit quality conditions and by extension, the credit quality of the Group’s loan portfolio. However, this could be tempered by reduced demand for loans by consumers in the context of an environment of increasing inflationary pressures and lower disposable income.

Segment Performance Mixed

FCGFH grew its Profit Before Tax (PBT) by 6.6% YoY. Retail & Corporate Banking continued to be the dominant contributor to PBT, accounting for 58.5% before eliminations. The segment increased 25.0% from $349M in HY 2021 to $436M in HY 2022, despite the decline in Total Net Income in the segment. Consumer lending remained muted, whilst commercial lending trended upwards arising from the significant relaxation of Covid-19 restrictions.

Treasury & Investment Banking, the second largest contributor to PBT (37.8% before eliminations) declined 2.3% YoY. Trustee & Asset Management (3.7% of PBT before eliminations) fell 8.1%.

APO of FCGFH

The Government of the Republic of Trinidad & Tobago (GORTT) intends to raise approximately TT$550M through the capital market in Fiscal 2022, via an Additional Public Offering (APO) of 10,869,565 of ordinary shares in FCGFH. The Government’s current controlling interest is 64.4% or 161,946,890 shares. This would calculate to be roughly $50.60 per share. The proposed sale would result in shareholding post-completion of 151,077,325 shares or 60.1% of issued shares.

The Honourable Minister of Finance, Colm Imbert stated in Parliament in March 2022 that the Government is targeting the middle of the year (June 2022) for the APO. Investors can look forward to this upcoming divestment, as the Bank continues to drive for growth and shareholder value creation via diversification, likely into new markets and territories. FCGFH’s pending acquisition of Scotiabank’s Operations in Guyana, if successful, would enable the Group to benefit from Guyana’s energy-fueled economic growth.

The Bourse View

FCGFH is currently priced at $52.74 trades at a P/E ratio of 19.2 times, (its historical average P/E multiple during 2017-2019 was 12.6 times) and relatively in line with the Banking Sector average of 18.2 times. The Group declared an interim dividend payment of $0.34 per share to be paid on 27th May, 2022.The stock offers a dividend yield of 2.3%, below the sector average of 2.5%.

Sluggish employment conditions and increasing supply-side inflation in T&T could impact consumer activity in coming periods, which could be offset by increasing activity as economies emerge from COVID-19 restrictions.

On the basis of improved performance in its non-retail segments and a return to relatively fair valuations, but tempered by a near-term weaker loan environment, Bourse upgrades its rating on FCGFH to MARKETWEIGHT.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”