HIGHLIGHTS

PHL Q1 2022

- Earnings: Earnings Per Share increased 175.8% to $0.03

- Performance Drivers:

- Improved Operating Margins

- Lower Finance Costs

- Outlook:

- Supply Chain Challenges

- Higher Cost of Living

- Normalization of Operations

- Rating: Maintained at MARKETWEIGHT

AHL FY 2021

- Earnings: Earnings Per Share improved 8.5% to $0.77 from $0.71

- Performance Drivers:

- Increased Revenues

- New product offerings

- Outlook:

- Reopening of entertainment channels

- Supply Chain Disruptions

- Rating: Assigned at MARKETWEIGHT

This week, we at Bourse review the financial performance of Prestige Holdings Limited (PHL) for the first quarter ended 28th February 2022 and Angostura Holdings Limited (AHL) for its financial year ended 31st December 2021. Both groups delivered higher year-on-year results, with PHL benefiting from reopening initiatives and lower operating expenses. AHL, meanwhile, experienced robust growth in its international markets. How will both companies fare in the months ahead? We discuss below.

Prestige Holdings Limited (PHL)

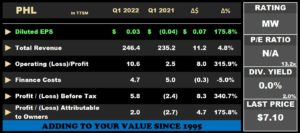

Prestige Holdings Limited (PHL) reported a Diluted Earnings per Share (EPS) of $0.03 for the first-quarter ended February 28th, 2022 (Q1 2022), 175.8% higher than the Loss Per Share (LPS) of $0.04 recorded in the previous period.

Revenue increased 4.8% from a previous $235.2M in Q1 2021 to $246.4M in Q1 2022. Cost of Sales rose 6.7% to $168.5M leading to a Gross Profit of $77.9M. Operating Expenses fell 7.0% from $54.8M to $50.9M in Q1 2022. PHL reported an Operating Profit of $10.6M relative to a previous $2.5M, advancing 315.9% year-on-year. Finance Costs fell 5.0% to stand at $4.7M. The Group recorded a Profit Before Tax (PBT) of $5.8M, 340.7% higher than a Loss Before Tax (LBT) of $2.4M in the prior period. Overall, PHL reported a Profit Attributable to Owners of the Parent Company of $2.0M.

Revenues Grow

PHL’s total revenue expanded to $246M in Q1 2022 from $235M in Q1 2021, as a result of the reopening of all restaurants with Safe Zone restrictions leading to improved economic activity for the quarter. Revenue growth increased 4.8% relative to a fall of 19.2% in the prior period. The Group experienced growth in its digital, delivery and drive-thru channels as well as strong management of operating costs and efficiencies. The lifting of restrictions could further aid recovery in the Group’s performance back to pre-pandemic levels. Looking forward, the Group is focused on building a robust platform to drive growth via its sales channels, signalling potential for further revenue improvement.

Margins Broadly Higher

PHL’s Gross Profit Margin declined from 32.9% in Q1 2021 to 31.6% in FY 2021, given the significant food cost inflation and supply chain disruptions at a global level. PHL closed a Subway location during the quarter in Lowlands Tobago, which reduced its store count to 128 locations, inclusive of the TGI Fridays location in Jamaica. Despite economic reopening, supply-chain challenges may continue to persist in the short term.

Operating Profit Margin moved from 1.1% to 4.3% in Q1 2022, underpinned by stringent cost management reflected by the decline in the Group’s operating expenses. This would have filtered into its Profit Before Tax (PBT) margin, expanding from -1.0% to 2.4%.

Expansion of Caribbean operations to drive growth

Starbucks Corporation will see the addition of four new licensed stores in Trinidad and Tobago during 2022, (expanding locations to 12) and Guyana’s first store to be opened between September to November by PHL, which won the development rights for the country. Guyana continues to see an unprecedented level of interest by various companies across the region and is positioned to maintain a positive economic standing because of its burgeoning oil and gas sector. According the International Monetary Fund (IMF), Guyana is expected to achieve GDP growth of 47.2% for 2022 and a further 34.5% at the end of 2023. This venture should augur well for the prospects of PHL into 2023 and beyond.

