HIGHLIGHTS

Revenue 2020/2021

- Revenue:

- Total Revenue ↑ 3.7% YoY, from $25B in 9M 2020 to $25.9B in 9M 2021

- Current Revenue ↑ 3.4% YoY

- Capital Revenue ↑ 21.8% YoY

- Tax Revenue ↑ 9.5% YoY

- Performance Drivers:

- Recovery of Energy Prices

- Decline of Production & Exports in Energy markets

- Business Closures & Lockdowns

- Outlook:

- Economic Reopening

- Ongoing Vaccination Drives

- Variants of the COVID-19

With the FY2021/2022 National Budget to be read on 04th October, 2021, this week we at Bourse review the Revenue side of the budget equation. Coming under significant pandemic-related and other pressures in recent times, T&T’s traditional revenue sources fell short of expectations in FY2019/2020. Despite improvement in energy prices during the course of FY2020/2021, disruptions to economic activity and lower domestic energy production suggest that revenue for the soon-to-be concluded fiscal year (FY2020/2021) could also fall short of expectations. How could this affect the FY2021/2022 fiscal outlook? Could any initiatives be taken to improve the revenue outlook? We discuss below

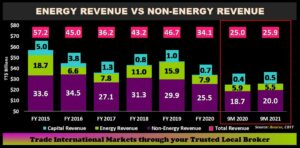

Revenue: Energy vs. Non-Energy

Based on data available from Central Bank of Trinidad and Tobago (CBTT), total revenue for the first 9 months of fiscal 2020/2021 appears to have improved marginally, increasing to $25.9B from the $25.0B reported in 9M of FY2019/2020 (+3.7%). Energy revenue amounted to TT$5.5B, a 7.6% decline from $5.9B reported in the prior comparable period. This is evident from the fall in production of Liquefied Natural Gas (-40%) for 9M 2020/2021 and Natural Gas (-23%) for October ‘20 to May ’21, falling from 3,451 mmscfd to 2,656 mmscfd. Crude Oil production only marginally increased for the same comparable period, up 0.6% from an average 57,550 barrels of oil per day (bopd) to 57,888 bopd.

Despite lockdowns on the domestic and regional level, Non-Energy revenue increased 6.9% from $18.7B in 9M 2020 to $20B in 9M 2021.

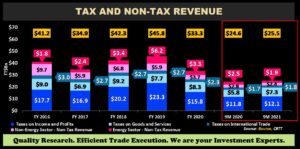

Revenue: Tax vs. Non-Tax

Tax Revenue increased 9.5% to $21.2B in 9M 2021 from $19.3B in 9M 2020. The largest component of Tax Revenue, Taxes on Income and Profits (2020: 59.9% of Tax Revenue) increased 2.6% from $11.8B in 9M 2020 to $12.1B in 9M 2021. Tax Revenue on Goods and Services, the 2nd largest contributor to Tax Revenue (2020: 31.5%), grew by 25.9% from $5.8B to $7.3B in 9M 2021. Meanwhile Taxes on International Trade (2020: 8.7% of Tax Revenue), consisting mostly of import duties, rose by 3.3% from 9M 2020 to 9M 2021. For the Fiscal 9M 2021, Non-Tax Revenue accounted for $4.3B of the $25.5B Total Revenue collected, 19% lower than $5.3B (9M 2020). The Non-Energy Sector is the largest contributor of T&T’s Non-Tax Revenue (2020: 52.8%). It comprises of proceeds from Rental Income, Interest Income, Royalties, Profits from Non-Financial Enterprises and from Public Financial Institutions, Fines and Forfeitures and revenue from the payment of Administrative Fees and Charges for government services.

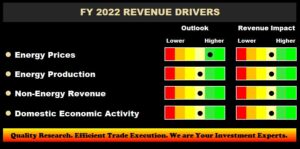

Energy Prices Recover

Budgeted Revenue for FY 2021 was pegged at an oil price of US$45.00/barrel, lower than both the Energy Information Administration’s (EIA) 2021 price of US$65.69/barrel and the 9M average market price of US$53.99/barrel. With relatively stable production of Crude Oil, better-than-expected prices should support revenue generation.

The FY 2021 Budget was based on a Natural Gas price of US$3.00/MMBtu, below the EIA’s 2021 forecast of US$3.77/MMBtu but higher than the 9M average market price of US$2.83/MMBtu. Despite prices being relatively in-line with budgeted estimates, the marked decrease in Natural Gas production over the Oct ’20 to May ’21 comparable (-23%), with revenue from Natural Gas production traditionally making up the majority of energy revenues, could be a cause for concern.

Revenue Outlook Brighter

In the short run, the EIA expects the price of oil to remain near current levels for the remaining of 2021, with a calendar fourth-quarter average of US$71.00/barrel and expects the price of Natural Gas to average USD$4.00/MMBtu during the same period. The recovery of prices should have a positive impact on revenue projections for the upcoming fiscal year.

On the domestic energy production front, bpTT’s very recent announcement of early first gas from its Matapal project (adding around 250-350 mmscfd of natural gas production) would be welcome news. BHP’s earlier announcement in May 2021 of first oil from its Ruby Natural Gas Field – expected to have the capacity to produce an estimated 16,000 bopd of crude oil and estimated natural gas production of 80 mmscfd – should also boost future revenues for the state.

On the non-energy front, increased vaccination drives in Trinidad and Tobago could also aid revenue recovery, with several non-energy sectors set to benefit from increased movement of the population and a return to higher employment.

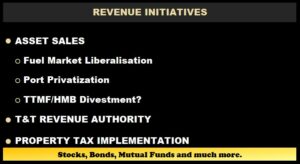

Revenue Initiatives

During the FY2020/2021 budget reading, Honourable Minister of Finance Colm Imbert announced the intention to sell National Petroleum Company’s approximately 81 Company-Owned Dealer Operated (CODO) gas stations, as part of a broader fuel market liberalization initiative. The conclusion of this process should generate some additional Revenue, though the estimate value of sale proceeds remains unclear. While legislation to liberalise the fuel market was passed in Parliament, it has not yet been implemented.

Minister Imbert in 2020 also announced the Government’s plan to privatize the Port of Port of Spain in the 2020/2021 Budget presentation. At the time of writing, the Port Authority of Trinidad and Tobago would have issued a Request for Expressions of Interest for a potential public-private partnership project.

On August 6th, 2021, the Board of Directors of Trinidad and Tobago Mortgage Finance Company Ltd (TTMF) and Home Mortgage Bank (HMB) approved a merger of both entities’ operations. The merger is expected to provide business synergies between both entities, increasing returns to the shareholders. The combined asset base of TTMF and HMB as at FY 2020 is TT$7.5B, with total equity $2.3B. The divestment of a merged TTMF/HMB via public offering has been mentioned over the past several years. The approved merger could bring this initiative one step closer to reality.

The T&T Revenue Authority (TTRA) Bill was passed in the Senate on 17th September, 2021 to replace the Board of Inland Revenue and Customs and Excise Division. The TTRA, as envisaged, is expected to improve tax collections with potentially $5 billion in Value Added Tax (VAT) revenue annually ‘lost’ at present.

The long-touted Property Tax is also close to implementation, which could add another tax-based revenue stream to the state’s coffers. Some experts have estimated annual Property Tax revenue to be in the order of $500M.

Next week, we review the expenditure side of the budget equation, which may have a more pronounced impact on this fiscal outlook for Trinidad & Tobago.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”