HIGHLIGHTS

Retirement Planning

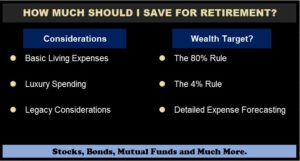

- How Much should I be saving?

- The 80% rule

- The 4% rule

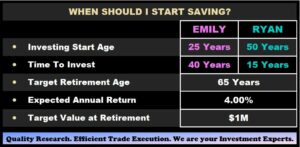

- When should I start saving?

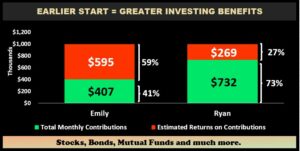

- Benefit from the power of compounding

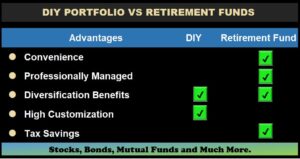

- What are my investment options?

- Investing in Retirement Funds

- DIY Investment Approach

This week, we at Bourse seek to shed light on a question that is sometimes considered much later than it should be: ‘Am I financially prepared for retirement?’ The recently read national budget provided guidance on a coming increase in the retirement age from 60 to 65. Regardless of when you retire, ensuring you have sufficient income post-employment to (i) live comfortably and/or (ii) enjoy new experiences is a process that should begin at the earliest point possible. How much you should save and how you should save are usually specific to each individual’s personal circumstances. We provide some general guidance and information to get you started in preparing for retirement.

How much should I save for retirement?

An important part of achieving financial comfort in retirement is setting a financial goal: the value accumulated or monthly income which, under normal circumstances, should allow you to afford your desired lifestyle. Desired lifestyle tends to comprise key items such as (i) basic living costs, (ii) luxury expenses and (iii) legacy (inheritance) considerations. How do you determine your number? There is no ‘one-size-fits-all’ answer, as different individuals have varying views on what is considered a comfortable retirement lifestyle. While complex and highly detailed analysis can be done to arrive at your retirement number, several useful and easily understood approaches/metrics can also help establish a fair idea of what your retirement income/wealth target should be.

The 80% rule. This rule suggests that retirees should aim to replace approximately 80% of their pre-retirement income during retirement, on the basis that certain expenses (mortgage payments etc.) will decrease or disappear altogether. Using this approach, an individual working for $15,000 monthly would require around $12,000 monthly of income in retirement. It should be noted, however, that individuals often simplify their lives in retirement, which may lead to lower retirement income needs.

The 4% rule is another approach, which in its simplest form calculates a target retirement ‘nest egg’ based on (i) your target annual retirement income/expenses and (ii) an assumption that you withdraw approximately 4% of your initial nest egg annually. For example, an individual with a target annual income (or expected expenses) of $120,000 ($10,000 monthly) would need a retirement nest egg of around $3M ($120,000/0.04), excluding any other sources of post-retirement income.

When should I start saving for retirement?

Whichever approach you use, let’s assume you’ve calculated your retirement number. Another important question to consider is “when should I start saving for retirement?”. The simple answer is, right now! An earlier start engages a very impactful investing concept: the benefit of compounding returns.

Let’s consider the case of two individuals, Emily and Ryan, who both earn $10,000 monthly, amounting to an annual gross salary of $120,000. Emily started building her long-term wealth at the age of 25 years, while Ryan began at the age of 50. Both individuals aim to retire at 65 years old, with the belief that their accumulated wealth at that age should be one million ($1M) at retirement. Both individuals also believe that they can achieve a reasonably conservative average annual return on their savings of 4.0% per annum.

With those assumptions and targets, our ‘early starter’ investor, Emily, would have to invest/make monthly contributions of $847 (roughly 8.5% of her gross salary) to achieve her retirement target of $1M. Comparatively, our ‘late starter’ investor, Ryan, who has 15 years before reaching retirement age, would need to make a monthly contribution of $4,064 (or 41% of gross salary) under the same conditions. Importantly, to achieve the same objective, Ryan is required to set aside around 4.8 times the amount each month compared to Emily, who started saving/investing for retirement much earlier.