The Bourse View

At a current price of $7.05, PHL trades at a market to book ratio of 1.7xs compared to the Trading sector average of 1.3 times.

The announcement of the removal of safe zone operations, limits on public gatherings and the resumption of dine-in operations of the PHL restaurants is expected to positively influence performance in subsequent periods. Ongoing economic pressures, particularly the rising cost of living, could possibly reduce consumers’ disposable income. The Group noted that the global supply chain challenges may put more pressure on the company’s operational costs through food inflation and additional logistics disruptions.

On the basis of potential of improved profitability in following periods, tempered by rising living and input costs along with weaker continued economic uncertainty, Bourse maintains a MARKETWEIGHT rating on PHL.

Angostura Holdings Limited (AHL)

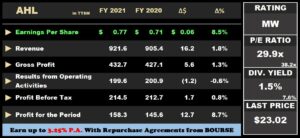

AHL reported an Earnings per Share (EPS) of $0.77 for the period ended 31st December 2021 (FY 2021), an 8.5% increase over the $0.71 reported in the prior comparable period.

Revenue for the period stood at $921.6M, a 1.8% increase from $905.4M recorded in FY 2020. Cost of Goods Sold increased 2.2% to $488.9M from $478.3M. Resultantly, Gross Profit advanced 1.3% to $432.7M. AHL reported an Expected credit loss Reversal on Trade Receivables of $6.4M in FY 2021 owning to improving international markets and credit expectations.

Results from Operating Activities stood at $199.6M, a 0.6% decrease compared to $200.8M reported in FY 2020. Finance Income increased 26.0% to $16.0M (FY 2020: 12.7M) while Finance Costs climbed 44.6% to $1.2M (FY 2020: $837K). Group Profit Before Tax for the period increased 0.8% from $212.7M to $214.5M. Taxation expense declined 16.3% to $56.2M, with the effective tax rate moving from 31.5% in FY 2020 to 26.2% in FY 2021. Overall, AHL recorded a Profit for the Period of $158.3M, 8.7% higher than a previous $145.6M.

Revenue Higher

AHL reported revenue growth of 1.8% in FY 2021. According to the Group, this was driven by its Rum and Bitters segments which registered growth of 34% and 30% respectively in EMEAA (Europe, Middle East, Africa and Asia), surpassing pre-pandemic sales levels by 57%. Both segments, which collectively accounted for 88.5% of sales in FY 2020, benefitted from increased economic activity and curtailed public health restrictions globally. AHL’s continuing trend of positive revenue growth is testament to the Group’s resilience and ability to navigate challenging and uncertain business cycles.

The introduction of new product offerings in each segment (Angostura Tribute, Symphony, White Oak Grapefruit & Pineapple and Tamboo Spiced Rum) and the rebranding of Angostura LLB to Angostura Chill may present increased opportunities for further revenue growth.

Margins Lower

Notwithstanding increased revenues, Group performance continued to be impacted by the pandemic in the form of increased raw material prices and supply chain challenges, pushing the cost of production upwards. These factors were reflected in lower margins with Gross Profit Margin declining to 47.0% relative to 47.2% in FY 2020. Operating Profit Margin fell to 21.7% from a prior 22.2% in FY 2020, weighed by a 13.3% increase in Selling and Marketing Expenses. Profit After Tax Margin advanced to 17.2% from 16.1% in FY 2020, supported by a lower effective tax rate.

The Bourse View

AHL is currently priced at $23.02 and trades at a trailing P/E of 29.9 times, below the Manufacturing Sector average of 38.2 times. The Group announced a final dividend of $0.26 payable on July 29th 2022 to shareholders on record by July 8th 2022. This brings the total dividend paid by AHL to $0.35, with a trailing dividend yield of 1.5%. The normalization of entertainment channels, compounded with current rebranding initiatives, should bode well for the Group’s future performance. The pace of growth, however, would likely depend on the Group’s ability to control costs in an effort to preserve margins. On the basis of product innovation and strong top-line performance, but tempered by relatively high valuations, Bourse assigns a MARKETWEIGHT rating on AHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”