HIGHLIGHTS

Expenditure 2020/2021

- Expenditure:

-

- Total Expenditure ↓ 7.0% YoY, from $35.7B in 9M 2020 to $33.1B in 9M 2021

- Current Expenditure ↓ 4.8% YoY

- Capital Expenditure ↓ 39.1% YoY

-

- Lower Capital Expenditure

- Social Spending Provides Economic Support

- Outlook:

-

- Shifts in Expenditure Allocations Likely

- Inflation Likely to Trend upwards

- COVID-19 Related Expenditure Persists

- Mandatory Spending Remains High

As the Honourable Minister of Finance prepares to deliver his FY2021/2022 budget speech today, this week we at Bourse examine the historically ‘sticky’ expenditure side of the budget equation. Substantial dips in revenue over the past several fiscal years have not been met with commensurate cuts in expenditure, creating multiple years of Expenditure exceeding Revenue (fiscal deficits). With the path to Revenue improvement likely being slow, can any adjustments to Expenditure be made to help balance the country’s fiscal position? We discuss below.

Expenditure to End Higher?

Government Expenditure has averaged around $50.0B from FY2016 to FY2020. The FY2021 budget was based on a 2.4% decrease in Total Expenditure to $49.6B. With an additional $2.9B approved via the Supplementation and Variation of Appropriation (Financial Year 2021) Act, Total Expenditure for the soon-to-be-concluded FY2021 could be higher than initially estimated.

Capital Expenditure Curbed

Total Expenditure consists of all recurrent (current) and capital expenditure. Current expenditure comprises of spending by the Central Government on items non-capital in nature, meaning they provide a productive use to society but may not necessarily provide a concrete asset in return that can be used for revenue generation. Capital expenditure is money invested to facilitate production and revenue generation. Traditionally, current expenditure comprises a larger percentage of total expenditure than capital expenditure.

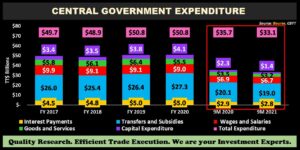

For the past 5 years (excluding any FY2021 values), current expenditure has averaged $46.8B or a little over 92% of Total Expenditure. Current expenditure for the first 9M of FY2021 was reported to be $31.7B, 4.8% lower than the prior comparable period in FY2020. Capital Expenditure for 9M FY2021 fell to $1.4B compared to 9M FY2020’s $2.3B. With Revenue constrained, Capital Expenditure would hold lower priority relative to paying ‘day-to-day’ expenses. In February 2021, the Honourable Minister of Finance noted that mandatory payments for T&T (including salaries and wages and financial support to regulated industries) amounted to $3.5B on a monthly basis, or approximately $42B annually.

Transfers & Subsidies Dominate

A closer look at the composition of expenditure reveals that Transfers & Subsidies account for 57.4% of Total Expenditure for 9M 2021, amounting to $19B. The second highest component, Wages and Salaries (20.3% of Total Expenditure), experienced a marginal decline of 2.2% from $6.9B in 9M 2020 to $6.7B in 9M 2021.

Expenditure on Goods and Services also fell 9.4% YoY, to $3.2B in 9M 2021. Interest Payments decreased from $2.9B to $2.8B in 9M 2021, or 8% of Total Expenditure.

Total Expenditure slipped 7.7% from $35.7B in 9M 2020 to $33.1B in 9M 2021. In addition, supplementary funding was given to the 14 municipal corporations in the sum of $94M for payment of wages and salaries to maintain staff, as well as sums owed for the provision of goods and services.

Breakdown of Transfers and Subsidies

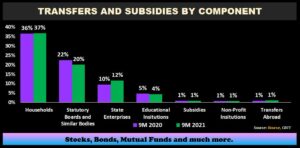

For the fiscal 9-month period (October 2020-June 2021) Transfers and Subsidies amounted to $19.0B, down 5.4% from $20.1B reported in the prior comparable period. Transfers to households, the largest component of Transfers and Subsidies, increased marginally by 1% from $7.3B in 9M 2020 to $6.9B in 9M 2021. Transfers to Statutory Boards and Similar Bodies declined 2% or $0.7B whereas Transfers to State Enterprises increased 2% over the 9-month period. Transfers to Educational Institutions decreased by 1% (117.8M) while Subsidies, Transfers to Non-Profit Institutions and Transfers Abroad each remained constant at 1% of Transfers and Subsidies.

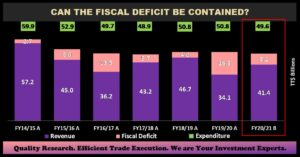

Funding the Fiscal Deficit

Trinidad and Tobago’s budget has been operating in a fiscal deficit for over a decade. Over the last five fiscal years, the cumulative Fiscal Deficit sums to $48B. Put differently, T&T would have had to fund an average $9.6B deficit annually through some combination of asset sales (divestments, initial public offerings, privatizations etc.), borrowing and drawdowns on savings (the Heritage and Stabilization Fund or HSF).

Expenditure Initiatives & Outlook

In tandem with several likely Revenue initiatives including the T&T Revenue Authority (TTRA) bill recently passed and the Property Tax close to implementation, the efforts to curb Expenditure levels would likely be equally important to balancing the budget equation. Transfers and Subsidies remain the largest component, with increased allocations through the Income Support programme and Salary Grants required in the current environment.

In a June 2021 press conference, the Honourable Minister of Finance reiterated the need to address subsidies including fuel, electricity and water to better manage the country’s financial position. This was initially highlighted during the FY2020/2021 budget speech, where reviews to tariffs for electricity and water rates were expected to take place. To date, no changes to rates have yet occurred.

The FY2020/2021 budget also spoke to the liberalization of fuel markets and the shift to floating fuel prices in T&T. Initially carded for January 2021, fuel prices have remained fixed. With the price of Crude Oil currently soaring above US$70/barrel, it is likely that the fuel subsidy bill for the now-concluded fiscal period would be higher than initially estimated. Wages and Salaries, meanwhile, are likely to remain sticky in the near-term, whereas, interest payments are likely to increase, with government borrowing expanding to fund the fiscal deficit.

The areas which might have greater room for adjustment to spending would lie within expenditure on Goods and Services, as well as Capital Expenditure. These segments, however, collectively comprise less than 20% of Total Expenditure. With the reallocation of expenditure from infrastructure & capital projects towards grants and social spending support, consideration of the economy’s ability to absorb extended periods of capital expenditure cuts would be needed. With the likelihood of another fiscal deficit for FY2021/2022, additional debt issuance, drawdowns on the HSF and asset sales may have to be pursued. Against this backdrop, wider-ranging concerns related to T&T’s debt-to-GDP ratio, level of the HSF, International Reserves and international credit ratings will come into focus.

We at Bourse take this opportunity to wish the Honourable Minister of Finance a successful delivery of the FY2021/2022 fiscal budget.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”