This example is a compelling illustration of the “power of compounding”: generating investment returns on (i) your savings and (ii) the returns generated by those savings. Emily’s total contributions over a much longer time period would total around $407,000. The remaining $595,000 (or roughly 59%) of her $1M goal would have been generated by investment returns. In contrast, Ryan would have made cumulative contributions of $732,000 to achieve his $1M goal. However, only $269,000 (or around 27%) of his target value would have been achieved from investment returns.

Less obvious but equally important with an earlier start is the fact that Emily would have more flexibility on a monthly basis over a longer period with her income. Ryan, meanwhile, might feel a little more constrained in his later years, having to set aside a significant portion of his income to achieve the same retirement target as Emily. Additionally, a longer investment period usually gives investors the benefit of being able to ‘ride out’ economic and market cycles, with short-term fluctuations being less impactful (more often than not) to long-term wealth accumulation.

What retirement investment options do I have?

So, you’ve (i) determined your retirement number and (ii) decided to start saving and investing as soon as possible. A third and equally important question for individuals needs to be answered: ‘what investment options do I have available?’ This is a key component of your retirement readiness, as the selection of an investment option(s) will influence just how much you might need to save. Taking the investment route, there are two broad alternatives: (i) investing in a retirement fund, or (ii) the Do-It-Yourself (DIY) investment approach.

The Retirement Fund Approach

One of the more common approaches for saving for retirement, contributing to a registered Retirement Fund is a conveniently packaged solution to achieving retirement goals. Investors can select to place their fund maturity between ages 50 to 70. Retirement funds offer a host of benefits, including (i) professional and active investment management, (ii) diversification built-in to the portfolio, (iii) plan flexibility into the amount and frequency of contributions and most importantly (iv) the ability to save on taxes today.

With respect to tax benefits, individuals can currently avail of a tax allowance up to $60,000 annually on retirement funds that are registered with the Board of Inland Revenue. In other words, using a retirement fund as an investment vehicle to achieve your future financial goals could generate up to $15,000 tax savings annually. Seeking professional advice can provide valuable insights and help you create a solid retirement savings plan. At maturity of an individual’s Retirement Fund plan, the investor can choose one of two options:

(i). A Lump sum plus annuity, receiving 25% as a tax-free lump sum, with the remaining 75% used to purchase an immediate annuity which will generate monthly income, OR

(ii). A total annuity pay-out, where 100% of the plan value is used to purchase an immediate annuity which will generate monthly income.

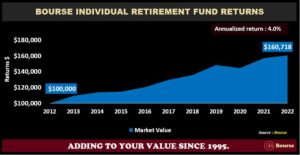

There are several retirement fund solutions to choose from in Trinidad & Tobago, made available by major financial services providers including Bourse. Taking a closer look at the Savinvest Individual Retirement Fund (IRF), managed by Bourse, a single lump-sum investment of $100,000 made at the start of 2012, for example, would be worth $160,718 as at the end of 2022, (around a 4.0% annual return over the period).

The ‘DIY’ Investment Approach

Another available option to preparing for retirement is the Do-It-Yourself or DIY Approach. Like traditional investing, this involves the investor building his/her own investment portfolio (with varying degrees of input/advice) and subsequently self-monitoring and managing it. The main benefit of the DIY approach is customization: an individual could tailor his/her portfolio to specific risk/return preferences. The DIY approach, however, forgoes the professional management which is found with Retirement Funds. It may also limit the individual investor to ‘retail’ investment opportunities, as opposed to investments which would be made available to institutional investors (including pension funds, retirement funds and other mutual funds). Importantly, the DIY approach forgoes allowances on taxes.

Which Approach is best for me?

Ultimately, the best approach is specific to each individual’s circumstances. The Retirement Fund route does, however, offer more benefits when compared to the ‘DIY’ investment approach, with convenience being high on the list of attractive features. For individuals, preparing financially for retirement – whether at age 60, 65 or any other number – shouldn’t be viewed as a daunting task. A few simple steps – starting with a self-evaluation of your desired future living standards – can set you on the path to achieving the retirement lifestyle you want and are willing to prepare for. As always, it makes good sense to consult with an expert investment adviser – like Bourse – to help make more informed investment decisions.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”