HIGHLIGHTS

NCBFG Q1 2022

- Earnings: Earnings Per Share declined 30.7% from TT$0.07 to TT$0.05

- Performance Drivers:

- Lower Gains on FX and Investment Activities

- Increased Operating Expenses

- Outlook:

- Economic Uncertainty

- Rating: Assigned at MARKETWEIGHT

MASSY Q1 2022

- Earnings: Earnings Per Share 9.7% higher, from $1.76 to $1.93

Continuing Operations: EPS 7.8% higher, from $1.66 to $1.79

Discontinued Operations: EPS 0.4% higher, from $0.10 to $0.14

- Performance Drivers:

- Increased Revenues

- Sale of Non-Core operations

- Outlook:

- Geographical Diversification

- Portfolio Restructuring

- Economic Uncertainty

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of the Caribbean’s second largest indigenous banking group, NCB Financial Group Limited and regional conglomerate, Massy Holdings Ltd, for the three months ended 31st December, 2021. NCBFG reported lower earnings as the Group grappled with higher operating expenses and lower revenue from its banking and investment activities, while MASSY recorded improved performance in four of its five operating segments. Can NCBFG recover despite the still uncertain operating environment? Will MASSY be able to continue successfully navigating weaker regional economic activity? We discuss below.

NCB Financial Group Limited (NCBFG)

NCBFG reported Earnings Per Share of TT$0.05 for the three months ended December 31st 2021, 30.7% lower than TT$0.07 reported in the prior comparable period. The Group’s Net Interest Income expanded 17.8% to TT$703.2M from a prior TT$596.8M. Net Fee and Commission Income increased 9.5% to TT$277.6M relative to TT$253.6M in Q1 2021. Gains on FX and Investment Activities fell 70.0% to TT$70.1M. Credit Impairment Losses rose from TT$50.5M in the prior period to TT$79.2M, up 56.8% year-on-year.

Net Result from Banking and Investment Activities fell 1.8%, moving from TT$1.09B in Q1 2021 to TT$1.07B in Q1 2022. Net Result from Insurance Activities advanced 8.3% to TT$401.9M. Overall, Net Operating Income stood at TT$1.47B, 0.7% higher than the prior comparable period. Operating Expenses climbed 5.5% to TT$1.17B relative to a previous TT$1.10B.

Operating Profit fell 14.4% to TT$304.0M from a prior TT$355.2M. Profit Before Tax was down 10.1% YoY to TT$ 316.5M. Net Profit totalled TT$232.3M or an 8.1% decline, while Net Profit Attributable to Shareholders fell to TT$114.0M from TT$169.2M, 32.6% lower.

Operating Income Marginally Higher

NCBFG reported a modest 0.7% increase in Net Operating Income for the period under review. Net Interest Income, the largest component of Net Operating Income (47.9%), expanded 17.8% as the Group recorded strong growth in its interest earning portfolios. NCBFG’s loan portfolio and customer deposits increased 19.1% and 17.9% respectively, reflecting customers’ continued confidence in the Group.

Net Fee and Commission Income (18.9% of Net Operating Income), increased 9.5% YoY following increased transaction volumes. Net Result from Insurance Activities (27.4% of Net Operating Income) rose 8.5%, helped by a 15.3% increase in Net Underwriting Income.

Gain on Foreign Currency and Investment Activities fell 70.0%. According to NCBFG, this was due to reduced gains from the Group’s security dealings and lower net foreign exchange gains.

Operating Profit by Activity

The Group recorded year-on-year Operating Profit Growth in three out of seven segments. Life and Health Insurance & Pension Fund Management, which accounts for 33.4% of Operating Profit, contracted 18.3% from TT$270M to TT$221M in Q1 2022, as a result of higher claims. Conversely, General Insurance (27.6% of Operating Profit) reported a strong performance increasing 91.6% YoY from TT$95M to TT183M in the current quarter, indicating enhanced business activity. NCBFG was also able to improve its Corporate and Commercial Banking and Treasury and Correspondent Banking segments, up 30.4% and 10.7% respectfully in Q1 2022.

Valuations Expand

NCBFG’s trailing earnings per share declined from TT$0.31 in Q1 2021 to TT$0.25 in Q1 2022, as The Group’s Price-to-Earnings (P/E) multiple has been continuously expanding and rose to its highest level over the past five years from 17.7 times to 32.3 times in Q1 2022. Support for NCBFG’s price across both Jamaican and T&T exchanges might suggest that investors remain confident in the Group’s long-term prospects, notwithstanding weaker short-term results. Investor sentiment is, however, fickle by nature and could turn quickly with persistent underwhelming financial performances.

Outlook

The global economic rebound could positively impact the Group, as Covid-19 restrictions are gradually being lifted in its main operating jurisdictions and the threat of nationwide lockdowns abate. Based on its 2021 annual report, Jamaica remains NCBFG’s largest jurisdiction by Operating Income, accounting for 55%. Trinidad and Tobago is the second largest with 15%, with the Dutch Caribbean accounting for 8%, Bermuda at 5% and other at 17%.

The global and regional increase in economic activity may be tempered by inflationary pressures and monetary tightening by central banks in an attempt to decelerate inflation. The Bank of Jamaica executed three rate hikes in 2021, while suggesting the likelihood of further increases in the coming months. These initiatives affect the Group directly as a slowdown in economic activity caused by rising interest rates may lead to lower transaction volumes and remittances which can be reflected in lower fee and commission income. On the other hand, an increase in interest rates makes borrowing more expensive and may lower demand for loans. Nevertheless, this may also lead to increased interest income and higher margins for the Group’s banking sector. Lastly, the Group’s Insurance and Asset Management segment is likely to be affected by its exposure to interest rate movements and lower stock valuations, directly impacting Gains on Foreign Currency and Investment Activities.

The Bourse View

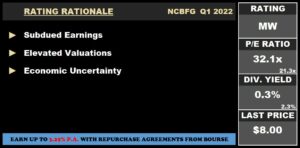

NCBFG is currently priced at $8.00 and trades at a Price to Earnings ratio of 32.1 times, above the Banking sector’s average of 21.3 times. The Group made the decision to not declare an interim dividend payment in its latest earnings release.

Gradually improving economic conditions across its operating jurisdictions should bode well for NCBFG’s fortunes. The Group continues to focus on strategic transformation, positioning for growth in the future. The recent surge in regional COVID-19 cases could possibly extend the adverse experiences of the Group on claims and persistency ratios.

On the basis of volatile financial markets, relatively high valuations and prevailing economic uncertainty, Bourse assigns a MARKETWEIGHT rating on NCBFG.

MASSY Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $1.93 for the first quarter ended December 31st 2021 (Q1 2022), 9.7% higher than the EPS of $1.76 reported in Q1 2021.

Revenue from Continuing Operations grew 8.4% YoY, from $2.98B to $3.23B. Operating Profit After Finance Costs advanced 7.4% to $262.8M,. while Operating Profit Margin fell from 8.2% to 8.1%. Share of Results of Associates and Joint Venture contracted by 25.4% to $12.1M. Nonetheless, Profit Before Tax (PBT) expanded by 5.4% to $274.9M. Income Tax expense decreased to $85.3M, 1.1% lower. MASSY’s Effective Tax Rate on Profits before Tax from Continuing Operations was 31.0% in Q1 2022, lower than the 33.0% rate recorded in Q1 2021. Overall, Profit Attributable to Owners of the Parent stood at $191.3M, (up: 10.3%) compared to $173.5M reported in the previous period.

Improving Segment Performance

MASSY’s overall PBT expanded by 5.4% for the period under review. PBT from the Integrated Retail segment (49.7% of PBT) grew 16.3% YoY from $127M to $148M in Q1 2022, with segmental revenue increasing 6.9%, as the Group continues to grow its existing organic businesses.

Gas Products, 25.7% of PBT, gained 2.1% on improved share of results from its Joint Venture Company, Caribbean Industrial Gases. The segment’s performance was also supported by increased Nitrogen and Carbon Dioxide demands in Trinidad & Tobago for industrial purposes, and healthcare-driven demand for Oxygen.

The Group’s Motors & Machines segment, which accounted for 17.2% of PBT in Q1 2022, is spread across three jurisdictions: Trinidad and Tobago (T&T), Colombia, and Guyana. The segment grew 10.3% YoY. MASSY established an e-commerce platform in Colombia and unveiled Nissan and Hyundai digital showrooms in 2021 (Massy Motors Trinidad).

Guyana remains a positive driver to demand for machinery and new motor vehicles amidst its economic acceleration.

Financial Services (7.5% of PBT) marginally increased by 0.2%, as the Group was able to record investment gains from its international investment portfolio. The Real Estate segment posted a decline by 119.2% in Q1 2022.

Guyana Contribution to PBT Increases

Trinidad and Tobago remains MASSY’s core generator of PBT, contributing 44.1% of PBT in Q1 2022 compared to a contribution of 43.4% in Q1 2021. Barbados, which represented 10.6% of PBT in Q1 2021 accounted for 11.6% of PBT in Q1 2022. The Group continues to benefit from the rapid growth in Guyana, with the country’s contribution to PBT increasing to 19.8%. Colombia now accounts for 7.0% of PBT, relative to 9.1% in Q1 2021. Meanwhile, PBT contributed by Jamaica fell to 4.9% while PBT contributed by the Eastern Caribbean declined marginally to 12.3%.

MASSY’s Cross-Listing Experience

Investors would have reacted positively to MASSY’s announcement and eventual cross-listing on the Jamaican Stock Exchange (JSE) on January 27th 2022, with MASSY’s debut price being J$2,463.08 (TTD$106.41). After peaking at J$2,502.28 on January 28th, 2022, MASSY’s share price has declined fairly steadily, closing on the JSE at J$1,979.32 or an equivalent of TT$85.51 on February 11th, 2021. Since cross-listing, a total of 186,409 MASSY shares were traded on the JSE, or an average daily trading volume of 14,339 shares.

The JSE trading price represents a 19.3% discount to the TT$105.95 closing share price on the Trinidad and Tobago Stock Exchange (TTSE).

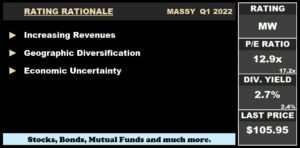

The Bourse View

At a current price of $105.95, MASSY trades at a trailing P/E of 12.9 times, below the Conglomerate sector average of 17.2 times. It should be noted that MASSY’s P/E ratio ex discontinued operation stands at 16.0 times. The stock offers investors a trailing dividend yield of 2.7%, just above the sector average of 2.4%. The Group’s operational jurisdictions may face some impediments to growth during the fiscal year, with the IMF lowering growth projections for Latin America and the Caribbean to 2.4% in 2022 after an estimated rebound of 6.8% in 2021. On the basis of improving overall performance and increasing geographic diversification, but tempered by lingering economic uncertainties, Bourse maintains a MARKETWEIGHT rating on MASSY.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”